Recently, retail investors have started to pay more attention to “liquid alternatives” investment strategies. This makes sense to us because we believe investors have similar needs, whether they are individuals or institutions. That is, we believe both investor groups need sources of return other than traditional equity and bond markets to help them meet their investment objectives. For decades, institutional investors have used hedge fund strategies to fill that role. However, hedge funds have been generally unavailable to typical retail investors due to net worth requirements, high investment minimums, and limited liquidity.

Recently, retail investors have started to pay more attention to “liquid alternatives” investment strategies. This makes sense to us because we believe investors have similar needs, whether they are individuals or institutions. That is, we believe both investor groups need sources of return other than traditional equity and bond markets to help them meet their investment objectives. For decades, institutional investors have used hedge fund strategies to fill that role. However, hedge funds have been generally unavailable to typical retail investors due to net worth requirements, high investment minimums, and limited liquidity.

New Products – Many Choices

Hedge fund managers have responded to investors’ demand for low minimum, low fee, high-quality, daily-liquidity choices. Some have begun to offer their strategies directly in a mutual fund structure or to serve as sub-advisers on multi-manager mutual funds. As the universe of strategy choices grows, so will the complexity. Expertise and discipline will be of paramount importance if investors want an efficient portfolio that maximizes return per unit of risk, while also supporting an existing asset allocation.

Hedge fund managers take a wide variety of approaches to profit from the investment markets. Some focus on short-term opportunities, others on long-term opportunities. Some invest in a particular asset class, such as single-company stocks; others invest in futures contracts across a broad set of global asset classes. The list of specialties and styles goes on and on.

These specialties and styles are merely building blocks. To be successful, investors must have a deep fundamental understanding of how each strategy works. On which market inefficiencies is the strategy attempting to capitalize? Will it perform best under a certain set of conditions or in a particular market environment? Answering one question invariably leads to many others. But this analysis is critical, and only after extensive digging can one build an efficient portfolio where individual pieces complement each other and work together as a team.

We believe a deep level of fundamental understanding, coupled with extensive diligence is the key to consistent long-term performance across the widest range of market conditions.

Portfolio Construction

Building an alternatives portfolio is a bit like building a basketball team. Putting aside the urge to clone a group of 1992 Michael Jordans, we know that a basketball team requires a set of players with complementary abilities, each specializing in one or more skills. A team composed entirely of point guards might handle the ball effectively, but will almost surely come up short on rebounds. A team of 7-footers should grab all the rebounds, but faster, more athletic guards and shooters will run circles around them. You get the point.

The same rules apply to alternatives investing. Specific hedge fund strategies tend to have strengths that suit a given set of market conditions. We believe that recruiting a team of complementary strategies offers the best opportunity to succeed. For investors with classic stock/bond holdings, a reasonable goal for their alternatives allocation is to create a portfolio with a legitimate shot at achieving positive returns regardless of the market environment. This will serve to diversify the investments they already have. The path to that goal is thoughtful diversification.

Diversification

Most investors understand the value of a diversified portfolio. However, diversification among hedge fund strategies can be difficult to achieve. Allocating to a mix of equity long/short, event-driven and equity sector specialists may seem like a diversified approach, but over time, these strategies all tend to be dependent on price gains in stocks and/or corporate credit. Despite being “hedged,” these funds typically struggle during prolonged bear markets. Thinking holistically about risk and return across an entire investment portfolio (alternatives and traditional holdings), we believe allocating a meaningful amount to these particular hedge fund strategies may have limited benefit to investors whose existing portfolios are already dominated by equity-like risk.

Implementation

A more effective way for investors to increase their overall diversification through an alternatives portfolio may be to include a broad set of fundamentally different hedge fund strategies.

Combining specialists whose collective opportunity set represents a relatively risk-balanced mix of investment strategies may lead to a more consistent return profile. This mix of strategies should span a variety of trading time horizons (short-, medium- and long-term holding periods) and styles (fundamental, technical, discretionary, systematic, trend-seeking, mean reversion-seeking) and should be spread broadly among asset classes (stocks, bonds, interest rates, currencies, commodities).

Balance

To give investors the best chance to consistently achieve their targeted return and risk profile, we believe an alternatives portfolio should combine a global asset opportunity set with a carefully selected group of specialist managers, each with its own investment “DNA”, a liquid/dynamic approach, and an ability and demonstrated willingness to go long or short.

Each discipline and style used by a given manager may have an advantage in a particular set of market conditions. A basketball coach can tweak the team’s lineup to match a future opponent’s strengths or weaknesses. That’s not as easy in the investment world. Predicting future market conditions and their impact on strategies is quite a challenge. This is why we believe balance among hedge fund strategies is critical, thus resisting the urge to make a big “bet” on any particular strategy.

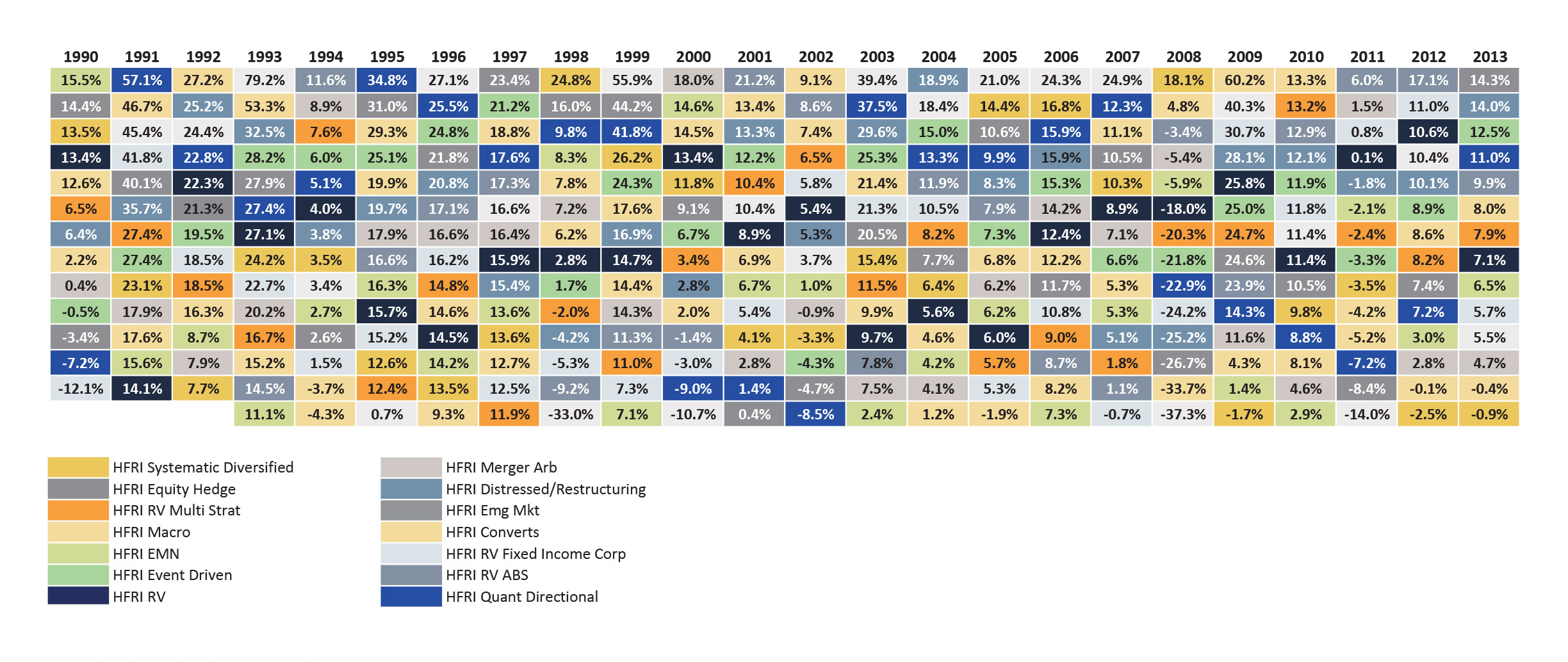

The table below illustrates hedge fund strategy performance across a 24-year span, with the best performing strategy at the head of each column. You can clearly see that no single “color” dominates the top of the charts. Predicting the performance of each strategy ahead of time is even more difficult than completing a perfect March Madness bracket.

Rather than trying to make such strategy calls, we believe the more sensible approach is to understand individual strategies and their ties to market conditions. Then, combine those strategies based on the opportunities from which they attempt to profit. The result should be a portfolio that acts more like a championship team than a gang of one-trick ponies.

Click here to view the chart.

Charles Korchinski is the Director of Liquid Strategies at Larch Lane and sits on the Rothschild Larch Lane Investment Committee acting as an investment adviser to the Rothschild Larch Lane Alternatives Fund.