Affluent Americans have typically been vocal about the quality of

service they expect in their leisure activities. In recent years, an

increasing number of high-end hotels, restaurants and other venues have

begun catering to those tastes with client service models based on

customization and personal interaction. When it comes to advisory

services for the wealthy, research shows that the emphasis should be on

much the same-enhancing the client relationship at a personal level

while still providing demonstrated investment expertise.

To better understand what high-net-worth clients want from advisors, Janus Labs, an advisor-focused arm of Janus Capital Group, recently partnered with private wealth industry expert and Private Wealth editor Russ Alan Prince to survey more than 900 affluent investors (see sidebar for methodology).

The survey revealed surprising information about wealthy investors' expectations, preferred client service experience and the primary drivers of their loyalty. Understanding what motivates affluent clients can translate into a quantifiable, repeatable process that helps advisors build their practice and tailor their efforts to the unique needs of a high-net-worth client base.

Loyalty Is The Glue

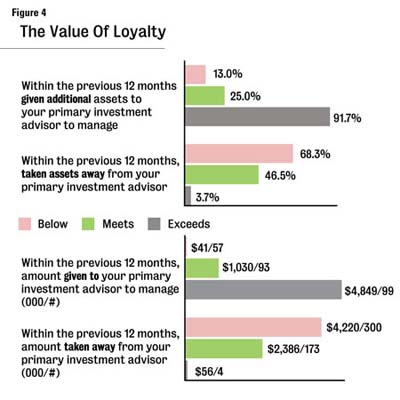

Survey results indicated that the surest way to achieve this goal is by cementing loyalty with clients. Survey respondents considered loyal to their financial advisor displayed distinct client actions. Most notably, 87% of loyal clients intend to bring more assets to their primary financial advisor, versus only 23% of satisfied clients. Also, these loyal clients:

Provided four times more referrals.

Took away fewer assets.

Took money from other advisors first.

Sought nontraditional or value-added services from their advisors.

The survey results provided valuable insight into what does and does not build loyalty and underscored that successful advisory relationships are not solely performance-based.

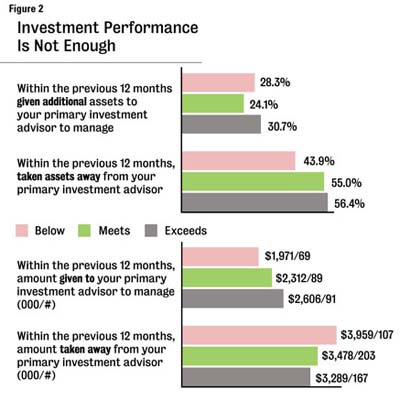

Investment Performance Is Not Enough

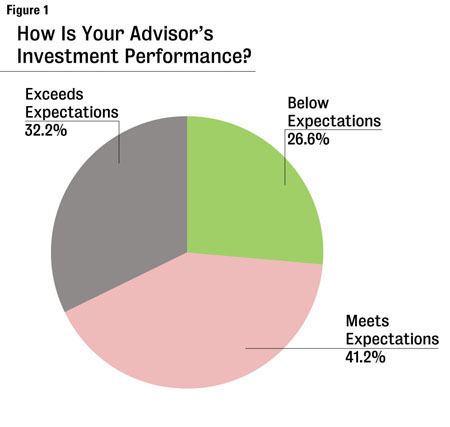

While the affluent primarily seek top-notch investment performance from their advisors, in many cases performance that exceeds affluent investors' expectations does not always translate into a sustained relationship. To address this issue, we first divided our sample of respondents based on whether the investment performance provided by their primary investment advisor (the one who's managing the majority of their investable assets) was below, matched or exceeded their expectations (Figure 1).

The key takeaway is that when comparing affluent investors with differing perspectives of their portfolios' performance, there was little difference in previous actions or future intentions.

The Value Of Loyalty

Our research has shown us that clients generally understand that it's impossible for an advisor to constantly and unfailingly deliver exceptional portfolio performance. However, they do hold their investment advisor responsible for what they can control-that is to deliver, without fail, an exceptional experience. This experience helps produce loyal clients, and loyal clients are the building blocks to an extremely successful investment advisory practice.

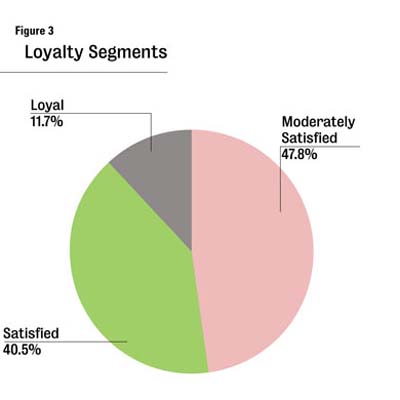

Based on a

proprietary empirical methodology developed by Prince & Associates,

the 919 affluent investors in our sample were divided into three

segments (Figure 3).

It is important to note that only about 12% of these affluent investors can be defined as loyal. Also, the majority-nearly half-are only moderately satisfied.

Five Drivers Of Five-Star Service

The survey identified five primary areas that affluent investors cited as crucial to an exceptional advisor-client relationship.

Investment approach.

The strategy advisors use in an attempt to achieve their clients'

financial goals is clearly critical. More important, investors in our

survey who understood and could easily articulate their advisor's

approach proved to be the most loyal. This helps create a higher degree

of comfort with the advisor and may increase the likelihood the client

will be able to provide better referrals. (Figure 5)

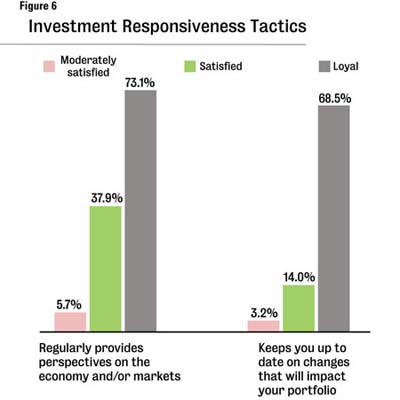

Investment responsiveness. The survey found that it is critical to keep clients up to date on developments in the financial markets or economy that could affect their long-term financial plans. It helps to have a plan in place for communicating major market or economic changes to clients. (Figure 6)

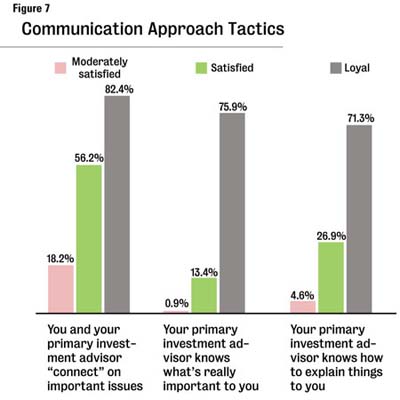

Rapport. The survey found that empathy, insight and approach were the most important qualities in building a relationship between an advisor and a client. If you are unaware of what really matters to your clients, develop your own client-discovery process to identify both their personal and investment goals. Pay attention to your clients' personality cues and tailor your communication style accordingly. (Figure 7)

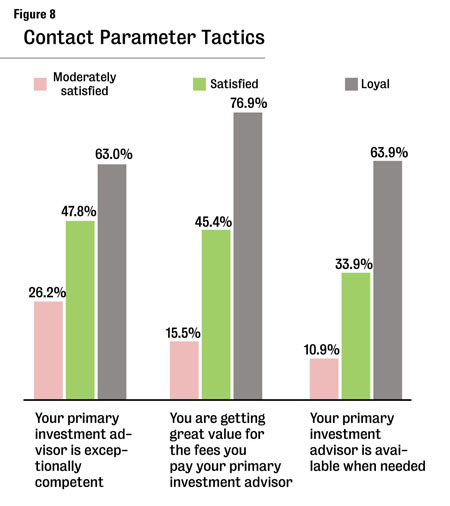

Professionalism. The survey identified five factors that influenced whether an advisor is perceived as skilled and competent. The factors are technical expertise, cost/value, integrity, responsiveness and contact parameters. The perception of advisor competence obviously is critical to building client loyalty. It is also important to contact your affluent clients on a regular basis. Advisors who sought both regular and ad hoc opportunities to communicate with their clients often saw a significant increase in loyalty. In fact, loyal clients report more than 10 times as many contacts over a 12-month period than moderately satisfied clients. (Figure 8)

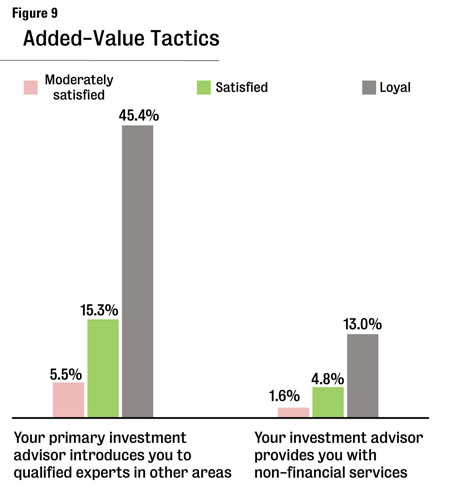

Added Value. Providing non-investment offerings and referrals helps create deeper and more meaningful bonds between advisors and affluent clients. The investors in our survey expressed interest in areas such as income tax planning, estate planning, charitable giving and succession planning. Even if you're not an expert in these areas, you can look for opportunities to introduce clients to other qualified experts. As an added benefit, this leads to the establishment of a referral network with professionals in other fields. (Figure 9)

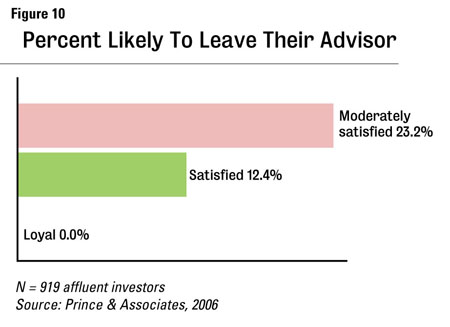

Moving The Needle In Your Practice

To provide affluent clients with a stellar customer service experience, advisors should strive to move those clients who define themselves as satisfied or moderately satisfied to the loyal category. Again, survey respondents defined themselves as loyal according to their actions: adding more assets, taking away fewer assets, providing referrals and receiving non-traditional services from their advisor.

The

good news is that advisors have control over the business tactics that

drive loyalty. By providing a five-star client experience, advisors can

help increase their base of loyal, affluent clients, which can

potentially lead to greater assets, more quality referrals and a

"sticky" client base who commit to their client-advisor relationship

for the long term.