DoubleLine Capital’s Jeffrey Gundlach recommends shorting the S&P 500 Index and going long on emerging market stocks despite conventional wisdom that rising U.S. rates will lead to a stronger dollar.

Specifically, Gundlach recommended wagering long on the iShares MSCI Emerging Markets exchange-traded fund and betting against the SPDR S&P 500 ETF. He also said it’s a myth that the Federal Reserve raising rates necessarily leads to a stronger dollar.

“What the heck, let’s have some fun,” Gundlach, chief investment officer of DoubleLine Capital, which managed $105 billion as of March 31, said Monday at the Sohn Investment Conference in New York. “Let’s leverage it one time.”

Gundlach, 57, is primarily a bond investor who has built a career making prescient market calls. Last year, he correctly predicted that Donald Trump was likely to be the next U.S. President. On a May 2 webcast, he advised sticking with gold and emerging-market debt while warning the stock market may face a correction and oil prices are likely to fall.

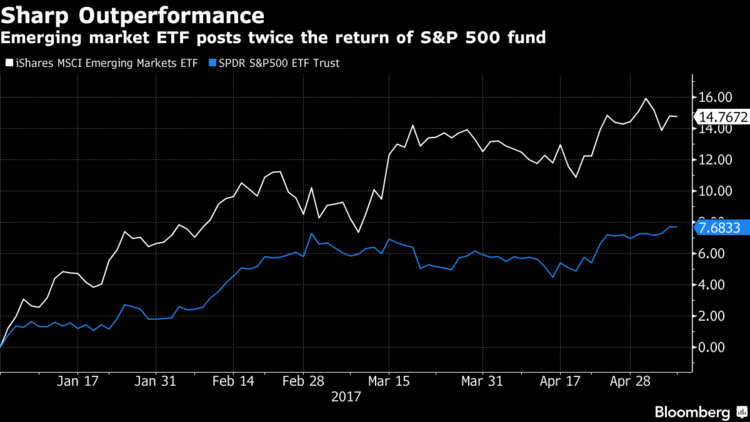

This year’s bet is a relative value play and not a forecast that the S&P 500 will fall, Gundlach said today in an interview on CNBC. The iShares MSCI Emerging Markets has returned 15 percent so far this year, at twice the pace of the SPDR S&P 500 ETF. Last year, the gauge of emerging market stocks trailed the U.S. benchmark.

“I don’t like catching falling knives, you’ve gotta watch out for value traps,” Gundlach said during his Sohn presentation Monday. “For about a year-and-a-half now, there’s been no outperformance of the S&P 500, but rather the emerging markets had been competing well and now they’re outperforming year to date,” he said.

At last year’s conference, Gundlach recommended a pair trade, going long on a mortgage REIT ETF while shorting a utilities sector ETF. After covering the cost of one turn of leverage, the trade yielded 40 percent in the year through Friday.

The Los Angeles-based firm’s flagship $53.5 billion DoubleLine Total Return Bond Fund, which invests mostly in mortgage-backed securities, has a better five-year record than 93 percent of its Bloomberg peers, with average annual returns of 3.6 percent.

This article was provided by Bloomberg News.