A little while ago, Kevin Drum of Mother Jones -- a very smart and perceptive writer on economic and policy issues -- posed a big question: Why is finance so dominant in the U.S. economy?

How did this happen? Finance isn't a monopoly. In fact, it's one of the most globalized, fluid, and competitive industries on the planet. Why haven't its profits long since been reduced to zero, or close to it? I can understand occasional blips as markets change—CDOs and SIVs get hot for a while, so experts in CDOs and SIVs make a killing—but the overall industry? How has it managed to hold onto such outlandish rents for such a sustained period?

I think we do know a partial answer -- or several partial answers -- to this question.

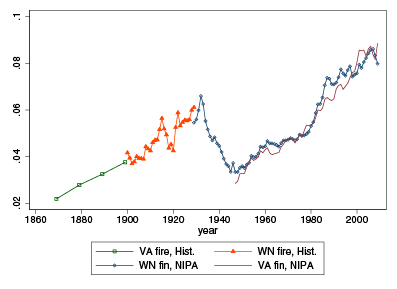

First, it’s important to point out that when an industry grows as a share of U.S. gross domestic product, it doesn’t always mean that it’s more profitable than before. Profitability could potentially shrink as an industry grows. But in the case of finance, that’s not what’s happened. Here, courtesy of economist Thomas Philippon, is a graph that shows finance’s share of GDP on the vertical y-axis:

As you can see, finance’s slice of the overall economy peaked at more 8 percent in the 2000s.

And here, via University of Connecticut law professor James Kwak, is its share of corporate profits:

One thing we see from these charts is that finance has always been a very profitable industry. In the '60s, when finance was less than 5 percent of the economy, it made 10 percent to 15 percent of the profits, even though it was more tightly regulated than now. That means part of the answer to Drum’s question -- the source of finance’s excess profitability -- might lie in the nature of the industry itself, or how we measure it, rather than in recent events.

But that can only be part of the answer. There are also two other questions. First, why did finance grow so much as a percent of output since 1980? And second, how did it keep being so profitable even as its size ballooned?

Let’s start with the question of why finance has grown so much in recent years. We can get some clues to this by considering which parts of finance have grown. Financial economists Robin Greenwood and David Scharfstein took a look at this back in 2013, and found that the acceleration since 1980 has come from two sources: 1) asset-management fees, and 2) lending to households.

Asset-management fees are middleman costs that all kinds of players in the finance industry charge to move money around. These fees are usually charged as percentages of the assets being managed. The amount of wealth in the U.S. economy has soared since 1980 -- just think of the rises in the housing and stock markets over that time -- meaning that the middlemen in the finance industry have been taking their percentage fees out of a much larger pool of assets. That has increased finance’s share of national income. People also started to put more of their money in asset markets -- where money managers charge percentage fees -- instead of keeping it in banks or government bonds, which don’t.

But why have profits from these middleman fees stayed so high? Why haven’t asset-management charges gone down amid competition? In a recent post, I suggested one answer: people might just be ignoring them. Percentage fees sound tiny -- 1 percent or 2 percent a year. But because that slice is taken off every year, it adds up to truly astronomical amounts. So if people are just ignoring what middlemen skim off the top, because each fee seems small, investors could be handing significant fractions of the country's GDP to the financial sector out of sheer carelessness. That would certainly keep profits high; if many investors pay no attention to what they're being charged, more competition can’t push down those fees.