The chances of ECB’s reversing policy as Herr Folkerts-Landau suggests range between slim and none. He surely knows this, too, which makes me wonder what he hopes to accomplish with his pronouncement. DB senior management must have approved the message. Given their situation, it is a strange way to talk about your regulator. Maybe we’ll find out what DB is up to before this weird summer is over.

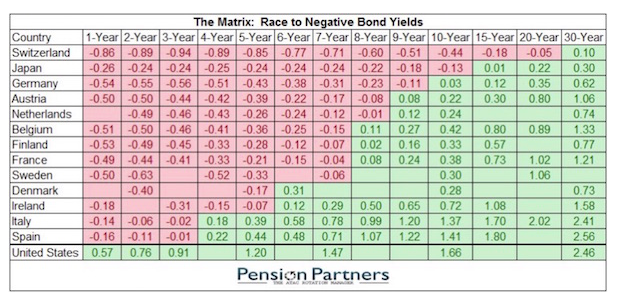

As a sidebar, I thought I would throw in the following rate chart from Europe and Japan, showing just how far out the yield curve negative rates extend. Given that the ECB intends to absorb investment-grade corporate bonds, it is going to push corporate bonds into negative rates when they’re sold on the open market and will push the negative rates out on the yield curve for sovereign bonds. How in the Wide Wide World of Sports does anybody think that pensions and insurance companies can survive in such a market? Remember, they are required to hold a certain amount of government bonds, and their investment return targets are north of 5%. I could do a whole letter on the coming debacle in European insurance companies. It is way beyond the crisis point now.

UK Eyes the Brexit

Across the Channel, UK citizens will vote on June 23 whether to leave the European Union. The latest polls suggest that the vote is very close and the “Leave” side has a slight edge. However, the poll I saw this afternoon showed “Leave” ahead by a full 10 points, 55 to 45. More importantly, the trend over the past few weeks has seen the spread in favor of “Leave” widen. If you are in the “Remain” camp, you have to be worried.

It is hard to overstate the impact Brexit will have, should it pass. And the impact will spread far beyond Britain’s borders The UK is the EU’s second largest economy after Germany and one of its largest exporters. Numerous laws and international agreements may need to be rebuilt. Even with years of planning, Brexit could make the Y2K bug look puny.

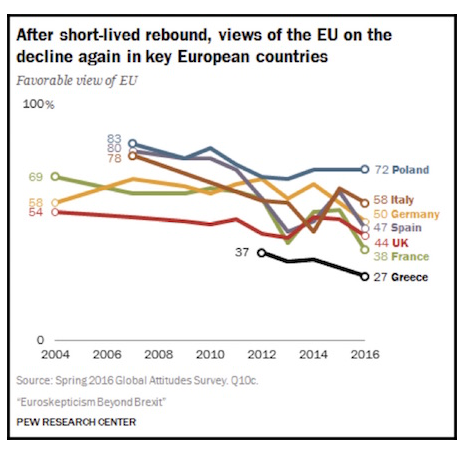

A major concern is what a winning Brexit vote might inspire in other nations. French voters dislike the EU even more than UK voters do, according to a recent Pew survey reported by Ambrose Evans-Pritchard. The EU racked up a 61% unfavorable rating in France versus 48% in the UK. Opinions in Spain and Germany aren’t much more positive. The EU doesn’t look like an “ever-closer union” to the citizens of its largest members.

Yesterday I got the following note from Brent Donnelly (trader par excellence at Citi FX, whose morning note is a must-read). He is quoting the London Daily Express:

EU FALLING APART: Now HOLLAND wants its own referendum to follow historic Brexit vote.

NINE out of 10 Dutch people hope the Netherlands will hold its own EU referendum amid mass discontent at Brussels bureaucrats. A whopping 88 per cent of people polled by a top Dutch newspaper said they would be in favour of an in/out vote along British lines. They have been inspired by possibility of Britain quitting the bloc on June 23 – and hope ‘Nexit’ will follow Brexit.

Harry van Bommel, MP for Holland’s Socialist Party, told Express.co.uk: “If Britain leaves, that will give other countries courage.

“So now debate is beginning in the Netherlands about having a referendum on EU membership.

“We cannot go on the way we are – financing Greece, trying to keep countries in the eurozone. The eurozone will break up eventually.” He added: “Because we’re in the euro, Dutch people see budget cuts, unemployment going up, and they relay that to the EU. These facts make the EU very unpopular. People distrust Europe and some people even hate Europe – it’s in an existential crisis.”

The graph below shows the general negative trends in opinions on the EU in other European countries.

Despite this trend, Politico reported last week that French leaders intend to push for severe consequences against the UK if Brexit passes. Paris thinks it must send a strong warning to other would-be deserters that leaving the EU would be very painful. Maybe they also want to send that warning to their own citizens.