Key Points

• Apocalyptic scenarios abound, but investors who have defaulted to optimism historically have been rewarded.

• A number of things have been going right recently.

• Pay more attention to Buffet than politicians.

In the world of investing, apocalyptic scenarios abound. You can fit the extreme optimists in a thimble. We sit somewhere in the middle—having had a neutral rating on U.S. stocks since the beginning of 2015. It’s certainly more adrenaline-inducing to have a high-conviction extreme view, but investing is typically more gray than it is black or white. But admit it—you are often more intrigued by the apocalyptic scenario. More ink is spilled on it, it often sounds “smarter,” and it reads more like a suspense novel; albeit the end of a suspense novel. I read an interesting article recently by Fear & Greed Trader in which it noted (emphasis mine):

“To the pessimist, a bad event or the simple prospect of one occurring is the end of the story. To the optimist it’s just another chapter in an ongoing novel. The difference between an optimist and a pessimist often comes down to endurance and time frame. Pessimism is intriguing to most because their messages require action. An investor has to do something when they take up the pessimistic approach. On the other hand, optimism means for the most part ‘staying the course.’ Pessimism is ‘SELL, it’s another 2008,’ which grabs your attention because it’s an action you need to take right now. Optimism is mostly, ‘make adjustments as necessary, stay the course,’ which is easy to ignore since it doesn’t require doing anything. Optimism sounds like a sales pitch; most people hate sales pitches. While pessimism sounds like someone trying to help you, with the incessant dire ‘warnings’ of what may come to pass.”

Optimism as default strategy

I have always agreed with the notion set forth in that article that defaulting to optimism is the best strategy longer-term when it comes to investing and creating wealth over the long haul. In addition, one of my long-held mantras is that I’m always more intrigued with the story no one is telling than with the story everyone is telling. I am well-aware of the risks to the market which remain ample. We expect continued bouts of volatility and greater frequency of corrections. But the glass is not empty. The story almost no one is telling is that the glass is at least half full.

With that as background, it’s time to look at what’s been going right in the market recently.

Over the past year, the market has been characterized by frantic bouts of risk-aversion and a dramatic spike in cross-asset correlations (making investors question the merits of diversification). Based on how a broad array of asset classes performed, 2015 was the most difficult year since 1937 for investors to make money, given that not a single major asset class had double-digit returns last year.

But here is a top-10 list of signs that the landscape may be improving:

1. The S&P 500 is back above its 50-day moving average; and an increasing number of stocks are trading above their 200-day moving averages.

2. Volatility has eased (and its term structure has normalized; meaning forward expectations for volatility have come down).

3. On February 12, 16 and 17 the S&P 500 gained more than 1.5% each day for three consecutive days. According to MarketWatch, this has only happened eight times since 1970 and every time, the market was higher a year later by an average of more than 19%.

4. Fourth quarter 2015 U.S. real gross domestic product (GDP) was revised from 0.7% to 1.0%, relative to consensus expectations it would be revised down to 0.4%.

5. The headline January Durable Goods (+4.9%) and Industrial Production (+0.9%) reports were better than expected (consensus expectations were +2.9% and +0.4%, respectively).

6. Initial unemployment claims remain comfortably below 300k (with last week’s reading coming in at a very low 262k).

7. Oil prices appear to be in a bottoming pattern; with the old resistance from the downtrend now serving as support; while the U.S. dollar has been consolidating its prior gains for a year now (i.e., the currency/commodity headwinds are fading).

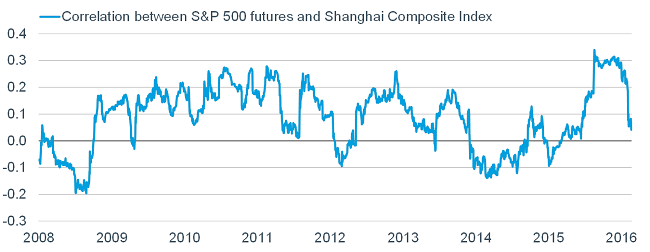

8. China’s stock market weakness is not decimating the U.S. stock market like in the recent past (last week’s rout did not see follow-through in U.S. markets); and the correlation between the two markets has plunged.

Source: Bloomberg, FactSet, as of February 26, 2016. Rolling 120-day correlation between daily % change in S&P 500 futures and China Shanghai Stock Exchange (SSE) Composite Index. S&P 500 futures based on the Chicago Mercantile Exchange (CME) E-mini S&P 500 front-month continuous contract.

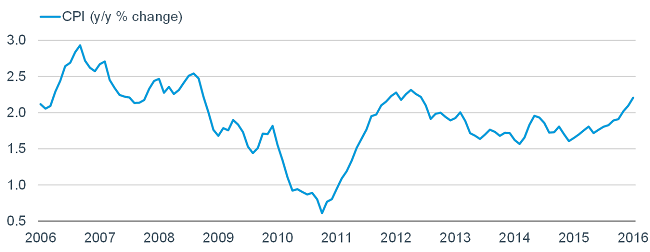

9. Inflation is ticking higher and getting closer to (or above) the Fed’s 2% target. (The PCE is the Fed’s “preferred” measure).

Source: FactSet, as of January 31, 2016.

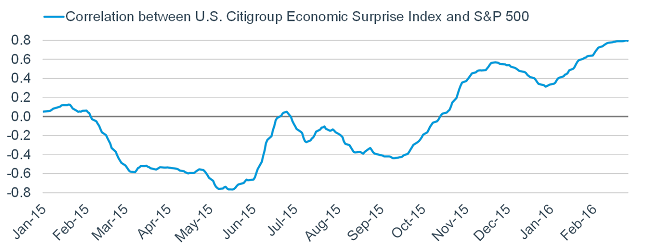

10. Expectations for the Fed raising rates in March have ticked up (albeit to a still low level), while the market’s been rallying—suggesting perhaps that good economic news is good news! Confirming this is the much higher correlation between the S&P 500 and the Citigroup Economic Surprise Index (which measures how economic data is coming in relative to expectations).

Source: Cornerstone Macro, FactSet, as of February 26, 2016.Rolling 90-day correlation between U.S. Citigroup Economic Surprise Index and S&P 500.

I wish I could put the election season and political discourse on the top-10 list, but there doesn’t appear to be a chance of improvement there any time soon. However, in keeping with the theme in this report of finding optimism, I will close with a page from Warren Buffett.

In his latest letter to shareholders, Buffett wrote: “As a result of this negative drumbeat, many Americans now believe that their children will not live as well as they themselves do. That view is dead wrong: The babies being born in America today are the luckiest crop in history.”

As reported by BloombergBusiness, while he touched on risks including terrorism, cyber warfare, climate change and economic dislocation for workers, Buffett also suggested that the picture of woe was generated out of politicians’ self-interest, not because it accurately reflects the nation’s challenges: “It’s an election year, and candidates can’t stop speaking about our country’s problems (which, of course, only they can solve).”

Politicians are self-interested? I hadn’t noticed. Investors are dour? I have noticed. There are reasons for optimism? Take notice; there are many.

Liz Ann Sonders is chief investment strategist at Charles Schwab & Co.

Read more here.