She did that earlier this year with Amazon, the fund’s top performer in 2015. Although her stake in the company was the largest detractor to her performance in the first quarter of 2016 (profit-taking at the company drove down its stock), her cut in stakes helped mitigate the damage. Hirsch likes the company’s market leadership in key areas and management’s proven ability to execute its plans, so Amazon remains a core holding.

On the other hand, she is less likely to adjust positions that are not as sensitive to broad market sentiment, a group that includes tax software maker Intuit, a longtime fund holding. Although fraud issues plagued the company last year, she believes Intuit’s move to a model that relies more on subscription business should benefit it over the long run.

“We’ll only eliminate a position if we lose confidence in management or expectations are no longer doable,” she says. “But we will work through short-term growing pains.”

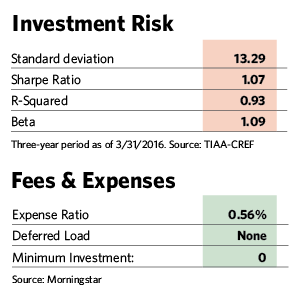

The strategy, along with an unusually low expense ratio for an actively managed fund, has generated peer-beating performance over the long term. As of April 30, the fund’s institutional class shares had outperformed 92% of Morningstar peers over three years, 95% over five years and 86% over 10 years. At the end of this year’s first quarter, the fund’s three-year annualized return was 71 basis points ahead of its benchmark, the Russell 1000 Growth Index. For the five- and 10-year periods, returns were about even with the index.

The portfolio, comprising 82 stocks, differs from the benchmark in a number of respects. The weighted median market capitalization for its companies is $48.7 billion, whereas that number is $72.09 billion in the index. The TIAA-CREF fund has a 21.63 forward price-to-earnings ratio, which is slightly higher than the index’s. The fund also has higher technology, consumer cyclical and financial stock weights than the index, while it is underweight in the industrial, telecommunications and consumer defensive sectors.

Although Hirsch picks stocks for their earnings, company managements and other fundamental company characteristics, she also pays attention to broad-brush sector trends that are likely to affect portfolio stocks. At 37% of assets, technology is the largest sector in the fund, followed by consumer discretionary at 24% and health care at 17%. The fund is underweight in consumer staples because of the sector’s poor growth prospects. The fund is also underweight in telecommunications services, where intense competition and government regulation pose dual threats.