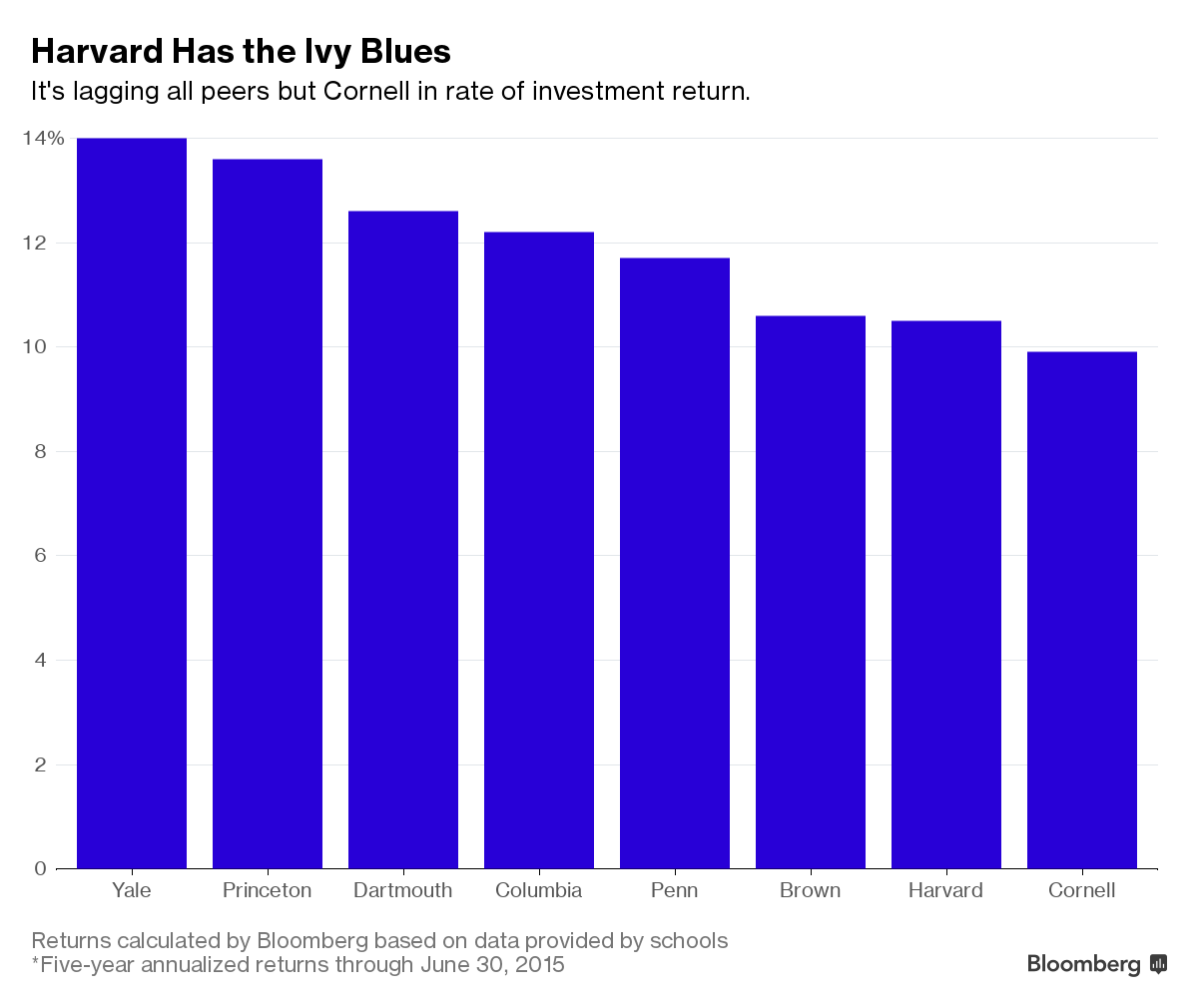

In a rare comedown, Harvard is close to conceding defeat to Yale, at least when it comes to investing.

Harvard University has zeroed in on two leading candidates to helm its $37.6 billion endowment, the biggest in higher education, according to people familiar with the matter: N.P. ‘Narv’ Narvekar, who oversees Columbia University’s endowment and Amy Falls, who stewards Rockefeller University’s and is on Harvard’s investment committee.

Both prospects have relatively small staffs and farm out their money to the best managers they can find, the approach favored by Yale endowment chief David Swensen, whose investment performance has outstripped Harvard’s. By contrast, Harvard has long hired in-house investment pros, including some swashbuckling Wall Street types with eight-figure paychecks.

Shifting Strategies

Harvard’s previous managers have left behind a decade of lackluster performance, shifting strategies and billions in forgone returns, threatening Harvard’s economic edge on its rivals. Stephen Blyth, the former Deutsche Bank bond trader promoted to chief executive, resigned for personal reasons in July after only 18 months following an unexpected and unexplained medical leave in May. The organization also eliminated at least a dozen trading jobs this year.

Harvard’s search will be its fourth for an endowment chief since 2005. Restive Harvard alumni said the school must find a manager for the long haul and either embrace its in-house approach or make a firm break with the past.

“Yale has been the pillar of stability and Harvard has been plagued by turnover,” said Tim Keating, a Harvard alumnus and president of Keating Wealth Management near Denver. “It’s inexcusable that this debate over how to best manage the money has been going on for ten years.”

A person familiar with the search said Harvard could make its choice as soon as Thursday in a regular board meaning and announce it later this month or early October. Harvard spokesman Paul Andrew declined to comment. The Wall Street Journal on Tuesday first reported Harvard’s interest in Narvekar and Falls.

Trading Desk

Harvard, which has a staff of more than 200, has assembled its own trading desk and has often been compared to a kind of non-profit hedge fund. Top Harvard traders once made as much as $30 million in a single year. That compensation inspired consternation among some professors and alumni.