KEY TAKEAWAYS

· Broad bond market strength coupled with strong investor demand for yield has driven year-to-date strength in high-yield municipal bonds.

· We remain neutral on high-yield municipal bonds as more expensive valuations and greater interest rate sensitivity offsets above average yields.

High-yield municipal bonds have benefited from broad bond market strength in 2016, but are now more subject to the path of interest rates over the remainder of the year. As we mentioned in our Midyear Outlook 2016: A Vote of Confidence publication, we expect more muted returns across the bond market, and high-yield municipal bonds may see a slowdown after a robust 8.9% total return through July 22, 2016. Additionally, a small number of high-yield municipal sub-sectors, including tobacco bonds, have benefited from outsized gains over the first half of 2016, which we believe are unlikely to be repeated. We are neutral on high-yield municipal bonds as above-average yields are offset by a smaller yield advantage to comparable maturity AAA bond yields and greater than market interest rate sensitivity. On a positive note, default risk, perhaps the greatest threat to high-yield municipal bond prices, remains subdued and unlikely to pose a notable risk absent an economic recession.

DRIVEN BY INTEREST RATES

Many investors may be unaware that interest rate sensitivity can be a key driver of municipal high-yield bond prices, and that has indeed been the case in 2016. The average maturity of high-yield municipal bonds is roughly 20-years, which makes prices very sensitive to interest rate changes and helps explain the rise in prices given widespread yield declines over the first half of 2016. By comparison, the average maturity of taxable high-yield corporate bonds is roughly six years.[1] The greater the interest rate sensitivity, the greater the price gains associated with falling interest rates.

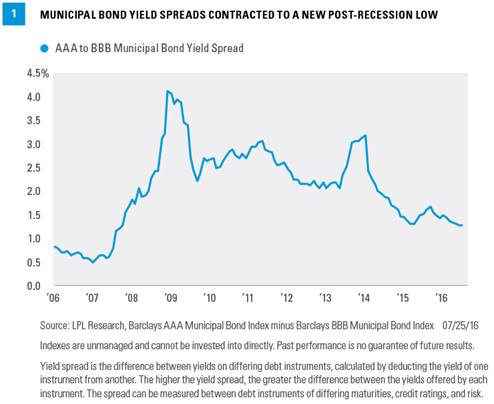

Investor demand for higher-yielding bonds has led to stretched valuations. Average yield spreads between top-quality AAA-rated general obligation (GO) bonds and BBB-rated GO bonds fell to their narrowest level of the post-recession period and below early 2015 levels [Figure 1]. Due to the volatility of Puerto Rican bonds in the municipal high-yield universe over the past years, we find the AAA to BBB yield spread a good proxy for the declining risk premium investors are willing to accept to hold lower-rated bonds.

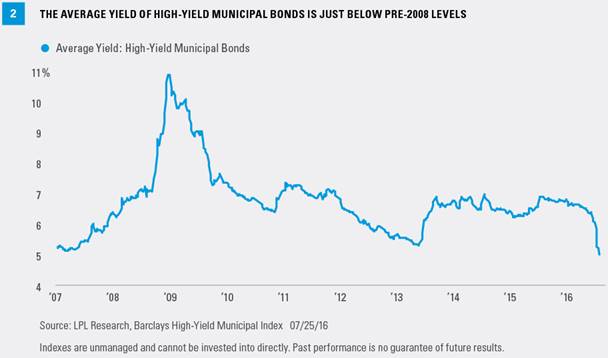

Excluding Puerto Rico, the average yield of the broad high-yield municipal bond market is now lower than pre-2008 levels [Figure 2]. The bulk of Puerto Rican municipal bonds have now dropped out of the Barclays Municipal High-Yield Index upon failure to make payment on approximately $20 billion worth of bonds on July 1, 2016. The sharp drop in yield in July 2016 reflects the exit of Puerto Rican bonds and reveals how low yields are absent the riskiest segment. The average current yield is 5.0%, below yields witnessed in early 2007 and mid-2013 just prior to the taper tantrum bond sell-off.

On a positive note, credit quality underlying the vast majority of lower-rated municipal bond issuers remains firm. Although the dollar amount of defaulted municipal bonds has spiked due to Puerto Rico, the number of municipal defaults is on pace to fall below 2015’s already low number, according to Municipal Securities Rulemaking Board (MSRB) data.

Historically, municipal bonds have had a much lower default rates compared with taxable corporate bonds [Figure 3]. In addition to the average maturity disparities, this is another reason why high-yield municipal bonds exhibit greater interest rate sensitivity. Their inherently higher quality makes them more sensitive to interest rate shifts compared with taxable high-yield corporate bonds, which are much more sensitive to changes in the pace of economic growth and credit quality risks. Most large municipal defaults in recent years, including Puerto Rico, Detroit, and Jefferson County, Alabama, have been years in the making and received a disproportionate share of news headlines; but generally, they had little lasting market impact as municipal problem issuers remains isolated.