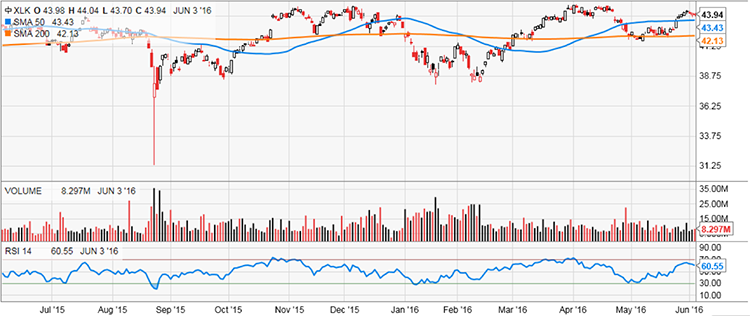

The call for this week: Friday’s upside reversal caused one old Wall Street wag to exclaim, “When the stock market ignores bad news that’s good news!” To be sure, there is not enough data to alter our “call” for new all-time highs as of yet. On a valuation basis the forward 12-month earnings estimate for the SPX (IBES) is $124.48, giving us a nearly 6% forward earnings yield and a forward P/E multiple of 16.9x. If new highs do emerge, the market probably will be led by the healthcare and technology sectors. That should put focus on the Health Care SPDR (XLV/$72.29) and the Technology SPDR (XLK/$43.94). Looking at the chart, it is worth noting that the XLV has broken out to the upside (see charts on page 3). Today “The Street” will put on rabbit ears at 12:30 p.m. to hear if Ms. Yellen has damage control on her mind, which has left the futures flat this morning.

PS – My friend Jason Goepfert (SentimenTrader) notes in Barron’s over the weekend:

Examining data beginning in 1928 shows that in 12 out of 14 years in which the SPX posted three consecutive months of gains following a 12-month low (like now), the market rallied for the next three months. If the fourth month rose as well, future gains in the months ahead were even better, except for 1930 and 1940.

Jeffrey D. Saut is chief investment strategist at Raymond James.