Many investors have heard of the “value premium”—the idea that cheaper stocks have outperformed growth stocks over time. But over the last 10 years, value stocks have underperformed growth stocks by an average of 2.5% annually. Experts attribute the superior performance of the latter to the increased investor appetite for risk and a demand for strong earnings in the face of sluggish economic growth.

At the beginning of 2016, value began making a modest comeback, with the market rotating away from high-growth, momentum names toward defensive, high-dividend-yielding and deep-value cyclical companies. As of mid-May, the growth component of the Russell 1000 index was up 0.13%, while the value component had risen 2.67%.

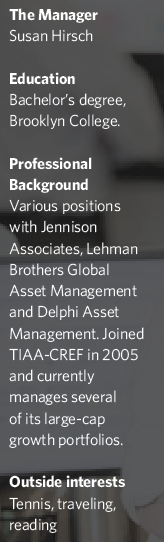

Susan Hirsch, manager of the TIAA-CREF Large-Cap Growth Fund, believes that value stock outperformance earlier in the year was a matter of playing catch-up after such a long performance drought. While growth stocks may underperform over the near term for that reason, she expects that a continuation of sluggish global growth will support long-term bullishness on growth stocks. “In a slow-growth world, growth works,” she says.

Nonetheless, growth stocks are notorious for big moves up or down depending on how well companies meet earnings expectations. A disappointing quarter can easily send a stock plummeting 10% or more, while a better-than-expected quarter often puts a big bounce in a stock’s step.

Hirsch, who has been managing the 10-year-old fund since 2006, often buys stocks of well-run companies that are having a temporary earnings disappointment or some other short-term problem. She typically follows companies for years before moving in. She puts a lot of emphasis on strong management, a characteristic she believes is particularly important in the growth space.

The fund’s buy-on-bad-news strategy came into clear focus earlier this year when Hirsch established a small position in Mexican fast-casual restaurant Chipotle not long after an E. coli scare sent 22 customers to the hospital and crushed earnings. She saw a good company with solid leadership that was having a temporary but solvable problem and selling at an attractive price. “Here in New York, there are lines out the door at Chipotle during lunch,” she says. “The restaurant’s concept and brand still resonates well.”

Hirsch says she typically adjusts positions rather than makes sweeping changes as events unfold. When things look a little frothy with a stock, she may trim its position. When a temporary problem emerges and sends a stock south, she may add to a holding or initiate a new position.

Lately, she’s been tamping down on portfolio risk a bit, trimming positions in a stock if investors’ high expectations about it are already built into its price. Such positions, she says, have more to lose from bad earnings news than they have to gain from positive surprises.

She did that earlier this year with Amazon, the fund’s top performer in 2015. Although her stake in the company was the largest detractor to her performance in the first quarter of 2016 (profit-taking at the company drove down its stock), her cut in stakes helped mitigate the damage. Hirsch likes the company’s market leadership in key areas and management’s proven ability to execute its plans, so Amazon remains a core holding.

On the other hand, she is less likely to adjust positions that are not as sensitive to broad market sentiment, a group that includes tax software maker Intuit, a longtime fund holding. Although fraud issues plagued the company last year, she believes Intuit’s move to a model that relies more on subscription business should benefit it over the long run.

“We’ll only eliminate a position if we lose confidence in management or expectations are no longer doable,” she says. “But we will work through short-term growing pains.”

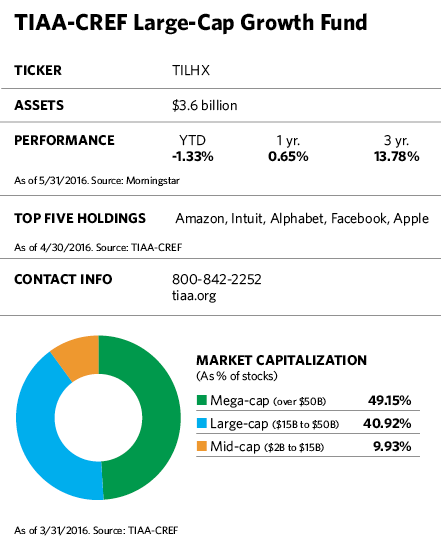

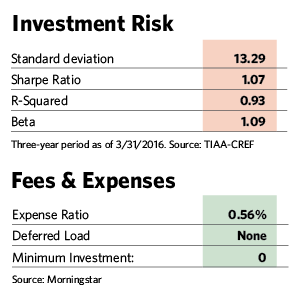

The strategy, along with an unusually low expense ratio for an actively managed fund, has generated peer-beating performance over the long term. As of April 30, the fund’s institutional class shares had outperformed 92% of Morningstar peers over three years, 95% over five years and 86% over 10 years. At the end of this year’s first quarter, the fund’s three-year annualized return was 71 basis points ahead of its benchmark, the Russell 1000 Growth Index. For the five- and 10-year periods, returns were about even with the index.

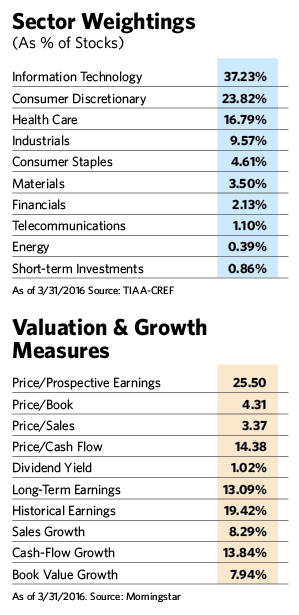

The portfolio, comprising 82 stocks, differs from the benchmark in a number of respects. The weighted median market capitalization for its companies is $48.7 billion, whereas that number is $72.09 billion in the index. The TIAA-CREF fund has a 21.63 forward price-to-earnings ratio, which is slightly higher than the index’s. The fund also has higher technology, consumer cyclical and financial stock weights than the index, while it is underweight in the industrial, telecommunications and consumer defensive sectors.

Although Hirsch picks stocks for their earnings, company managements and other fundamental company characteristics, she also pays attention to broad-brush sector trends that are likely to affect portfolio stocks. At 37% of assets, technology is the largest sector in the fund, followed by consumer discretionary at 24% and health care at 17%. The fund is underweight in consumer staples because of the sector’s poor growth prospects. The fund is also underweight in telecommunications services, where intense competition and government regulation pose dual threats.

Consumer discretionary stocks are being lifted by the consumption habits of both 80 million millennials at one end of the age spectrum and 70 million baby boomers at the other, she says. The former group, many burdened by student loans and other debt, often prize value over luxury. When they do pamper themselves, it is likely to be with small purchases such as $5 coffees at Starbucks (a fund holding). E-commerce websites, such as Amazon and Expedia, fulfill the growing appetite for online shopping among both younger and older consumers.

Estée Lauder, one of the fund’s top performers in the first quarter of this year, has been successful in leveraging its old-school brand into names such as Clinique, which appeals to a younger audience. At one time, Hirsch says, Estée Lauder was a family-run business with poor management but a steady-eddy fan base for its line of cosmetics. But under the guidance of Fabrizio Freda, who became president and CEO in 2009, the company has spiffed up its image and increased its use of social media to reach a younger clientele. It has also broadened its product line through acquisitions of luxury brands such as GLAMGLOW, which specializes in facial masks and has a strong foothold both online and in high-end department stores. The company has also increased its consumer reach through the acquisitions of several luxury perfume brands.

Other consumer discretionary holdings in the growth fund include Mattel, whose products include Barbie and American Girl dolls. Hirsch believes Mattel should benefit from an uptick in birth rates in the U.S. In the financials sector, the increasing use of credit cards in emerging markets provides a tailwind for fund holdings MasterCard and Visa.

Over the last year, health-care stocks have been plagued by uncertainty over political campaign rhetoric and by the cautionary tale of Valeant Pharmaceuticals International. Once a high-flying growth stock, the company took a hit last summer following government investigations into its pricing and distribution practices. By late April of this year, its shares were trading at about 80% below their August 2015 high.

A widespread perception that valuations on biotechnology stocks had reached their limit made matters worse. As a result of all these factors, many biotechnology stocks are selling 30% or more below their 52-week highs. Hirsch believes that the market is failing to distinguish between innovators and companies subject to negative regulatory oversight, such as Valeant.

One such innovator, fund holding Celgene, is best-known for its blockbuster blood-cancer-fighting drug Revlimid. The stock slid in the first quarter along with those of most biotech companies amid the increasing publicity about high drug costs and possible government efforts to rein them in. Since then, the stocks’ recovery has been slow, and Celgene still trades at a below-market multiple.

Hirsch says that despite investor pessimism, the company provided guidance of 20% growth through 2020, driven by a strong pipeline that should offset the expiration of certain patents in coming years. That pipeline includes new drugs to treat blood cancer, as well as ulcerative colitis and Crohn’s disease. Celgene has also made a number of strategic acquisitions in recent years and has numerous partnerships and collaboration deals across the industry.

In the technology area, the company owns Alphabet, the parent fund of Google (after the latter’s 2015 reorganization) and also now the parent of several other companies that Google once owned in industries such as technology and life sciences. Hirsch says Alphabet’s CFO, Ruth Porat, is providing more information about what’s going on at the company between quarterly earnings reports than Alphabet revealed in the past. Hirsch also notes that Google’s core search business continues to report strong top-line revenue growth.