Health-care costs have always been a concern for future and current retirees, but because of recent changes in the industry, it is now becoming an increasingly important aspect of retirement planning.

Longer life spans, market volatility, increasing medical costs, the elimination of corporate retiree health plans and the uncertainty in the future of Medicare and Medicaid are a few of the reasons that retirees are beginning to adjust their outlook on health-care spending.

Although health-care expenditures should be a primary concern to retirees, recent data tells a different story. A 2011 study by Sun Life Financial found that 92% of American workers either had no idea what their health-care costs would be in retirement or they vastly underestimated the costs. Fidelity estimates that a 65-year-old couple retiring in 2013 will need $220,000 to cover their medical expenses throughout retirement. The $220,000 estimate does not include expenses for supplemental insurance and other health-related items such as over-the-counter medicines, vision and dental expenses, or long-term health care.

What Are My Options?

Medicare

Medicare was created by the government to provide health insurance for those aged 65 and older. Medicare was not designed to and will not cover all of your medical expenses. In fact, Medicare has large gaps in coverage and no out-of-pocket limitations. Medicare has four primary parts: Part A (hospital coverage), Part B (physician and medical service coverage), Part C (Medicare Advantage), and Part D (prescription drug coverage). Part A has no cost to individuals who qualify for Social Security. Medicare Part B has monthly insurance premiums that are dependent upon income and can range from $104.90 to $335.70 per month per person. Part B premiums are typically deducted from your Social Security benefit. These premiums, however, can be paid directly if you are still working or have deferred Social Security. Because of the gaps in coverage and the potential unlimited out-of-pocket expenses associated with Parts A and B, retirees often will need to find a source of supplemental insurance.

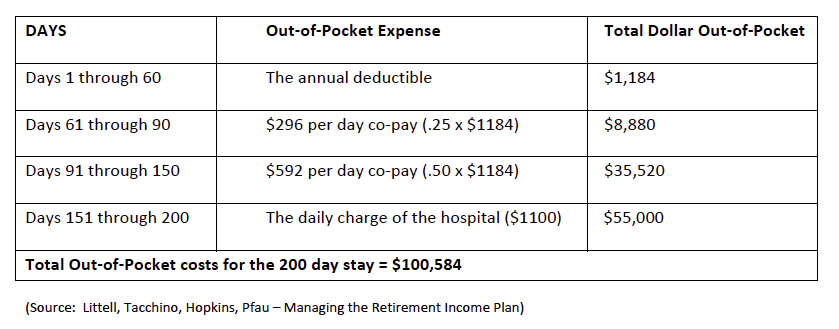

Unlimited out-of-pocket expenses can multiply quickly without a source of supplemental health insurance. For example, let’s examine the cost to an individual who spends 200 days in the hospital and is only covered by Medicare Parts A and B.

Medicare Alternatives And Supplements (Employer-Sponsored, Medigap and Medicare Advantage)

There are many options to evaluate when considering supplemental insurance. Retirees with employer-sponsored supplemental plans typically have the simplest choice. In general, employer-sponsored plans provide the most cost-effective coverage. Individuals without an employer-sponsored option face a more complex decision.

One option for supplemental coverage is Medigap insurance. There are 10 standardized policies meant to cover “gaps” in basic Medicare coverage such as copays, coinsurance and deductibles. Medigap policyholders must be enrolled in Medicare Parts A and B. In addition, most will choose to enroll in Medicare Part D.

An alternative to supplemental insurance is the Medicare Advantage Plan (also known as Part C). Part C acts as primary insurance and replaces Medicare Parts A, B and D. Medicare Advantage Plans are typically structured as HMO/PPO plans that employ a network of providers. These plans usually include prescription drug coverage as well. Under most circumstances, there will be a number of Medical Advantage (MA) plans in your area to choose from. Important factors to consider when evaluating Medicare Advantage and Medigap policies include: potential costs, plan provider availability, deductibles and prescription drug coverage (especially for those currently taking prescription medication).

Long-Term Care

Long-term-care (LTC) includes a wide variety of home and community-based services that are not covered by Medicare or Medicare supplemental insurance. Because these services are not covered by standard insurance policies, LTC has become an increasingly important aspect of retirement planning. Individuals can plan ahead for prolonged care costs with long-term-care insurance (LTCI).

Traditionally, individuals have relied on family members for long-term-care assistance. Today, people are now seeking external services for loved ones. As a result, the costs associated with long-term care are increasing and so is the need for coverage. However, only 14% of individuals age 65 and older currently hold a long-term-care policy.

When considering LTCI policies, it is important to understand that premiums can vary greatly depending on coverage options. Premium costs can be affected by many factors such as coverage benefits and terms, inflation adjustments and marital status. Also, both eligibility and cost typically increase with age. When weighing the option between LTCI and self-insurance (out-of-pocket expenses), it is important for individuals to understand the costs and benefits associated with each.

There are many LTCI policy options from which individuals can choose. Variable annuities with long-term-care income riders are becoming increasingly popular. These policies provide guaranteed income with additional long-term-care coverage when necessary.

There are also hybrid LTC policies that provide a death benefit to heirs along with generous amounts of coverage. These policies are generally purchased with a single premium that is refundable. An example of a hybrid policy for a healthy 65-year-old female (according to Lincoln Financial Group) would be one with a single premium totaling $100,000, with $428,000 in LTC coverage and a $140,000 death benefit. This policy would protect an individual’s net worth while also eliminating costly premium payments for coverage he or she may never use.

People often ask themselves, “What are the odds I will need LTCI?” The U.S. Department of Health and Human Services reports that 70% of people over age 65 will require some form of long-term-care services at some point in their lives. But upon closer inspection, when you consider the period of time that must elapse before an LTCI policy covers costs, only 35% of individuals will actually use this coverage. Therefore, factors including genetics, lifestyle and advances in technology all need to be considered when you are deciding on an LTCI policy.

Reducing Costs

Medicare insurance premiums rise as income increases. One of the ways you can help lower health-care expenses in retirement is by keeping income levels below a high threshold. For example, an individual with income below $85,000 a year will pay $104.90 per month for Medicare Part B. Individuals with an income above $214,000 will pay $335.70 per month. One way to reduce your reported income in retirement is by contributing to a Roth account early in life. Withdrawals taken from a Roth account are not considered income and therefore may be able to keep you in a lower tax bracket. Individuals with less income in lower tax brackets will pay smaller premiums.

Some supplemental plans offer high-deductible options. If you are healthy, choosing a high-deductible plan can help you reduce premiums. If an unexpected medical cost does arise, these plans typically offer a maximum out-of-pocket limit once you have reached your deductible.

Affordable Care Act Of 2010 (Obamacare)

In 2010, the Affordable Care Act, also known as “Obamacare,” was passed to increase the affordability and quality of health insurance.

Many of today’s workers put off retirement simply because of the rising costs of health-care coverage. The Affordable Care Act has tried to make it easier for individuals to retire before age 65 and still have access to affordable health care. Under the law, individuals can shop for private insurance plans on what are called “insurance exchanges.” The new health-care plans offered through the exchanges will provide group-rate premiums to retirees and prohibit insurance companies from denying coverage for pre-existing conditions.

The law also benefits individuals that currently receive Medicare. Obamacare aims to strengthen Medicare plans by reducing prescription drug and preventative care costs. Therefore, people with Medicare whose prescription drug costs have hit the so-called "doughnut hole" could save an average of $16,000 over 10 years.

Looking Forward

Today, health care has become a $2.7 trillion industry in the United States, according to The New York Times. Advances in technology and the demand for proper medical attention have resulted in healthier, longer lives. As individuals require better and more expansive coverage, the cost of medical insurance has increased greatly. By 2020, it is expected that the average couple will need over $250,000 to cover medical expenses in retirement, according to the Employee Benefit Research Institute.

As a result of these changes, it is important to factor health-care costs into every individual’s retirement planning strategy. Although medical expenses are often random, with a properly crafted plan, you can reduce the risk that health-care costs will diminish a well-funded retirement portfolio.

Don L. Riley is chief investment officer at the Wiley Group.

Health-care Costs: Your Retirement Portfolio’s Dark Horse

October 10, 2013

« Previous Article

| Next Article »

Login in order to post a comment