More speculative issuance has increased in the high-yield bond market, but we do not find it broad-based enough to offset broader credit quality dynamics.

More speculative issuance has increased in the high-yield bond market, but we do not find it broad-based enough to offset broader credit quality dynamics.

High-yield bonds are among the leading performers in the bond market in 2013, according to the Barclays US High Yield Index, but the sector is not without critics. Naysayers have highlighted the record-low yields offered by the lowest-rated debt companies in the bond market, the increasing amount of leveraged buyout (LBO)-related issuance, and growth of more speculative bond structures/issuance in 2013. Indeed, all of these warrant attention and are risk factors that require close monitoring, but we do not find them big enough to offset broader credit quality dynamics.

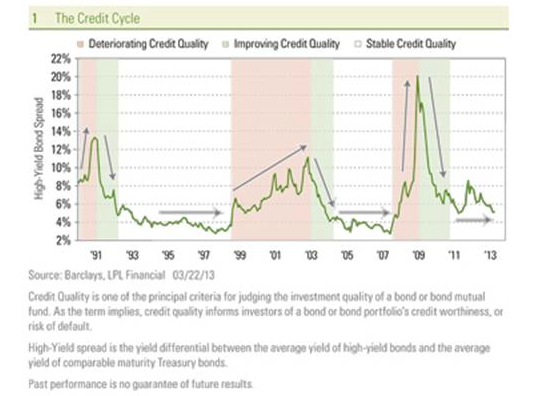

In our view, the underlying trend of stable credit quality has remained intact and may be seen as a positive for high-yield bond investors. The performance of corporate bonds, both investment-grade and high-yield, is highly influenced by the credit cycle: the longer term underlying trend of corporate credit quality. Change in the credit cycle is marked over quarters, not months, and therefore is like a giant supertanker at sea that is unable to turn on a dime. The credit cycle can be best understood by viewing how yield premiums, or spreads, increase, decline, or remain stable over time [Figure 1]. The credit cycle consists of three stages:

1) Improving credit quality. During this stage, corporations endeavor to clean up balance sheets and improve their credit health. Actions to achieve this goal include cutting costs, reducing debt, and raising cash, and these are all aimed at improving companies’ ability to service debt obligations and lower default risk. Default risk is the risk a bond issuer is unable to make the required principal and/or interest payments on their debt obligations. Of course, the economy has an impact, and these actions typically coincide with an improving economy that provides a tailwind to improving credit quality trends. During this period, yield spreads to Treasuries have historically declined as investors acknowledge the improving credit quality trend by buying corporate bonds. Performance of investment-grade and high-yield bonds relative to Treasuries has historically been strong during such periods.

2) Stable credit quality. Eventually, further balance sheet improvement is difficult to achieve and credit quality remains stable. However, once corporations clean up balance sheets, the trend has been typically long-lasting. Performance of investment-grade and high-yield bonds relative to Treasuries has historically been good during stable periods, but the performance differential is much narrower as interest income, not price appreciation, is the main driver of performance.

3) Deteriorating credit quality. Eventually credit conditions deteriorate usually due to a downturn in the broad economy or to companies simply being more lax about credit quality controls. Often both occur simultaneously. Adding debt to grow business more quickly and please equity holders at the expense of bondholders is perhaps the most common example of opening the door to weaker credit quality metrics. Performance of investment-grade and high-yield bonds relative to Treasuries has historically been poor when credit quality deteriorates as investors demand higher and higher yield premiums, which puts downward pressure on corporate bond prices, as compensation for increasing credit risks.

Stable Credit Quality Intact

We believe we are in the middle stages of the stable portion of the credit quality cycle (white shading). The longest period of stable credit quality occurred over approximately five years in the 1990s, from the first quarter of 1993 until the first quarter of 1998. Another lengthy period of stable credit quality lasted for roughly three years in the 2000s, from the fourth quarter of 2003 until the first quarter of 2007.

We estimate that the stable portion of this credit cycle began in the middle of 2010 and may to continue through 2013 and perhaps beyond. As Figure 1 illustrates, each stage of the credit cycle persists for an extended period of time—often years. Still-high refinancing activity, the dominant driver of new issue activity in recent months and years, suggests that the current stability in credit quality may continue.

Refinancing activity remains the dominant trend among new issuance despite the modest increase in more speculative issuance. The powerful refinancing trend, along with relatively low leverage, is a primary reason we believe the credit cycle will remain stable. The amount of maturing debt through the end of 2014 is extremely low and a key factor as to why the default rate for speculative grade bonds remains well below historical average of 4.8 percent, currently at 2.7 percent of issuers according to Moody’s, as of February 28, 2013. Based upon dollar amount, however, the default rate is even lower at 1.5 percent. Moody’s forecasts very little change to the default rate over 2013, a forecast with which we agree. This favorable credit backdrop provides a good underpinning to high-yield bonds.

Figure 1 also reveals that the current 4.9 percent average yield spread of high-yield bonds (as of March 25, 2013), is higher than what occurred during prior stable credit quality periods. Relative valuations are therefore more attractive now compared to prior episodes. However, we would argue that record-low yields and lingering memories of the financial crisis are likely to keep valuations from improving further. Still, interest income can be a notable driver of returns.

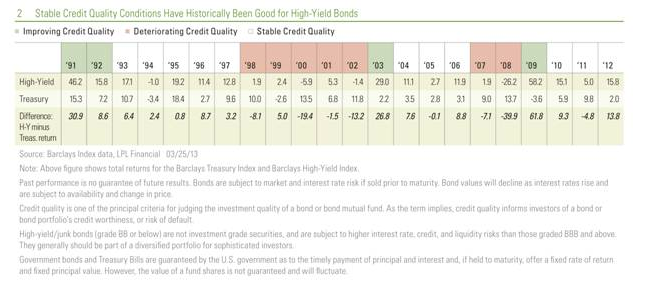

The stable portion of the credit cycle has historically been a rewarding one for high-yield bonds, as they have outperformed Treasuries in most calendar years [Figure 2]. Since yield premiums remain relatively stable, the primary driver of the performance differential boils down to the extra yield generated by high-yield bonds and not price changes. Note that the start and end of various segments of the credit cycle do not fall precisely at the end of each calendar year, but we show the predominant cycle in effect for a particular year.

Therefore, we believe high-yield bonds should be a consideration to add value in investor portfolios. Critics of the high-yield bond market remain focused on the low average yield, but this viewpoint ignores the record-low yields prevalent across the bond market, not just high-yield bonds. While valuations have increased for high-yield bonds, they remain particularly high for government bonds. We would caution that the price appreciation witnessed year to date in 2013 is unlikely to continue, but interest income, even at lower yield levels, can still be a driver of return. With an average yield spread of 4.9 percent to comparable Treasuries, high-yield bonds have offered a notable yield advantage in a low-yield world.

Changes Brewing?

We believe company credit quality metrics likely peaked during the middle of 2012, but this does not mean a quick and rapid downturn is at hand. Credit quality standards have become more lax based upon the credit metrics of recent high yield issuance and more speculative structures. Over time, these initial seeds may sow the return of deteriorating credit quality. Investors will demand lower prices and greater yields as compensation for increasing risks, and high-yield bonds may underperform higher quality alternatives when that occurs. However, the change in credit quality standards is occurring slowly and over the remainder of 2013 is not likely to offset the beneficial characteristics of high-yield bonds as part of a diversified bond portfolio in today’s low-return bond market environment.

Anthony Valeri has been with LPL Financial since June 1993. As Senior Vice President and Market Strategist, Valeri is a member of the Research department’s tactical asset allocation committee and is responsible for developing and articulating fixed income and general market strategy.