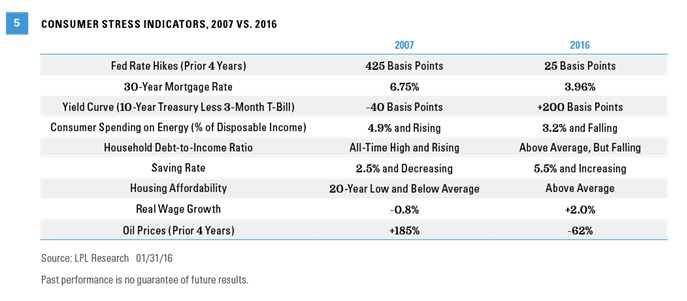

Today, consumers have spent the past six and a half years repairing their balance sheets [Figure 4], oil prices have dropped by nearly 60%, and consumer spending on energy and energy services have been cut by 50% over the past five years. Yes, the Fed has raised rates by 25 basis points (0.25%), but that’s a far cry from the 425 of 2004 through 2006. The yield curve remains positively sloped and mortgage rates are under 4%, nearly 2.5% below their mid-2007 levels. Housing prices are up, but this time they are rising in-line with consumer incomes, not outpacing them, and inventories of new and unsold homes are close to all-time lows. Housing affordability, while not at all-time highs, remains well above average [Figure 5].

Although nominal wage growth is tepid as it was in 2007, real wages (wage growth adjusted for inflation) are running well above levels seen in 2007, thanks mostly to the drop in energy prices. The personal saving rate stands close to 6%, nearly double what it was in late 2007, and it has moved steadily higher, not lower, in the past few years. And while U.S. and global financial institutions aren’t in perfect shape here in early 2016, safeguards imposed by financial regulation have kept them strong, albeit with some unintended consequences in the bond market.

It is hard to argue that the global financial system isn’t better off today compared to 2007. In short, the U.S. consumer — two-thirds of the world’s largest economy — is in far better shape today in almost every respect than it was in 2007, just prior to the onset of the worst of the Great Recession in 2008.

A GLOBAL GROUNDHOG DAY?

While the odds of recession in the U.S. have increased this year, along with the odds of a mistake by global policy makers as they navigate slow global growth, a downshift in Chinese economic growth, shifting foreign exchange rates, and a seemingly unending race by global central banks to find new ways to stimulate economic activity, we think a global Groundhog Day — a repeat of January 2016, 1998, or 2008 — is unlikely. However, we continue to expect more financial market and global economic volatility in 2016, as economies and policymakers continue to adjust to the unique challenges of the current economic cycle.

John Canally is chief economic strategist for LPL Financial.

Groundhog Day

February 2, 2016

« Previous Article

| Next Article »

Login in order to post a comment