Ned Johnson has used part of his wealth to amass a collection of antiquities worth nearly $260 million through his nonprofit Brookfield Arts Foundation, according to the charity's 2014 annual report. The nonprofit's purchases include a 200-year-old Chinese merchant house that Johnson had moved from that country and reassembled at the Peabody Essex Museum in Salem, Massachusetts. The house and its contents are worth $17 million, according to Brookfield's 2014 disclosure to the U.S. Internal Revenue Service.

Other beneficiaries of the venture investments include top Fidelity officials such as Peter Lynch, the legendary Magellan fund manager and Fidelity vice chairman, and current portfolio managers such as Danoff, who manages about $109 billion in assets at Fidelity's Contrafund.

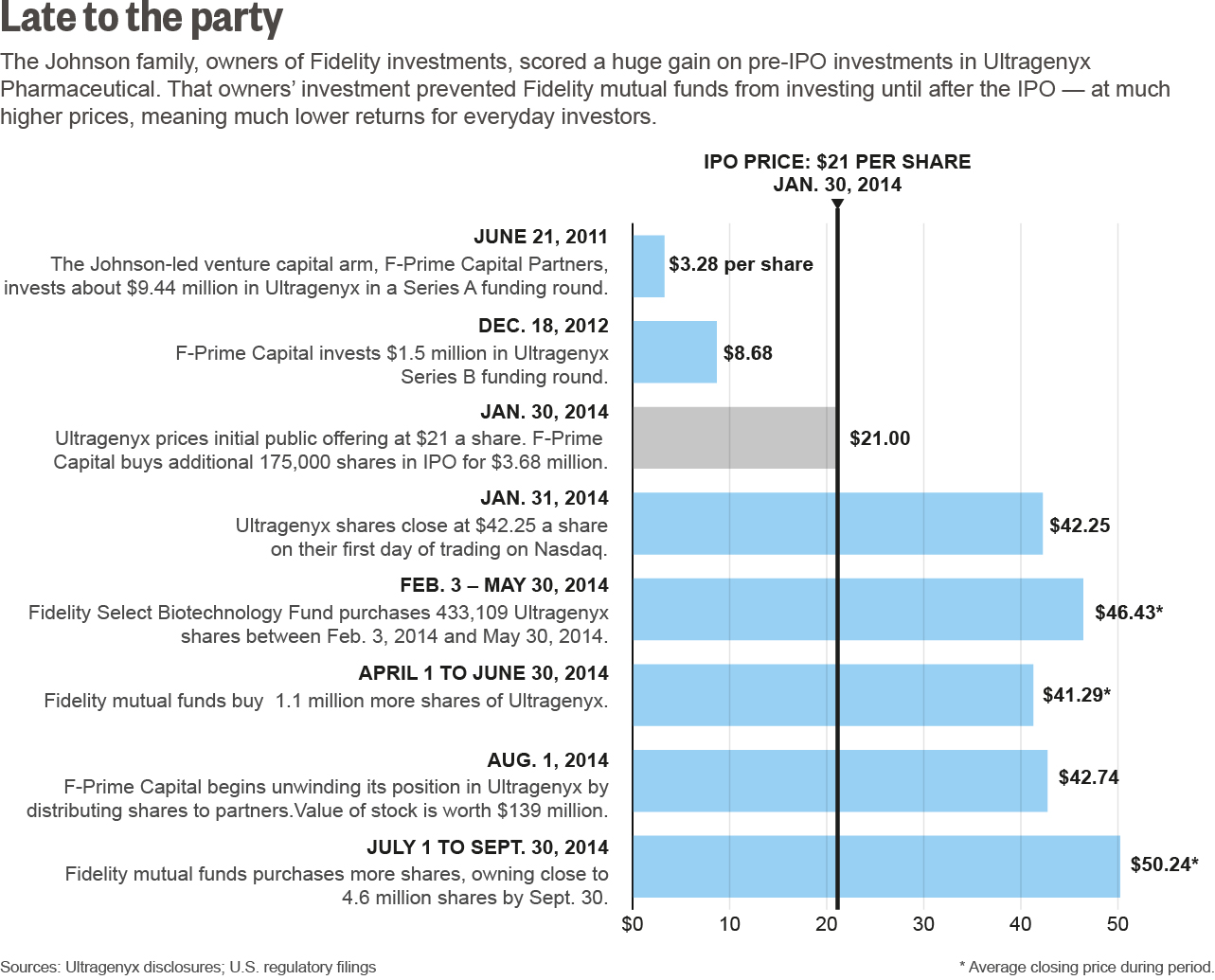

The Ultragenyx investment illustrates the opportunity cost Fidelity investors face when a mass-market fund encounters a conflict of interest with F-Prime.

Ultragenyx was hardly a hidden gem. Several of Fidelity's rivals, including American Funds, BlackRock and Columbia Management, also got in on the early action before the company's initial public offering. Columbia's Acorn Fund, for example, invested $10 million at the same time as F-Prime and had an unrealized gain of nearly 1,100 percent, or $108 million, in mid-2015 before unwinding part of its position, U.S. regulatory filings show.

In the third quarter of 2014, Fidelity funds boosted their collective stake in Ultragenyx by 3.3 million shares to become the biotech firm's largest mutual fund investor, with nearly 4.6 million total shares. By then, the average closing price of the stock had moved up to $50.24 from $41.17 in the second quarter. During the same quarter, F-Prime unwound most of its stake in Ultragenyx by distributing the stock to limited and general partners, U.S. regulatory filings show.

Asked about F-Prime, Fidelity said in a statement that its mutual funds get priority over the Johnson family's interests. "When both our proprietary venture capital group and our funds express interest in investing in the same private companies, the funds always prevail," the company said in a statement.

CONFLICTED REFEREES

One person who has been refereeing potential conflicts between Fidelity and Johnson family investments is Linda Wondrack. Until September, she doubled as chief compliance officer for the mutual funds and for Impresa Management, which manages the F-Prime assets. She served in both capacities for three years.

In September - after Reuters asked whether Wondrack's dual role presented a conflict of interest - Fidelity hired another executive to replace Wondrack in one of the two positions. The fund appointed a company veteran, Chuck Senatore, as chief compliance officer of Impresa Management.

A single person could not effectively perform both jobs, said Wake Forest University's Palmiter, who called the arrangement "nearly laughable."