A few years ago, China provided a strong tailwind for the emerging market story. Recently, it’s been more like a ball and chain. In the three months ended September 30, the MSCI China Index fell 23% (in U.S. dollars), and over the last three years annualized returns averaged less than 1%. By contrast, India’s market fell just 7%, and rose an annualized average of 2.73%, over the same periods.

As economic growth in China continues to disappoint, sending shocks through world markets, growth in India is moving ahead. In April of this year, the International Monetary Fund predicted that India is set to overtake China as the fastest-growing major emerging market, with a forecast of 7.5% GDP growth in 2015 compared with China’s 6.8%. The IMF also sees stronger growth for India than China in 2016.

This front-runner status comes as Brazil and Russia, the large commodity-exporting components of the BRIC countries, continue to suffer from falling commodity prices. By contrast India, which imports most of its oil and other commodities, has benefited from lower prices. Another driver for India’s stock market was the election of Prime Minister Narendra Modi in 2014, which promised to bring needed government and business reforms.

All these factors helped push the MSCI India index up 26% for 2014 even as the MSCI BRIC Index fell slightly. Following this strong performance, foreign institutions put almost $6 billion into Indian stocks in the first three months of 2015 alone, compared with about $16 billion for the entire previous year. India ETFs and mutual funds have also seen strong inflows.

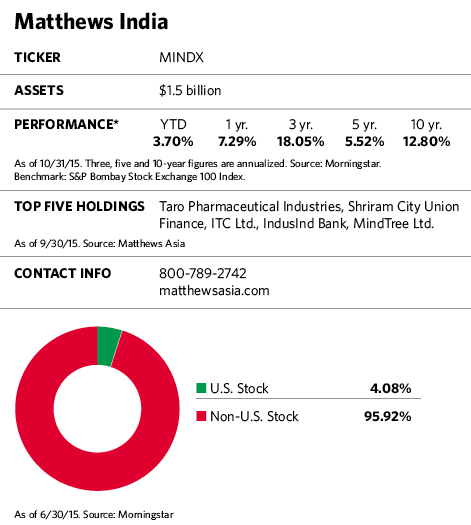

Sunil Asnani, manager of the $1.5 billion Matthews India fund, has mixed feelings about all the attention and is somewhat skeptical about India’s status as the new poster child for emerging markets. “Over the years, India has been subject to excessive optimism and excessive pessimism,” he says. “So this is nothing new.”