Alicia Munnell wants to make one thing clear. Social Security is not going bankrupt. The program that the economist calls “the most valuable component of our retirement system” is a sustainable system and can be fixed. America has just been avoiding the hard choices it has to make if it wants to keep Social Security around for future generations.

Munnell, who worked at the Federal Reserve Bank of Boston for 20 years, the Treasury Department for two years during the Clinton administration , and served on a U.S. Social Security Advisory Board in 2015, is director of the Center for Retirement Research at Boston College. She has parsed just about every argument for how to reset Social Security’s finances. In a recent conversation and paper, Munnell, 74, laid out the stark choices Americans face, and the solutions suggested by two diametrically opposed pieces of legislation.

We all know Social Security has long-term cash-flow issues. How would you describe the challenge?

Munnell: It’s a very simple system. It’s not like the health-care system, where you have insurance companies and doctors and patients. This is money in, money out.The recent Social Security trustee’s report said the same exact thing it’s said almost every year since 1992 or 1993. We have a deficit—it’s a little bigger now than in the past—that’s equivalent to 2 percent to 3 percent of taxable payrolls, and we need to fix it. Every year the actuaries tell us there’s a deficit; every year as a nation we do nothing. It’s very easy to put off making changes for something that won’t happen. You really won’t see anything until the trust fund actually is exhausted in 2034. At that point, benefits have to be cut or revenue increased, because the system is not allowed to pay out money that it does not have.

By the way, when people talk about how the Social Security deficit will lead to big increases in the budget deficit, well, Social Security can’t run a deficit. When people say that, either they don’t understand how the law works or are trying to create alarm about the system.

One misperception about Social Security is that it should be enough to live on, which was never really the intent. How much income does it actually replace for workers?

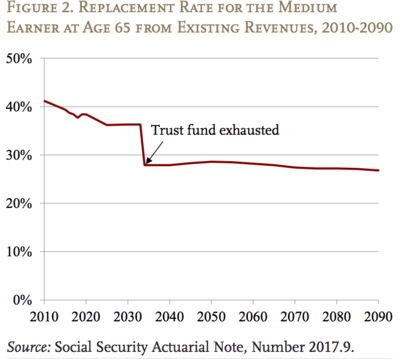

The current level of tax revenues coming in mean that the replacement rate—benefits relative to preretirement earnings—would drop from 36 percent for the typical 65-year-old worker right before the trust fund is exhausted to about 27 percent by 2070. That’s a level we last saw in the 1950s. Right now, the replacement rate is already set to decrease from 39 percent to 36 percent for those claiming Social Security benefits at age 65. That’s because of the gradual increase in full retirement age, from 65 to 67, that was part of the legislation in 1983.

You describe two proposals out there as good “bookends” to consider when looking at ways to get rid of the deficit facing Social Security.

I like the proposals as bookends because they are so different, they don’t compromise at all. One is all on the benefit side, just big benefit cuts. The other says it would enhance benefits a little and make big tax increases. And those are the two ways to go. They highlight the notion that we should really decide politically—and I don’t know quite how we do this—what share of the solution Americans want in benefit cuts, and what share they want in tax increases.