Below, we offer context for the size and breadth of the Saudi market, and detail why it has the potential to be a meaningful part of many emerging markets portfolios, both active and passive. We also outline a handful of issues concerning investing in Saudi Arabia which may temper this potential.

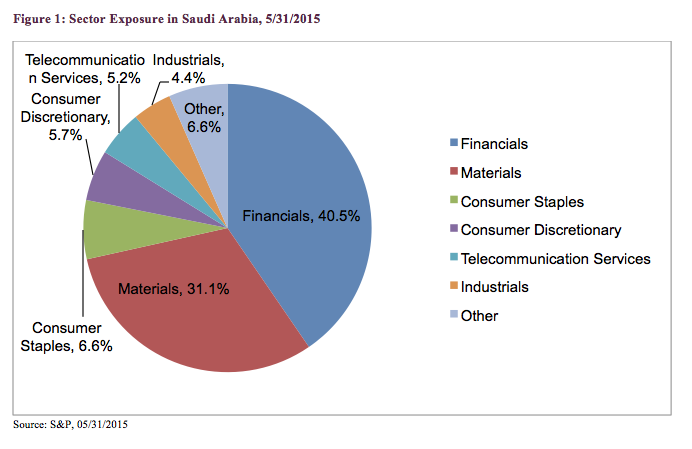

Saudi Arabia is the world’s largest oil exporter and continues to possess one of the largest reserves of crude oil in the world. Oil has made Saudi Arabia the largest economy in the Persian Gulf, with 158 local publically listed companies, primarily in the materials and financials sector.

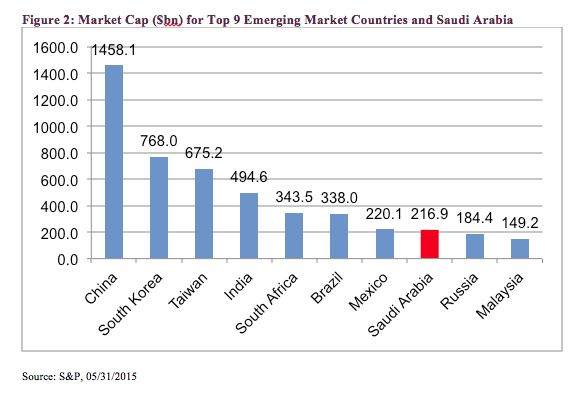

As of May 31, the market cap of the Saudi equity markets was $216.9 billion. As can be seen in Figure 2, at its current size, this would place Saudi Arabia as the eighth-largest emerging market country, similar in size to Mexico.

Note that the above figure shows the size of the total market. As most index providers will limit their weighting to the amount accessible to foreign investors, it is possible that a future index weight could be less than that indicated by Figure 2.

Saudi Arabia represents a new market for emerging markets investors and, in a somewhat rare situation, it is a newly accessible market that already exhibits a wide breadth of stocks (both in sheer number and sector assignment), many of which trade in relatively deep volumes. The opening of this market to direct foreign investment allows a wide opportunity for those wishing to gain exposure to the emerging economies of the Middle East.

Current Middle Eastern exposures consist of the relatively limited markets of Qatar and UAE, with a smaller number of equities primarily focused on finance. For active managers, the addition of Saudi Arabia should be seen as offering a wider pallet of choices on which to apply the tools of fundamental analysis, while for passive investors, the presence of Saudi Arabia should further diversify the country exposures in market capitalization indexes. Due to the low historical correlation between Saudi Arabia and most large emerging market countries, the addition of Saudi Arabia could potentially result in a lower volatility return pattern for passive solutions as well.

However, the optimism expressed above is tempered by some market realities. First, the QFI program is only granting limited access to the Saudi markets, with foreign ownership limited both at the stock and total market level (20 percent of any individual stock/10 percent of the total market can be foreign-owned). Certain stocks (primarily in the oil industry) are excluded entirely under the QFI program, limiting investor choice, and reducing the size of Saudi Arabia in any emerging market index that may include them. Historically, the Saudi Arabian equity markets have been closed to direct investment by non-Saudi investors, with foreign access limited to indirect exposure via the derivatives market. However, in July 2014, the Saudi Arabian cabinet announced the formation of a Qualified Foreign Investor (QFI) program to allow large institutional investors a means of gaining direct exposure to the Saudi stock market. Trading under this program starting last month.

Historically, the Saudi Arabian equity markets have been closed to direct investment by non-Saudi investors, with foreign access limited to indirect exposure via the derivatives market. However, in July 2014, the Saudi Arabian cabinet announced the formation of a Qualified Foreign Investor (QFI) program to allow large institutional investors a means of gaining direct exposure to the Saudi stock market. Trading under this program starting last month.

However, it has meaningful representation in the telecommunications, consumer and industrial sectors, as shown in in Figure 1.

Impact Of Saudi Arabia Opening Its Markets

July 14, 2015

« Previous Article

| Next Article »

Login in order to post a comment