The rocky rollout of Healthcare.gov is likely to be a mere tremor compared to the larger and more profound tectonic shifts that will change the old, familiar landscape of healthcare in the United States—for the rest of our lifetimes.

And the impact of these changes on your wealth—and wealth planning—may be enormous.

Let’s step back and provide some context for what I think is about to happen. Prior to the mid-1980s, corporate pension systems were mainly what are known as "defined benefit" plans. You put in your years working and, based on your salary history, your employer defined a pension benefit paid to you for the rest of your life. That eventually became too expensive for companies to afford, mainly because retirees were living longer and longer, and the reserves required to pay them were just too huge. The defined-benefit system was doomed to collapse under its own weight. And so it did.

Thus in the ‘80s and through today, the world shifted, for the most part, to a "defined contribution" framework. Now you could make a certain contribution to your 401(k) every year and the company would make a contribution to match. After that’s done, you’re on your own—at least as far as your employer is concerned. So if you want a good lifestyle after retirement, you’d better save enough money and invest it wisely, because Social Security alone isn’t going to provide it.

That shift—from defined benefit to defined contribution—is exactly what I think is going to happen to healthcare.

Today you work, and Medicare contributions are deducted from your pay. When you reach age 65, you start enjoying Medicare benefits for the rest of your life, a ‘defined benefit’ program like the good old pension system. And like the good old pension system, Medicare is expensive and getting more so as people live longer and healthcare costs rise.

So, given the similarities, what does this mean for the future? There are a variety of possibilities, and one doesn’t have to be clairvoyant to predict with some certainty that every one of them will likely cost anyone with (even modest) means far more than they are paying today for healthcare. And as with your retirement savings, if you want a good healthcare lifestyle, you’d better save up for it, because I believe you’ll most likely be funding it yourself.

Today, in countries like Canada and the U.K., both widely touted for their universal healthcare systems, citizens still buy their own supplemental policies to cover care that the national plans don’t touch. In Canada, long wait times for diagnostic tests and other procedures have created such stress that many Canadians, including Danny Williams, the premier of Canada’s province of Newfoundland and Labrador, elect to come to the states for procedures rather than wait for their system for help. “My heart, my choice,” Williams said, who came to Florida for a heart procedure. Now Canadian officials have become so sensitive about perceptions around wait times that they’ve “solved” it by making it a criminal offense to "queue jump," or pay a premium for premium access to health care—in Canada anyway.

I believe that the days of defined benefit healthcare—at least the kinds of benefits we’ve all grown up with—are numbered. And I believe that in time we will become a nation of people divided into two classes: those who can afford to purchase high-quality healthcare and the vast majority, who will get basic, government-provided or subsidized health services—the ‘healths’ and the ‘health-nots’.

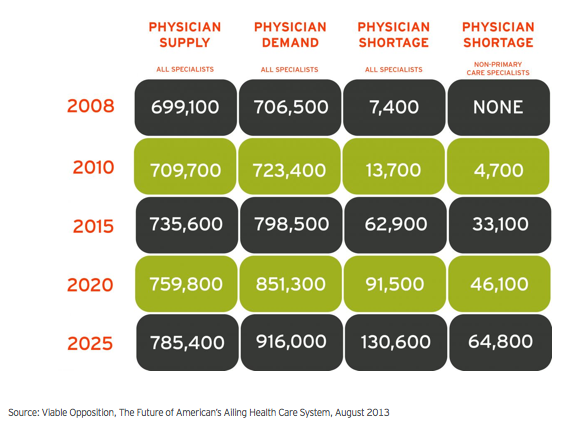

I say "health services" because many "health nots" may not enjoy the kind of doctor-based healthcare system of which we’re accustomed. Already, more and more doctors are opting to start or join "concierge" practices, where they can be selective about their patients and where they have no obligation to accept insurance or Medicare payments that are rapidly shrinking. In the U.S., there were about 4,400 private (concierge) physicians in 2012, a 25 percent increase from 2011, according to the American Academy of Private Physicians. For those who can afford this kind of service, healthcare will probably not change much (other than become more expensive). This migration of doctors into concierge practices, combined with a continuing real decline in doctors per capita as the population grows and the number of new medical graduates remains stable is poised to create an enormous doctor shortage.

In addition, traditional insurance companies—now the gatekeepers of healthcare and the people everyone loves to hate—may well not even exist in the future landscape. More and more so-called Accountable Care Organizations, or ACOs, like Johns Hopkins and Kaiser—are bypassing insurance companies entirely and providing a suite of services directly to patients. Another likely possibility in the next decade is that, if you can afford it, you’ll either see a concierge doctor or an ACO, and the only private insurance you’ll have is a catastrophic policy (assuming the government will allow such policies).