KEY TAKEAWAYS

· A strong July employment report caused Treasury yields to spike higher, but the broader message from the bond market has not changed.

· Improvement in economic data will need to exhibit greater consistency to exert meaningful upside pressure to bond yields.

HAS ANYTHING CHANGED?

A stronger than expected July jobs report caused Treasury yields to jump higher, but investors looking for the long-awaited rise in yields may have to wait longer. The bright spot provided by jobs offset otherwise bond-friendly developments, including a powerful policy move by the Bank of England (BOE) in response to Brexit risks and softer than expected U.S. economic data in the form of a below-expectation Institute for Supply Management (ISM) manufacturing reading and weaker economic growth, as measured by gross domestic product (GDP). Therefore, more proof is needed before yields may rise on a sustained basis, which would pose a more meaningful threat to bond prices.

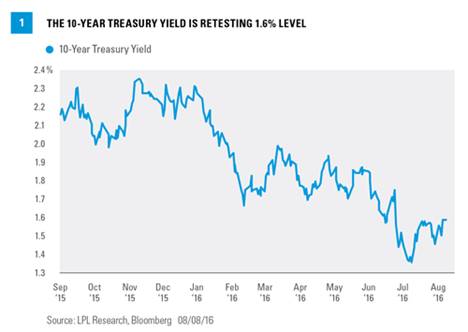

The 10-year Treasury yield rose to near 1.6% following the July jobs report, a level that brought about buying interest during July and helped support high-quality bonds [Figure 1]. Holding this technical level will help determine whether the current, sub-1.6% yield range holds, or whether the 10-year Treasury yield rises to the 1.7–2.0% yield range that characterized trading from late January to late June of this year. For most investors, such a nuanced yield environment does not materially alter the bigger picture even if further bond price gains have run their course.

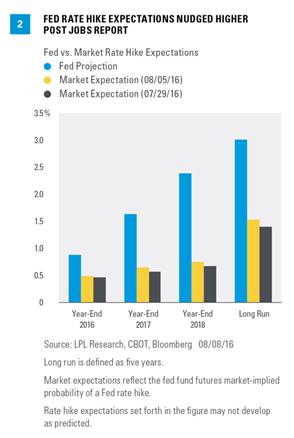

The employment report did, however, challenge very benign Federal Reserve (Fed) rate hike expectations. The jobs report helped keep bond investors “honest” and remain respectful of a potential rate hike in either September or, more likely, December 2016. Fed rate hike expectations increased for the week ending August 5, 2016, according to fed fund futures [Figure 2]. The market-implied probability of one 0.25% rate hike by December 2016 increased to 50%.

Bond investors still expect very little from the Fed over coming years. Figure 2 also illustrates that market-implied Fed rate hike expectations remain very mild with futures showing a long run rate of only 1.5%. The Fed has loosely described “long run” as a period of five years. This indicates that much of the good news for bonds is likely already priced in but shows that investors need more convincing. In short, futures still reflect expectations the Fed will raise interest rates very slowly given the sluggish global economic backdrop, and that more data will be required.

ASSESSING THE YIELD CURVE

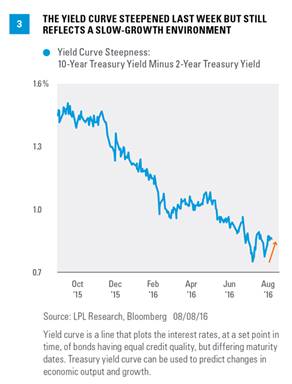

The yield curve steepened modestly in response to the stronger jobs report, a shift that reflects better growth expectations. However, the yield curve remains flat when viewed over a longer-term perspective [Figure 3] and is below the 25-year average of 1.2%. The yield curve slope remains positive and a substantial distance away from turning negative or inverting, but still reflects a slow-growth environment.

AUCTION ACTION & OVERSEAS INVESTORS

In the typical post-employment report lull, economic data are limited over the next two weeks and the bond market may take its cues from auction demand. Foreign demand, in particular, will be scrutinized closely as overseas purchases have played a key role in Treasury strength in 2016. Overseas investors’ cost to hedge U.S. dollar currency risk has increased over recent months and may impact demand. The Treasury will sell new 3-, 10-, and 30-year securities over consecutive days starting Tuesday, August 9, 2016, as this publication goes to print. Longer-term 10- and 30-year Treasuries will be a better test of investor demand.

CONCLUSION

On a longer-term basis, the pace of economic growth and Fed rate hike prospects will hold greater influence over the path of bond yields, but last week’s overall mixed message did little to alter the current environment. Economic data have yet to indicate a substantial acceleration that might warrant higher yields.

Until then, global central banks remain bond market friendly, as last week’s aggressive action by the BOE illustrated. The BOE announced additional stimulus consisting of a rate cut, increased government bond purchases, the start of corporate bond purchases, and a bank lending program. The bold move helped boost long-term bond prices and reinforced the bond-friendly stance of global central banks.

We continue to suggest a relatively neutral bond exposure, consisting primarily of high-quality intermediate bonds given the absence of notable value. Still, investors hoping for even better value and higher yields may have to wait longer.

Anthony Valeri is fixed-income and investment strategist for LPL Financial.