In upcoming years, financial advisors have a golden opportunity to play a more important role in expanding share of wallet among current investors and gaining business from new ones. There will be more “money in motion” during the next decade than any time in history, driven by two factors.

First, as boomers retire, their nest eggs will shift from IRAs and 401(k) plans to personal investment accounts. Second, inheritances from boomer parents will further expand investment coffers. In both cases, funds that were being passively managed, with an occasional portfolio rebalancing, will become much more actively managed as primary sources of income, and these boomers will be turning to financial services firms for investment information, tools and advice.

Critical Role Of Advisors In Driving Satisfaction And Profitability

What will it take to win as this opportunity for investment firms emerges? Of the seven factors that J.D. Power examines in measuring investor satisfaction in its U.S. Full Service Investor Satisfaction Study, "investment advisor" is far and away the most important. In fact, the weight—or value—of this factor has increased considerably during the past six years, to 34 percent in 2013 from 24 percent in 2007. Today, the investment advisor factor plays a more critical role in driving satisfaction and profitability for full service investment firms and investors than ever before.

The second-most-critical factor driving investor satisfaction is investment performance, at 19 percent. Yet, J.D. Power research finds there can be very different levels of satisfaction with investment performance among investors with the same reported investment return -- differences that are driven by the things advisors are and are not doing. Taking into consideration the impact of the advisor on satisfaction with investment performance, advisors are responsible for more than one-half of the overall investor experience. In other words, the actions the advisor does or doesn’t take can play an equally critical role in determining satisfaction with investment performance as do the actual investment returns.

Not only do advisors drive satisfaction, they also drive business performance. J.D. Power finds a clear relationship between investors’ intention to invest more money and their level of satisfaction with their firm and advisor. Nearly one-fourth (23 percent) of investors who are highly satisfied with their advisor (financial advisor satisfaction scores of 900 or higher on a 1,000-point scale) intend to increase the amount invested with their primary investment firm during the next 12 months. Additionally, 21 percent of investors with medium levels of financial advisor satisfaction (scores between 800 and 900) also plan to increase their investment amount in the coming year. However, only 14% of investors with low levels of satisfaction (between 600 and 800) are likely to increase their investment amount over the next 12 months.

What Drives Financial Advisor Satisfaction?

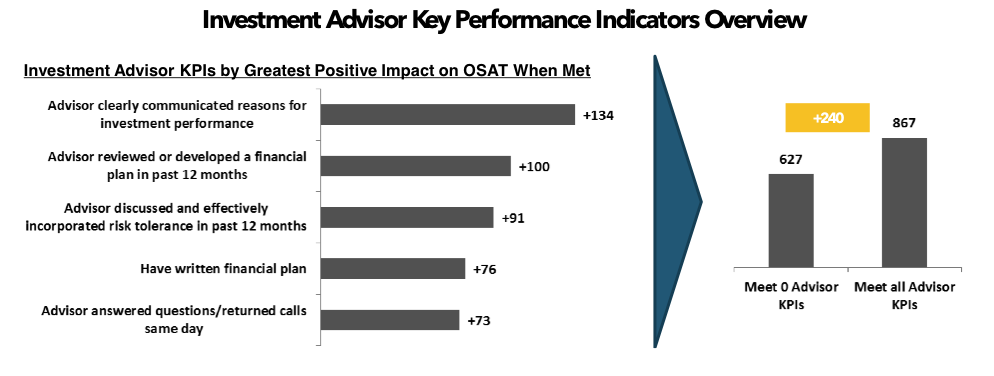

Through the years, J.D. Power has identified actions a firm can take to improve investor satisfaction -- key performance indicators (KPIs). Not surprisingly, the majority of KPIs are related to the financial advisor.

Findings from the 2013 study show that when financial advisors meet all five of the above KPIs, overall satisfaction increases by 240 points to an average index of 867, compared with only 627 when advisors don’t meet any of these identified KPIs.

However, recent research conducted by J.D. Power shows that while what advisors do is critical, how they do it is even more important.

The most satisfied investors are looking for a partnership, a collaboration, and how is at the crux of developing that strong relationship. Even when advisors are notably effective at what, financial advisor satisfaction and business results -- firm revenue and profitability -- are better when advisors improve how -- much like a brilliant doctor who also has a great bedside manner.

Strengthening Advisor Relationship Skills

In collaboration with Applied Psychoanalytics, drawing on extensive research into the key elements underpinning a strong patient-therapist relationship, J.D. Power has developed the Financial Advisor Strength Index, a tool that measures the strength of the investor-advisor relationship. The index model identifies five elements that characterize the optimal relationship:

Respect: Do advisors create an environment where investors perceive that their ideas, time, and relationships are taken seriously?

Mutual Navigation: Do investors help set their own investment agenda? Do advisors tailor their communication to effectively reach their clients?

Alignment: Are advisors and investors on the same page? Are approaches to clarification and confrontation effective?

Teamwork: Do advisors take turns asking questions? Do advisors listen? Are investors at the center of the relationship?

Durability: Is the relationship elastic and agile enough to endure the market’s rough times and advisor mistakes?

J.D. Power tested the validity of the model by re-contacting a sample of the respondents who participated in the 2013 Full Service Investor Satisfaction Study and asking them to complete a battery of questions related to the above. J.D. Power then analyzed the responses from the second survey and compared these satisfaction and business outcome findings with those from the 2013 Full Service Investor Satisfaction Study.

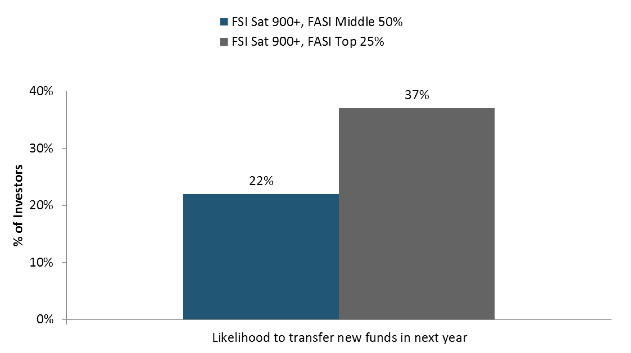

The most striking finding of the analysis is that even when satisfaction levels and KPI performance are similar—such as high financial advisor scores and strong relationship skills among advisors—business outcomes are significantly better when the Financial Advisor Satisfaction Index is higher.

Recommendations For Firms To Improve Relationship Skills Among Their Financial Advisors

- Focus on advisors, as they are responsible for more than 50 percent of the drivers of investment satisfaction.

- Continue to measure and manage advisor performance, which requires understanding the drivers of how and accurately measuring advisor effectiveness in those areas.

- Ensure advisors are performing the KPIs that lead to high levels of satisfaction -- in short, developing a sound financial plan with investors and establishing and maintaining strong lines of communication.

- Make sure advisors are doing the right things in the right way to develop a strong relationship with investors, which is characterized by credibility and trust and fosters the sense of partnership and collaboration investors want.

- Measure the current strength of the relationship with tools that capture the critical elements of relationship building: respect, mutual navigation, alignment, teamwork, and durability.

- Training, which historically has been centered on the technical parts of the job -- investment theory, product, and compliance -- needs to focus on improving relationship skills, as those will make the difference between winning and losing in the battle for money in motion.

Rockwell Clancy is vice president of financial services at J.D. Power. He oversees the company’s syndicated studies, proprietary research, consulting and performance improvement programs for consumer financial services.