Risk Tolerance And Behavioral Finance

One important challenge to this approach is that portfolios with such human-capital-adjusted allocations, when viewed in isolation, may feel “extreme” or “distorted” to the investor.

For instance, a government employee has an extremely conservative “bond-like” human capital. If that employee is also young, then human capital might make up well over 90% of his or her net worth. Accordingly, such a person could invest 100% of a liquid portfolio in equities, and the investor’s total household net worth would still be in a “10/90 portfolio”—10% is in equities while 90% is in a human capital “bond.”

But while such an allocation might seem reasonable in terms of human capital, the investment portfolio is still 100% in equities, which might feel jarring to a client with a conservative risk tolerance (who cannot recognize the role “invisible” human capital is playing).

A similar problem occurs when retirees try to allocate a portfolio around the bond-like asset value of their Social Security. The allocations appear concentrated and risky when you look at the portfolio by itself.

At the opposite extreme, an aggressive entrepreneur whose human capital is extremely stock-like would ideally allocate his or her entire portfolio to bonds and cash, just to tone down and diversify a household balance sheet of what otherwise may be nearly 100% equities. From the financial planning perspective and the investor’s risk capacity, this may seem entirely reasonable—a stock-like job plus the volatile value of a business really is risky, and should be dampened down with a significant bond/cash holding and a large emergency reserve.

However, in real life an aggressive entrepreneur with a high tolerance for risk in his or her job and business probably also has a high tolerance for portfolio risk. If the entrepreneur is so risk tolerant that 100% equity exposure is OK, then both the job and portfolio would be fully invested in stocks. The latter would not be used to diversify against the former.

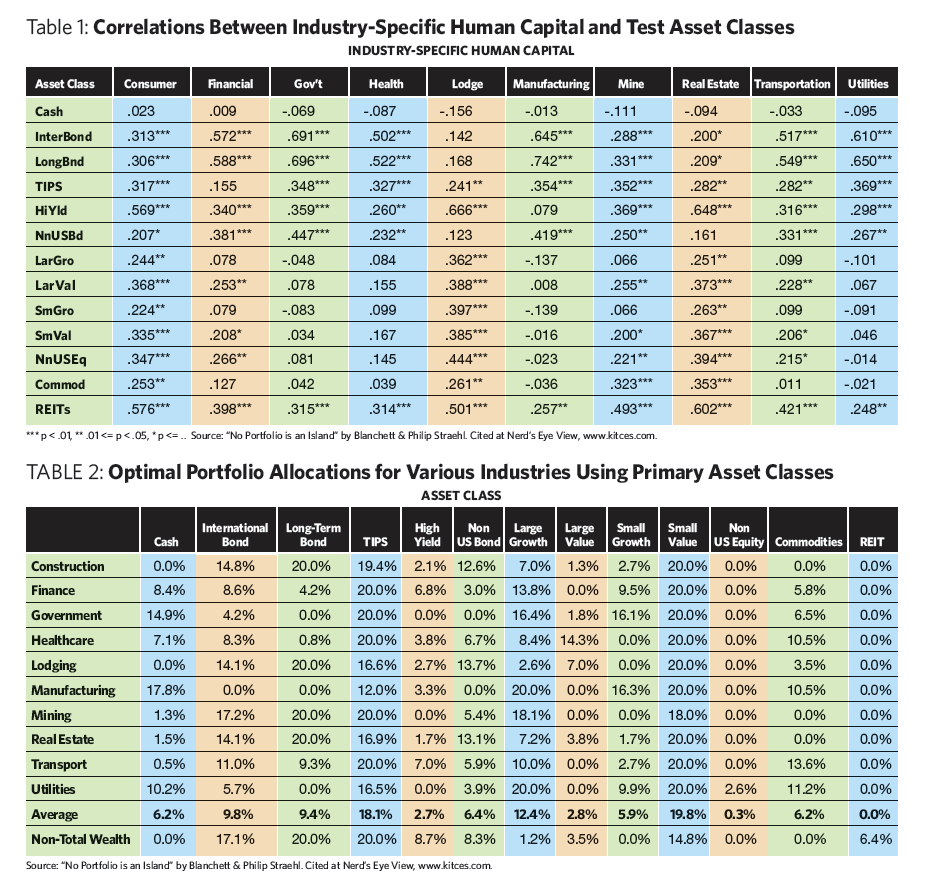

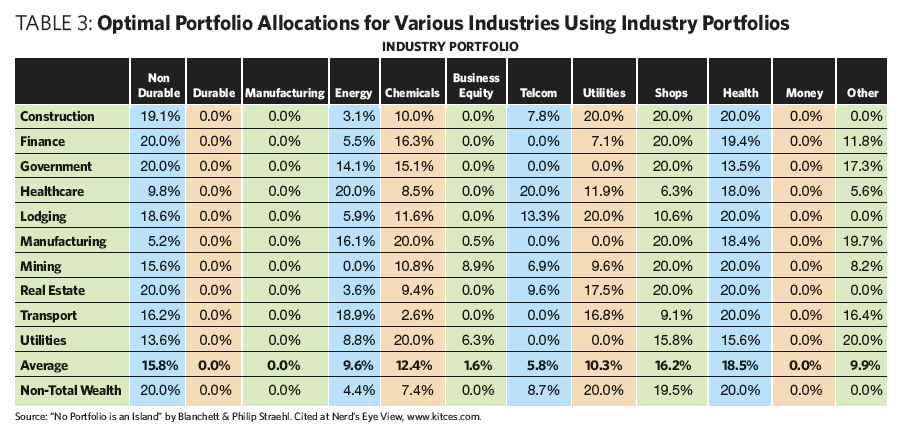

Even so, it’s arguably still relevant to diversify by sector and industry—to own less in financials if the entrepreneur runs a financial advisory firm (which is already the equivalent of a concentrated investment in the financial sector). This won’t run contrary to the investor’s overall risk tolerance. It’s just prudent diversification within equities.

Tools To Create Industry-Based Portfolios

Ultimately, the Blanchett and Straehl paper may create a basis for a new standard in how we invest portfolios for accumulators. But unfortunately, at this point we lack tools to actually execute the strategy. The concept of pitting jobs against stock holdings is perhaps a good starting point, but alas it’s difficult to apply consistently across a broad base of clients in a wide range of situations.

In the future, though, it wouldn’t be surprising to see a new set of investment tools evolve—perhaps software designed to take information about an investor’s human capital and come up with a more precise series of portfolio allocations that allow for better household diversification. Such an approach could be a significant value-add for “personalized” portfolio design. And notably, because the interrelationship between assets can change, and because over time a worker’s human capital declines while financial capital increases (as savings), the worker’s portfolio will need monitoring and ongoing management to be reallocated.

Such a strategy might actually benefit from the proliferation of sector-specific ETFs, which allow advisors to recreate the total equity exposure of U.S. stocks with more or less of those industries that duplicate the investor’s human capital. (TAMPs or robo-advisors might even help with implementation. Or what if asset managers came up with “target-date” style funds based not on retirement dates but industries?)

In other words, in the future it may even be far less common to own a single “core” investment position like the S&P 500 when more personalized portfolios that are better diversified around human capital can be created instead.

Michael Kitces is a Partner and the Director of Wealth Management for Pinnacle Advisory Group, co-founder of the XY Planning Network, and publisher of the continuing education blog for financial planners, Nerd’s Eye View. You can follow him on Twitter at @MichaelKitces.