A global environment of lower commodity prices, slower growth in emerging markets and divergent central bank policies combined with tremendous growth in the high yield and leveraged loan sectors has created a large and attractive market for opportunistic credit investors. Many highly leveraged companies, who have the least amount of flexibility to adapt to business challenges, feel the impact of heightened volatility. While the leveraged finance markets have become increasingly dislocated, entry valuations have become more attractive, providing the opportunity to invest in debt securities with high cash yields that can also benefit from the recovery in enterprise values.

Today, the cycle appears to be reversing, exposing risks that market participants may have failed to price in fully. The foundations of uncertainty include the effects of the Federal Reserve’s efforts to normalize interest rates, the extraordinary downdraft in commodities prices (which, even if it stabilizes or rebounds, has had a profound impact over the past year), the weakening of the Chinese economy and the doubt that has been cast upon China’s ability to transition from an export to a consumer-driven economy, regulatory pressures (in part from financial and other reforms) and geopolitical events. These sources of insecurity tend to amplify one another. As sentiment becomes increasingly negative, deteriorating market liquidity threatens to heighten volatility across financial markets and to create greater dislocations.

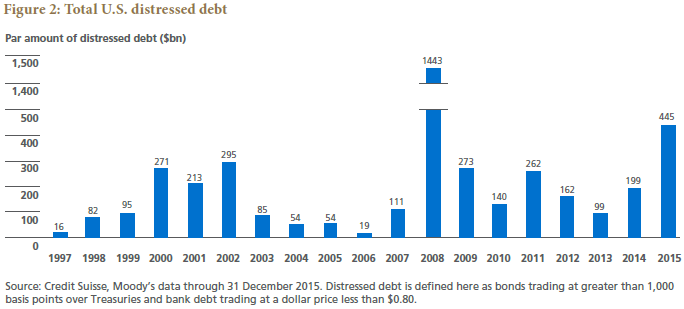

Leveraged finance markets are being tested. The volume of publicly traded distressed debt in the U.S. is currently $445 billion, an amount only surpassed during the recession of 2008 (see Figure 2).

Opportunities from dislocations

Market panorama

Over the past few years, accommodative monetary conditions have facilitated excessive risk-taking. In financial markets, valuations were distorted upward as some investors mispriced risk. The real economy saw a parallel phenomenon, as loose monetary conditions led to excessive investment and asset price inflation in key areas such as energy, commodities and emerging markets. The overall weakness in high yield credit is not just a commodity story; highly levered borrowers across every industry may struggle to grow into their capital structures as modeled growth assumptions prove to be too optimistic. Investors should be mindful of not just the enhanced volatility and considerably larger size of the leveraged finance markets today – U.S. and European markets grew 50% from $2.1 trillion in 2010 to almost $3 trillion in 2015 (see Figure 1) – but importantly their aggressive capital structures and higher leverage profiles.

While the broader leveraged finance markets were somewhat insulated from the commodity-focused challenges in 2015, today market stress has spread across industries. Commodity-related exposure is the largest single factor driving distress, but it is a minority share that represents only 25% of all distressed debt, according to UBS. Other sectors experiencing significant distress include telecommunications/media, services, technology, chemicals, defense and retail. As the credit market pendulum swings back from abundant to constrained credit availability and companies experience sluggish revenue growth and heightened cost volatility, many highly levered businesses could struggle to meet interest obligations, be unable to refinance maturing debt and have fewer financing alternatives.

Middle markets will likely struggle hardest. These companies (defined as having debt outstanding of less than $750 million, or whose EBITDA (earnings before interest, taxes, depreciation and amortization) is less than $100 million) have been the biggest beneficiary of the increase in credit availability, but also are more vulnerable to industry headwinds or company-specific challenges. Leverage multiples in the middle market hit an all-time high in the fourth quarter of 2015 of 5.7x debt/EBITDA, nearly a full turn of leverage higher than the previous peak in 2007 (see Figure 3). Leverage significantly reduces the flexibility a company has to respond to business challenges, as already lower free cash flow may not be sufficient to meet debt service obligations, let alone provide cash to address critical business issues. Furthermore, middle market companies often have more limited pricing power so heightened cost volatility is borne by the company instead of their customers. As a result of all these challenges there are many available investments, but investors must be highly selective about which opportunities to pursue.

Credit imbalances combined with diminishing market liquidity are creating asset mispricings and opportunities. This is particularly true in the middle market, where opportunistic investors may be able to reap the benefits as more and more companies face financing gaps. Highly levered companies will need to recalibrate to the reality of slower growth and more constrained demand for their products, and this adjustment process will be disruptive. While some companies with covenant-lite/covenant-loose structures may have an extended runway to cope with an evolving competitive landscape, a significant number of highly levered businesses will be challenged to catch up to their capital structures (and to stretched purchase valuations). Some may succeed in meeting their future obligations, but we expect many will need to restructure.

While energy and metals and mining companies receive more attention today, we also see opportunities to invest in dislocated credit in chemicals, retail and consumer products, aerospace and defense as well as telecom and media. The factors that have led to stress in these sectors include aggressive corporate behavior, competition from stronger and better capitalized companies, changing supply chain and consumer spending dynamics, technological innovation, regulatory changes, sequestration and geopolitical tensions. In addition, opportunities in Europe emanate from tepid economic growth, a banking industry that is adapting to a new regulatory regime and from legacy, suboptimal restructurings. Lastly, while private credit markets have lagged public markets in repricing risk due to the relative lack of transparency and its “mark to model” characteristics, we are increasingly seeing opportunities to provide rescue financings – i.e., provide capital to situations where there are acute financing gaps and where we believe we can negotiate more attractive terms.

As investors move outward along the risk spectrum and look toward distressed and opportunistic credit as a source of higher return potential in a low yield world, we offer the following guardrails: 1) Focus on companies that will be able to withstand an economic slowdown, 2) take a conservative approach to valuation assumptions and 3) strictly adhere to the absolute priority rule (in which senior creditors are paid in full before junior claimants receive anything). Investors should take a tactical investment approach focusing on situations where creditors’ rights are well defined by strong covenants and where risks are measurable and manageable.

Our approach

The appraisal of the risk/reward characteristics of an investment is an ongoing, iterative process. PIMCO’s focus on downside risk management in dislocated credit markets is expressed through an emphasis on senior fixed income investments that have an attractive high initial cash current yield; this helps accelerate the return of invested capital and enhances the ability to achieve successful outcomes. Our due diligence includes a thorough evaluation of a company’s on- and off-balance-sheet assets and liabilities (including environmental, pension, tax, legal and regulatory), factors that have led to a period of dislocation and potential recovery, determination of unlevered cash flows under different scenarios and an assessment of intrinsic value. In addition, a key element of our process is the collaboration of senior PIMCO professionals in corporate credit; we believe the integration of micro fundamentals with a macro view and the extended insights from across PIMCO’s specialist desks are important for risk pricing, risk sizing and exit strategies.

Sai S. Devabhaktuni is PIMCO's head of corporate distressed portfolio management.

Harnessing Value In Dislocated Credit

April 7, 2016

« Previous Article

| Next Article »

Login in order to post a comment