Since launching his own firm early in 2010, DoubleLine CEO Jeffrey Gundlach has taken the mutual fund industry by storm. His flagship fund, the DoubleLine Total Return Fund, and his company quickly became the respective fastest-growing mutual fund and fund company in history.

In the process, Gundlach has cultivated the image of a brilliant but coldly realistic student of financial markets prone to making bold, headline-grabbing predictions. The math wizard has marketed DoubleLine funds relying on his superb public speaking skills sprinkled with bombastic remarks. Often, he leaves audiences spellbound with his ability to discern the almost perfect negative correlations between such seemingly unrelated asset classes as gold and U.S. housing since 2010.

For the better part of two decades, Gundlach managed fixed-income assets for Trust Company of the West (TCW) in relative obscurity. Within fixed-income circles, he was admired as one of the world’s smartest managers of mortgage-backed securities (MBS). At TCW, he worked with Howard Marks, the world’s leading distressed debt investor, who left in 1996 to start Oaktree, which now owns about 20% of DoubleLine. Both firms are based in Los Angeles and some believe Oaktree may eventually buy a controlling interest in DoubleLine.

Gundlach turned in great numbers during the market meltdown of 2007-2008 after making a name for himself with his 15 years running the TCW Total Return Bond fund. He recorded a 7.2% return over that two-year period, according to Morningstar, which gave him their fixed-income manager of the year title in 2006. In 2009, the fund climbed 19.5%, most of that gain achieved before TCW fired Gundlach in early December. That meant he beat almost everyone else managing intermediate-term bond funds.

In short, Gundlach cleaned up while other portfolios were blowing up during the housing nightmare. But he never enjoyed the high profile of managers who pen provocative commentaries like Marks, Pimco’s Bill Gross and GMO’s Jeremy Grantham. All that changed in 2010 with the launch of DoubleLine. Further enhancing his visibility was the nasty legal battle that ensued in 2010 between DoubleLine and TCW, which accused him of theft of trade secrets. In the end, TCW’s lawsuit was an embarrassing failure. TCW lost and was forced to pay him a $67 million bonus it had withheld for one quarter’s worth of performance fees for a hedge fund he had managed.

Some say the reason for Gundlach’s departure was that TCW and its parent, France’s Société Générale, sought to avoid paying him potentially billions in performance fees on the hedge fund, as it became apparent the depressed mortgage-related securities purchased at fire-sale prices during the financial crisis were going to pay off. Others say he was fired because TCW got wind of reports he was looking to leave and start his own firm. Whatever happened, both parties no doubt would agree they had developed irreconcilable differences.

Within hours of TCW’s announcement that it had fired Gundlach and replaced him with a team of fixed-income professionals from crosstown rival Metropolitan West, Morningstar’s director of fixed-income research, Eric Jacobson, issued a report calling it a “savvy” move on the part of TCW. The timing of the report became the first in a series of comments and suggestions by Morningstar that incensed DoubleLine personnel, who believed that Jacobson was informed of TCW’s decision to fire Gundlach well ahead of time. Morningstar maintains it was referring to TCW’s decision to acquire MetWest as “savvy” because it might stem the likely flow of assets in the wake of Gundlach’s exit.

As Gundlach and his team were launching their new firm, they came to believe that Morningstar deviated far beyond any bounds of impartiality during the TCW lawsuit for reasons they still can’t understand. They note that, in the middle of the lawsuit, Morningstar mentioned that DoubleLine might be under a federal criminal investigation. The fund rater would later say it misinterpreted a DoubleLine filing.

Last year, Morningstar gave five-star ratings to the DoubleLine Total Return fund and the DoubleLine Core Fixed-Income Fund, which came up for their three-year reviews, accompanied by a neutral analyst rating. Still, after a 2011 report entitled “Swim At Your Own Risk,” DoubleLine ended communication with Morningstar.com analysts.

Executives at DoubleLine don’t think Morningstar.com analysts had an ulterior motive for playing favorites when Gundlach was pushed out of TCW, uncharacteristically siding with a large, established asset manager over a young startup. But like other financial analysts and asset managers, once they took a position, they dug themselves in. Beyond the TCW lawsuit, DoubleLine officials say the problem isn’t their funds. It is that open-end Morningstar.com analysts act as commentators, offering opinions while failing to understand complex debt securities like inverse floaters and other unique vehicles. DoubleLine officials quickly add that the analysts in Morningstar’s institutional research group, many of whom are CFAs, are professionals whom they respect.

A Morningstar spokeswoman says her company has been a longtime admirer of Gundlach, adding that he had been given center stage at Morningstar conferences several times. Both Gundlach and Morningstar executives also have been speakers at Financial Advisor conferences.

Gundlach “currently gets our highest marks for both people and performance in our analyst rating system,” says Morningstar’s director of media relations, Nadine Youssef. “If you read what we’ve published on Gundlach over the years, you’ll find extensive praise for his abilities. A neutral rating on his fund is hardly a stinging indictment. It’s simply our analyst’s current opinion, especially given the lack of information from DoubleLine.”

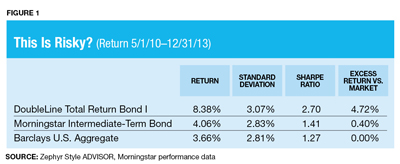

The feud disguises a larger question surrounding DoubleLine and all its competitors. As the bond market begins what many believe will be a glacial-age bear market, how risky are all these funds and how are they reaching for returns in a stingy bond market. In a recent report, Morningstar still refers to Gundlach as “a mortgage maven,” a manager with “a stellar record” at his previous job running the TCW Total Return Bond fund.

How Risky Is DoubleLine?

February 2014

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

The biggest problem in the bond market is trading risk, not default risk. Default risk is extensively analyzed and good shorthand formula's exist like the Z-score. The problem is playing in exotic securities and watching those securities crater when everyone tries to hit the cash-out door at once. In the default world all the owner and potential owners can have enough differences of opinion about a credit to keep markets functioning. Most of the risk is interest rate risk and when interest rates move everyone tries to get on one side of the trade. Bond dealers, not that they were ever a great help at times like that, are even less helpful now as risk capital available to hold positions is at a minimum. Then we've got the ETFs which ignorant rep cowboys blow out of at the first sign of trouble. So, the real question about DoubleLine is can they hold their positions and survive in severe market moves that are accompanied by no liquidity? Or, do they require being "nimble", that stupid Barron's adjective, stupid because it requires each one of us to be faster than everyone else. Unfortunately, last May's market move was hardly "severe", especially with the healing that went on almost immediately afterward. Rates moving up 3% in a year and volatility doubling is severe. Trust me, I remember that time. So, we don't really know if DoubleLine is well positioned based on then. What we want to see is that, in a severe scenario, the large amount of less risky assets is balancing the smaller amount of very risky assets. Does DoubleLine reveal that? If so, great accolades to them because most exotic managers are reluctant to reveal the secret sauce. If not, we're taking it on faith no matter how much Zephyr rear-view mirror analyzing we do.