The east German village of Glashuette doesn’t look like much: just a handful of streets stretching up and down a narrow valley from a bare station platform, where trains depart once an hour for the 45-minute trip to Dresden. Scratch a bit deeper, though, and you’ll find that the town of 7,000 is home to the greatest concentration of world-class watchmakers outside of Switzerland - with a business that’s growing even as Swiss producers retrench.

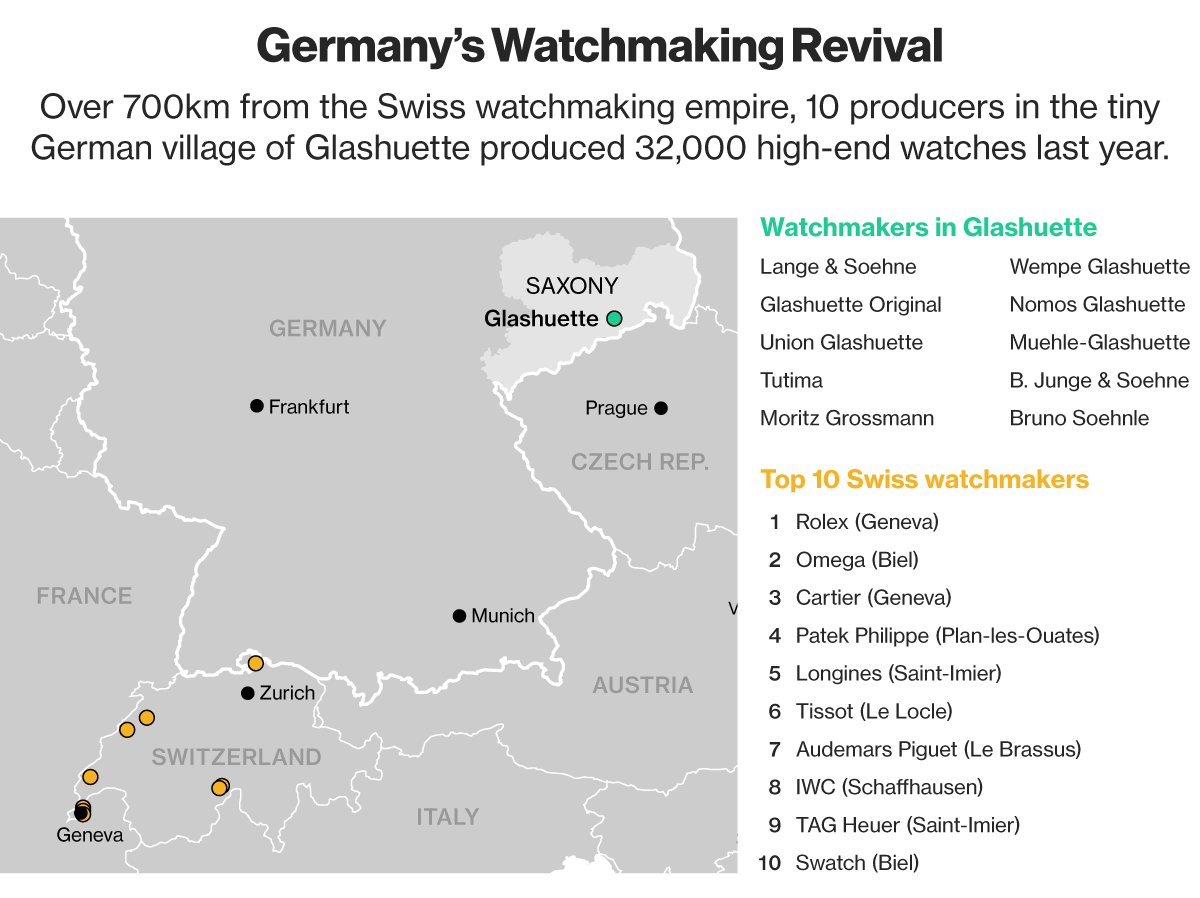

Glashuette produced more than 32,000 watches last year, with a total value of at least 500 million euros, according to analyst estimates. These aren’t Swatches: The town’s 10 watchmakers tend toward the high end, and the priciest local producer, A. Lange & Soehne, has built a reputation that rivals those of giants such as Patek Philippe and Audemars Piguet. Some of its watches top 1.9 million euros ($2.1 million), and its average price is roughly 50,000 euros.

“Our customers like that not everyone knows what they have around their wrist," says Wilhelm Schmid, chief executive officer of A. Lange & Soehne. "We’re a very well-kept secret, almost like stealth wealth.”

The German industry, though far smaller than Switzerland’s, is less dependent on sales to China, where the watch business has been hammered by an anti-corruption drive. And with most expenses in euros, producers have been able to keep costs in check, unlike Swiss rivals that have to deal with the surging franc.

While Switzerland’s Richemont in February said it may cut as many as 350 jobs in Switzerland, the two biggest watchmakers in Glashuette say they’re hiring. German watch exports last year jumped 14 percent even as Switzerland’s fell 3.3 percent, government data show.

Despite the differing fortunes, the market for luxury watches is global, and the Germans may soon face the problems that have hit the Swiss, cautions Rene Weber, an analyst at Bank Vontobel AG in Zurich. The slump in tourism to Europe after the November terrorist attacks in Paris and the bombings in Brussels last month will likely eat into sales, Weber says, and “the luxury watchmakers in Glashuette will also feel the downturn in Asia.”

Glashuette owes much of its prosperity to the Swiss. Lange has sent employees to the Swiss town of Schaffhausen, home to sister brand IWC, for training. And some Glashuette producers import components such as watch hands and dials from Swiss suppliers. In 2000, Richemont bought Lange, and Swatch Group acquired Glashuette Original and Union Glashuette.

Glashuette’s success is all the more notable given that the town’s industry has almost perished more than once. Lange was the town’s first watchmaker, founded in 1845 by Ferdinand Adolf Lange, a Dresden native who studied the trade in Switzerland and Paris. He trained Glashuette youths to make pocket watches, and as they gained experience some branched out on their own. By the turn of the century, Glashuette counted as many as 20 companies that manufactured watches, marine chronometers and grandfather clocks.

After World War II, the town’s half-dozen remaining watch companies were expropriated by East Germany’s communist government and merged into a state-owned “kombinat,” which continued to manufacture mechanical watches, marine chronometers and, from the 1980s, inexpensive quartz watches.

When the Berlin Wall fell in 1989, the kombinat had some 2,500 workers. But the company struggled with the introduction of the Deutschmark after unification with West Germany, and by 1994 employment in the town’s watch industry had plunged to just 72 people.

“Unlike Switzerland, which has been allowed to work in peace, we’ve had wars, economic crises, bankruptcies,” says Yann Gamard, president of Glashuette Original. “Everything was taken away from us by the Soviets after World War II. But the people remained, and so did their know-how.”