Buyers are coming back to the Hamptons, a favorite vacation-home spot for Wall Street’s elite. They’re just not splurging on mansions.

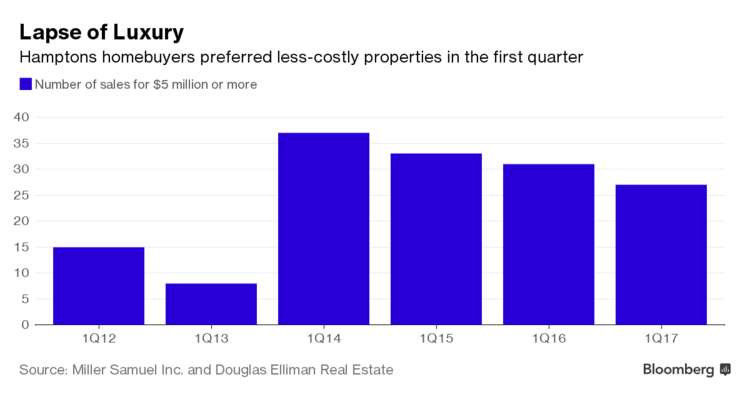

Across all price tiers, purchases in the Long Island beach towns rose 8 percent in the first quarter from a year earlier to 472, the biggest increase since 2014, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. But the high end of the market fizzled. Just 27 homes sold for $5 million or more, the fewest for a quarter in more than three years. The dearth of ultra-luxury deals in the Hamptons dragged the average sale price down 8.9 percent to $1.72 million, the firms said.

“You had your first-time, second-home buyers and first-time buyers, and they gravitated to areas where there was value,” said Ernest Cervi, a senior vice president at Corcoran Group, which released its own report on Hamptons sales Thursday.

Surging stocks and a Wall Street bonus pool that climbed for the first time in three years fueled buyer confidence in the Hamptons, a market whose fortunes are closely tied to vagaries of New York’s financial industry. Sellers on Long Island’s southeastern fork -- like their counterparts in Manhattan and Greenwich, Connecticut -- also helped coax home shoppers by being more negotiable on price.

Discounts for all Hamptons sales averaged 12 percent in the first quarter, up from less than 11 percent a year earlier, Miller Samuel and Douglas Elliman said. In the luxury category, defined in the quarter as $3.7 million or more, price cuts almost doubled to 16 percent on average.

Markets like the Hamptons have “come back to life at a price point that really tells us that it’s the buyers who felt they could not make a move because they had the election and the world on their mind,” said Scott Durkin, chief operating officer for Douglas Elliman. “That’s over now. Everyone is moving forward with their lives. From the numbers we’re seeing, they’re not having to pay full asking price.”

East of the Shinnecock Canal, in towns such as East Hampton and Southampton, 31 percent of sales were priced from more than $500,000 to $1 million, brokerage Brown Harris Stevens said in its own report Thursday. An additional 29 percent were priced at more than $1 million to $2 million. West of the canal, in towns such as Westhampton Beach, 73 percent of sales were for less than $1 million, the brokerage said.

North Fork

The hunt for lower-priced properties also propelled sales in the relatively less-costly North Fork of Long Island. Sales there jumped 19 percent from a year earlier to 197, while the median price of those deals climbed 10 percent to $525,000, according to Corcoran Group. In the Hamptons, which is on the southern fork, the median was $990,000, down 1 percent, the brokerage said.

Hamptons luxury homes that sold in the quarter spent an average of 197 days listed for sale, up from 109 days a year earlier, as discretionary buyers waited out deals in a market where high-end inventory is climbing, Miller Samuel and Douglas Elliman said. There was only a single sale above $20 million, compared with three in the first quarter of 2016, brokerage Town & Country Real Estate said in a report released earlier this month.