How high is up? That might seem like an odd question for registered investment advisors to be asking midway through a recovery year that still feels tentative and just six months after a year in which many firms endured a double-digit drop in revenue.

But the fact is that despite an admittedly very tough stretch, RIAs have weathered the financial storm far better than their competitors on Wall Street who have lost hundreds of billions in client assets. Indeed, the RIA industry seems to be at a critical inflection point, coming through the past few years remarkably strong and at the threshold of potentially explosive growth as more people-and advisors for that matter-see the strength of the RIA business model. Things look especially promising for RIAs who are focusing on efficiency and finding ways to spend more time serving clients.

Those are some of the headlines from the newly released 2010 Charles Schwab RIA Benchmarking Study. The RIAs we surveyed-870 of our clients, with more than $300 billion under management-estimated that their revenue will increase by a median of 15% this year, a result of continued client additions and the market rebound, which has done its part to replenish assets under management. In addition, many RIAs expect to benefit as existing clients invest bonuses or money from sales of businesses-windfalls that mostly disappeared during the recession.

The storm clouds are breaking, but before RIA firms can make the most of their growth opportunities there is still some ground to make up. Revenue at the median RIA firm fell by 11% in 2009. By and large, RIA firms did not add enough new clients to compensate for the decline in assets under management. As recently as 2007, RIAs were adding eight new clients for every 100 they had. But the median advisory firm ended 2009 with 103 clients for every 100 clients it had at the outset of last year.

Naturally, with asset levels down, client relationships produced considerably less revenue. Median revenue per client dropped 14.4% in 2009, to $6,900 from $7,800 in 2008. In 2007, median revenue per client was $8,400. But despite the financial metrics at play inside most RIA firms, advisors' clients were certainly not settling for less service. On the contrary, many clients of RIAs spent 2009 asking more questions and demanding more frequent communication and hand-holding.

Given the twin pressures on advisors to placate clients and staunch lost revenue, one pleasant surprise in our 2010 study may be how well RIA firm profits actually held up in 2009. The operating margin of the median RIA firm was 14.8%-down from 18.1% in 2008. RIAs who had been focused on adding staff and clients between 2003 and 2007 appear to have done a good job of reining in their costs in 2008 and 2009.

Sharper Efficiency, More Productivity

Another silver lining was the motivation RIAs showed in 2009 to focus on the operational efficiency-or lack of it-in their own firms. The inefficiency so easily pushed aside at a firm when it's growing revenue by 25% a year suddenly becomes harder to ignore when profit margins are squeezed. RIA firms often spend too much time on operational and administrative activities-time that could be better spent working directly with clients and on business development.

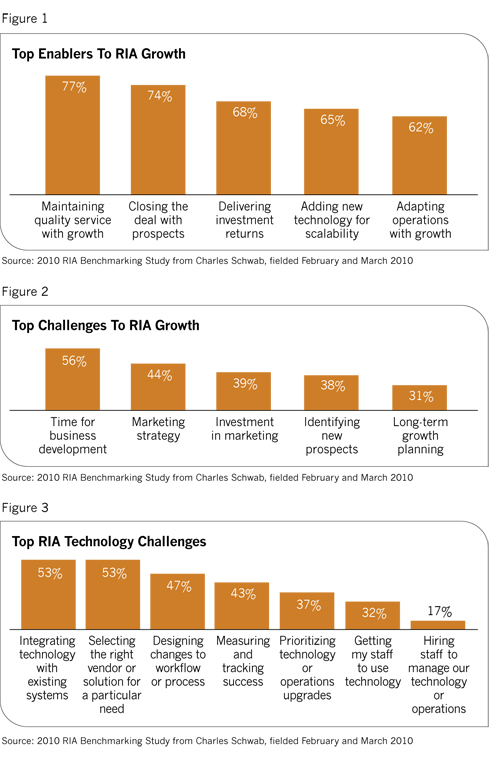

Advisors in the survey said they spent 30% of their time on operational and administrative tasks in 2009 and only 10% explicitly developing business-which means they are failing to seize growth opportunities. The lack of time they spent on business development was cited as a barrier to growth by 56% of the study participants. The second most common growth impediment was the lack of time they spent developing a marketing strategy (cited by 44% of the respondents); the third was an insufficient marketing budget (39% of respondents said). (See Figures 1 and 2.)

But despite these barriers, advisors tell us they are absolutely planning to grow: 84% of those surveyed plan to grow either aggressively or moderately in the next five years. But how can RIAs both increase their efficiency and devote more time to business development? According to our study, many of them see technology as the answer.

Just about every RIA in the study uses a portfolio management system (95% of the respondents). No surprise there; advisors have made portfolio management systems a foundation of their businesses for years. Most advisors (78%) also use some sort of e-mail retention software or service, a document management system (65%) and financial planning software (62%). In addition, in 2009, an increased number of advisors maintained Web sites with access to client accounts (41% versus 37% in 2008) used rebalancing software (40% versus 37%) or used trade order management software (23% versus 21%).

There is no question that RIAs can be more efficient when they have these technologies in place. For instance, RIAs who used a dedicated rebalancing system in 2009 said they were able to perform that task in 15% less time (the median reported improvement) than when they were doing rebalancing manually or using nonspecific software. And that is just one example.

Making More Out Of Technology

This is all good as far as it goes. However, most of the RIAs that have bought these technologies have purchased them only as separate modules and are even then using only a subset of their features. Fifty-three percent of respondents said they faced a challenge in integrating disparate technology systems and components; 47% said they were still figuring out what work-flow and process changes to make to maximize their technology investments (see Figure 3).

It can sap productivity when a firm has its technology systems siloed this way. For instance, if an RIA firm must re-enter client account information multiple times in multiple systems, it adds expense, increases the risk of error and draws the firms' principals into activities besides working with clients and growing business. After all, many RIA firms are small, with fewer than ten employees. When something important must be done-with a client's order, with a compliance issue or with a new technology-the people whose names are on the door often have to get directly involved.

A Focus On CRM

There is no overnight answer to RIAs' technology system challenges. However, one development worth tracking is in the area of client relationship management systems, or CRM. RIAs already clearly recognize the value of CRM systems; nine in every ten advisors regard CRM as being important to their business success, and 84% already use a CRM system.

As the application on the desktops of most employees in an RIA firm, the CRM can become the window into a client relationship, moving well beyond the management of contacts and personal information to include more detailed client information, transaction and performance history, holdings information and client correspondence. Furthermore, with its work-flow management capabilities, CRM software can help manage those daily business processes that really take operational efficiency to the next level.

But as it happens, few of the CRM systems at advisory firms today are set up like this. Like other technology, these systems are underused and unintegrated. Nevertheless, they will become more important to advisors and help them narrow the gap between efficiency and scale of service that now still favors the technology-deep wirehouses.

The Time Is Now For Advisors

This brings us back to growth opportunities. There is little doubt that many clients of Wall Street firms are thinking about moving their business after being shaken by the market. According to other research we have done, former clients of full-service brokerage firms remain RIAs' No. 1 source of new assets (according to the Schwab Independent Advisor Outlook Study, January 2010). That may not have amounted to much in 2009, when investors were reluctant to take any action with their assets, in many cases putting off the decision altogether.

However, fortune seems to favor the independent advisor. Cerulli reports that RIAs, independent broker-dealers and dually registered advisors will nearly match wirehouses' market footprint by 2012, taking a 39.3% market share of assets under management while the wirehouses take 40.7% (according to the Cerulli report, "Advisor Migration: The Changing Landscape of Retail Distribution," 2009). And even though people are taking longer to make the switch, the RIAs in our study remain very confident in their ability to close new business: 74% of advisors report that closing success is a top enabler to growth-the second-highest enabler behind quality of client service. (See Figures 1 and 2.)

In this respect, all the soothing RIAs did for client nerves in 2009 may well turn out to help them develop business. In 2009, 83% of new clients coming into RIA firms came from referrals. That number holds pretty steady in this business every year. But in order to find the time to engage and serve customers in today's new reality, advisors have to pay more attention to efficiency and productivity. Their ability to do that will likely answer the question of how high "up" really is for the RIA industry.

Bernie Clark is head of Schwab Advisor Services, a leading provider of custodial, operational and trading support for more than 6,000 independent investment advisory firms.