The economy was supposed to fire on all cylinders in 2015. Sufficient time had passed for the often-mentioned lags in monetary and scal policy to finally work their way through the system, according to many pundits inside and outside the Fed. Surely the economy would be kick-started by: three rounds of quantitative easing and forward guidance; a record Federal Reserve balance sheet; and an unprecedented increase in federal debt from $9.99 trillion in 2008 to $18.63 trillion in 2015, a jump of 86%. Further, stock prices had gained sufficiently over the past several years, thus the so-called wealth effect would boost consumer spending.

The economic facts of 2015 displayed no impact from these massive government experiments. The broadest and most reliable measure of economic performance – nominal GDP – decelerated. The 3% estimated gain registered in 2015, measured by the year ending quarter, was down from 3.9% and 4.1%, respectively, in 2014 and 2013. In fact the gain in nominal GDP in 2015 was less than the gain for any year since the recession. The two components of nominal GDP also decelerated in 2015. Real GDP slowed to 2%, down from 2.5% in the prior two years, and the implicit price deflator rose by 1% compared with a 1.4% and 1.6% rise in 2014 and 2013, respectively. All of the above economic measures were expanding at, or near, their weakest yearly growth rates in the final quarter of 2015, indicating that the economy possessed little forward momentum moving into 2016.

Personal consumption, the largest category of nominal GDP, decelerated to an estimated 3% rise in the latest twelve months, down from 4% at year-end 2014, the smallest year end annual increase since immediately after the 2008-09 recession. The faltering consumer pattern occurred despite a significant lowering of credit standards that accelerated automotive lending. The percentage of total auto loans in the subprime category hit a ten-year pre-crisis high in the third quarter, according to the New York Fed. In addition, the Affordable Care Act has caused health outlays to surge. Excluding these two special circumstances, consumer spending was notably weak, providing additional confirmation that the so-called wealth effect remains elusive.

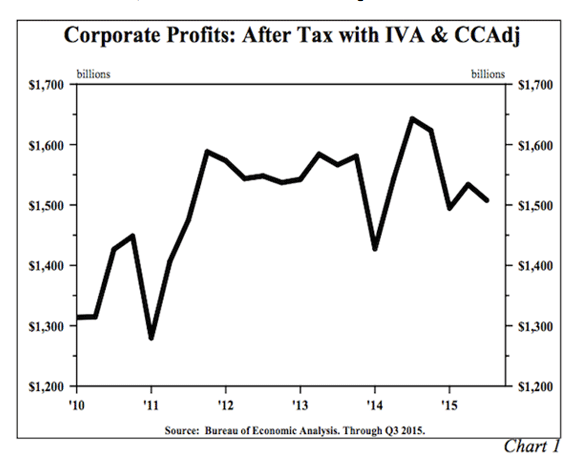

Other important economic indicators reported outright contractions last year. Industrial production slumped 1.4% over the first eleven months of 2015, with a drop of 2% outside of the automotive sector. Only about 10% of private payroll employment is accounted for in the manufacturing sector. This fact distorts the true impact of this critical part on GDP. According to the Federal Reserve Statistical Release on Industrial Production, the industrial sector accounts for about one quarter of real GDP on a value added basis. The importance of this sector to corporate profits is considerably greater. Not surprisingly, corporate profits registered year-over-year declines in the latest two quarters available. According to the BEA, corporate profits in the latest quarter were below the level reached in the fourth quarter of 2011 (Chart 1). The profits picture is a worrisome portent for 2016 since it has fallen prior to all the economic contractions since 1929, albeit it has also had a few false signals.

The 2015 global picture was just as disappointing. By some measures, worldwide economic growth was the poorest since the last recession. Reflecting the depth of the underperformance, world trade was essentially flat for the first time since 2009. Commodity prices, a sensitive and impartial barometer of global final demand, dropped sharply. At the December lows, the S&P GSCI Commodity Index was 59% below the April 2011 peak and at the lowest point since December 2004. The alternative Bloomberg Commodity Price Index, which is reweighted largely based on futures contract volume and includes gold, slumped to the worst level since 1999 (Chart 2). As in the United States, economic growth was ebbing in Japan, China, Canada, Australia, Europe and virtually all of Latin America as the books closed on 2015. As an indication of the Chinese problem, the Yuan has recently dropped to the lowest level since 2011. Thus, the global economy confirms that the entry point for 2016 is fragile.