Last Thursday, General Electric announced that it was selling a $26 billion real estate portfolio and substantially reducing the size of its financing arm, GE Capital. The only portion of the business being retained will be that which sustains GE’s manufacturing businesses. In addition, the company announced a $50 billion stock buyback and another $40 billion in dividends paid out through 2018.

Last Thursday, General Electric announced that it was selling a $26 billion real estate portfolio and substantially reducing the size of its financing arm, GE Capital. The only portion of the business being retained will be that which sustains GE’s manufacturing businesses. In addition, the company announced a $50 billion stock buyback and another $40 billion in dividends paid out through 2018.

This announcement has a number of broader implications beyond GE’s own company and stock price. It may be an indication of what large multinational companies must do at this point in the market cycle to show earnings growth. It also highlights the end of the boom in leverage creation and the benefits of being a global infrastructure specialist.

Financial Engineering

The corporate earnings growth rate for stocks in the S&P 500 Index (GE is one of them) has declined dramatically during the last year. One year ago, the estimate for 2015 S&P 500 Index earnings was $137.36 while today it stands at $118.37. This is a 14 percent decline in expectations. Weaker corporate earnings are likely a function of much lower energy company earnings stemming from a decline in oil prices, slower economic growth, a stronger U.S. dollar and perhaps less room to engineer earnings.

When GE made its announcement last week, the stock’s initial reaction was to rally over 9 percent. Investors in the company’s shares were acknowledging that the reduction in risk by eliminating much of GE Capital as well as the return of capital in the form of dividends was welcome. They were also acknowledging that the share buyback would make it easier for GE to reach its earnings growth rate over time.

A share buyback does two things. It reduces the supply of a company’s stock by taking shares out of the market, and it makes the divisor for earnings per share smaller. This makes it easier to make a growth rate hurdle. Here is how the math works.

Assume that Company A has 1,000 shares of stock outstanding and will earn $100 this year. Their earnings per share equal $100 divided by 1,000 shares or $0.10 per share. If they buy back 100 shares, reducing their outstanding stock by 10%, then their earnings per share rises by 11.11%. In our example, they will divide their $100 of earnings by 900 shares outstanding which equal $0.11. In other words, the stock buy-back increases earnings per share even though the actual amount of earnings remains the same. (See example below.)

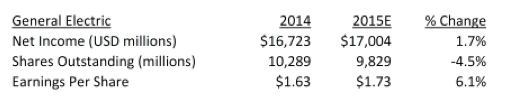

In 2014, GE earned $16.7 billion in net income for earnings per share of $1.63 with shares outstanding of 10.3 billion. In 2015, GE is estimated to make $17.0 billion in net income an increase of 1.8 percent over last year. However, the shares outstanding will be reduced by about 5 percent to approximately 9.8 billion shares, which will boost earnings per share to $1.73 for an increase of 6 percent over 2014.

In GE’s case, it can use the sale of its financing arm to purchase much of the stock. Many companies are using the debt market and the low level of interest rates to finance such purchases. The low cost of leverage makes this exercise very attractive for large multinational companies at a time when revenue growth is tough to come by and earnings growth is even tougher.

Leverage

The GE announcement may also indicate something else. It may be an acknowledgement on GE’s part that the era of creating leverage is over, or at least not as profitable. With last week’s announcement, GE CEO Jeff Immelt commented, “… the business model for large, wholesale-funded financial companies has changed, making it increasingly difficult to generate acceptable returns going forward.” This seems to be an acknowledgment that the growth rate required by GE’s shareholders will not be met by the financing business.

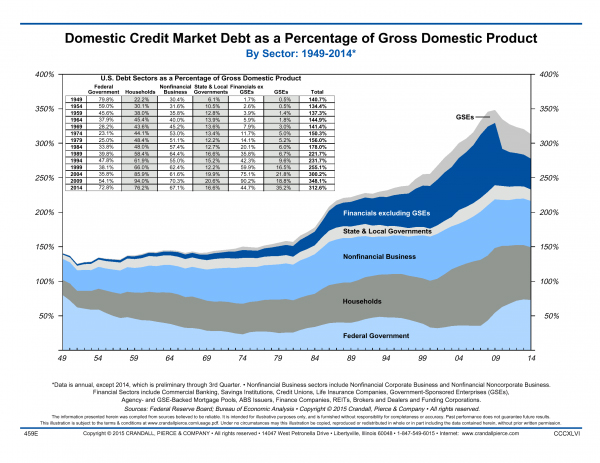

The chart below is one we’ve highlighted before, but it bears repeating. It represents the aggregate level of debt in the U.S. as a percentage of our gross domestic product, a way of measuring the size of our economy. As you can see, the recent level is down from the 2009 peak. The chart goes back to 1949, representing a very long period of economic growth. While the current level is below that earlier peak, it remains almost twice as high as the period from 1949 through 1985. During the 1990s and early 2000s, financials (which includes the likes of GE Capital) and households took on an enormous amount of additional debt. This binge resulted in above-average economic growth from unsustainable consumption. This was in part due to the boomers building families and wealth.

As this group ages, they become less interested in debt and the overall growth rate in leverage should decline. In addition, the methods of wholesale finance that contributed to an economic growth rate that was 1 percent to 2 percent higher than the last five years have become less attractive as regulation has tightened capital standards.

It may be then that GE’s move is a harbinger of more changes to come in the wholesale finance business as well as an indication that the gross level of leverage in our economy will continue to decline. These factors would lead to the CEO’s comments regarding the difficulty of “generating acceptable returns.”

The regulatory issue can’t be understated here. GE Capital was labeled as a systemically important non-bank by the Financial Stability Oversight Council and would be regulated like a bank with tighter capital restrictions. Banks like JP Morgan, Wells Fargo and Citibank have depositors and are able to fund their businesses differently. GE Capital and other wholesale financial institutions must rely on a different source of funding and the tighter regulations resulting from their designation as well as the changes coming to money market funds make it more difficult to earn that “acceptable return.”

Infrastructure Specialist

Immelt also said “this is a premier industrial and technology company with businesses in essential infrastructure industries” when he made the announcement last Thursday. The emphasis on infrastructure cannot be missed. The secular growth rate in the world’s middle class, resulting from a significant improvement in the standard of living for over a billion people in the next 20 years, will require an incredible investment in infrastructure in the areas of energy, health care and transportation.

Last year, GE fought hard to acquire Alstom, France’s leading energy company. This move and many others highlight the desire Immelt has to transform the company from an organization whose earnings were primarily driven by the finance unit to one whose products benefit from the long-term secular trend mentioned above.

There is a lesson here for investors. Immelt runs one of the largest conglomerates in the world. As a result, his role could be compared to that of a portfolio manager. He must allocate capital to those areas of the global economy where he believes the company can compete and deploy that capital effectively enough to generate an above average return. He has been CEO since 2001 and his track record in this regard has been challenging at best. What does a portfolio manager do when things aren’t working so well? They go back to basics and focus on the fundamentals.

In order to achieve the desired result for shareholders, he is focusing the company on what it is good at and identifying areas of the global economy he can take advantage of given its expertise. We wish him success in the transformation, for GE shareholders sake as well as the global economy.