The U.S. Federal Reserve has had a tough time getting inflation back up to desired levels. There's one area, though, where it may be having a bigger effect than some of its major foreign counterparts: house prices.

Comparing house prices across borders can be a fraught enterprise, given the idiosyncratic nature of housing markets and statistics. That said, after the U.S. housing bust tanked the global economy, the Bank for International Settlements started collecting and publishing data for a large number of countries. Though still imperfect, the data allow for some rough comparisons.

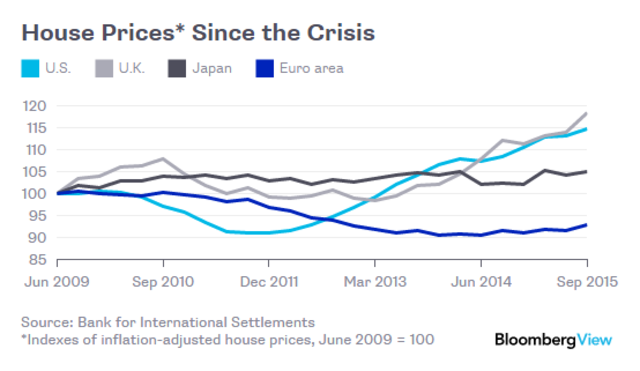

The latest numbers, updated Friday, show the U.S. on a run: Over the year through September 2015, house prices exceeded consumer-price inflation by 5.9 percent -- more than in the euro area, Japan or the U.K. That put them up almost 15 percent in inflation-adjusted terms since the economy hit bottom in mid-2016, just short of the U.K. Here's how that looks:

Although many factors can affect house prices, much of the difference is probably attributable to central-bank policy -- pushing up house prices, after all, is one of the goals of monetary stimulus. The Fed and the Bank of England moved quickly and decisively to push down short-term and long-term interest rates in 2009 and beyond, while the European Central Bank was relatively slow to respond to economic malaise and the Bank of Japan had already used much of its ammunition (though Japan's demographics play a role, too).

The question, then, is whether higher house prices will do any good. In the short term, they increase inequality, because the benefit accrues to relatively wealthy property owners and raises the bar for poorer folks who want to own. The expectation is that this wealth effect will translate into greater spending and investment that will benefit everyone. There are some signs that may be happening -- the U.S. economy is certainly doing better than the euro area's. Still, real median household income -- though rising -- only slightly exceeds its pre-recession level.

Price gains are undoubtedly a relief for millions of U.S. homeowners who came out of the crisis owing more on their mortgages than their houses were worth. Now the rest of the economy just has to catch up.