A comparison between India and Brazil highlights the importance of a selective approach to emerging markets. In the early 1990s, India and Brazil both rose to prominence alongside China and Russia as members of the “BRIC” group. More recently, the two countries have taken divergent paths. Both countries benefit from favorable demographics, but while India has recently focused on positive economic reforms and prudent fiscal policy, Brazil has lacked the political will to address structural issues in its economy. As commodity prices continue to decline, Brazil’s economy has struggled given the country’s heavy reliance on commodity exports. In contrast, India, a commodity-consumer, has reaped benefits from lower commodity prices due to its increased reliance on imports. These differences have contributed to a divergence in monetary policies as well as equity and currency market returns.

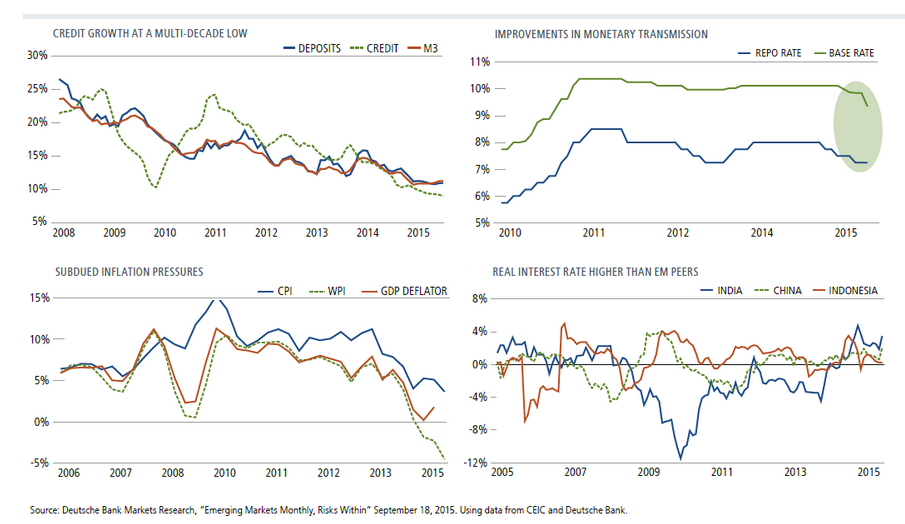

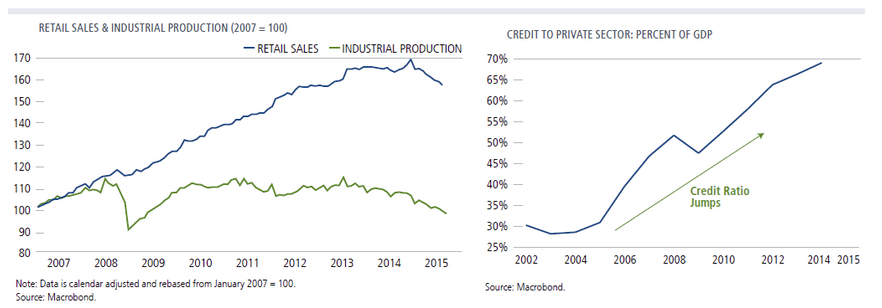

A comparison between India and Brazil highlights the importance of a selective approach to emerging markets. In the early 1990s, India and Brazil both rose to prominence alongside China and Russia as members of the “BRIC” group. More recently, the two countries have taken divergent paths. Both countries benefit from favorable demographics, but while India has recently focused on positive economic reforms and prudent fiscal policy, Brazil has lacked the political will to address structural issues in its economy. As commodity prices continue to decline, Brazil’s economy has struggled given the country’s heavy reliance on commodity exports. In contrast, India, a commodity-consumer, has reaped benefits from lower commodity prices due to its increased reliance on imports. These differences have contributed to a divergence in monetary policies as well as equity and currency market returns.The Reserve Bank of India recently announced a 50 basis point cut in its repo rate (the rate at which the Reserve Bank of India lends money to commercial banks). This larger-than-expected cut illustrates India’s confidence in inflation remaining subdued and the country’s ability to maintain accommodative monetary policy as global growth struggles. While India will not be immune to a global slowdown, the progress it has made in reducing its current account and fiscal deficits as well as in containing its inflation rate has decreased its vulnerability relative to other emerging markets (Figure 1). With economic growth momentum improving over the previous two years, optimism around new leadership, and the potential for positive reforms, India looks better positioned to attract and retain capital despite recent volatility in the emerging markets. Looking forward, subdued inflationary pressure should permit more accommodative monetary policy to continue while an improved fiscal situation can provide additional flexibility to support growth.

Nick Niziolek, CFA

Co-CIO, Head of International and Global Strategies, Senior Co-Portfolio Manager at Calamos Investments

As a Co-Chief Investment Officer, Nick Niziolek is responsible for oversight of investment team resources, investment processes, performance and risk. As Head of International and Global Strategies, he manages investment team members and has portfolio management responsibilities for international, global and emerging market strategies. He is also a member of the Calamos Investment Committee, which is charged with providing a top-down framework, maintaining oversight of risk and performance metrics, and evaluating investment process. Nick joined the firm in 2005 and has 13 years of industry experience, including tenures at ABN AMRO and Bank One. He received a B.S. in Finance and an M.B.A. from DePaul University.

Dennis Cogan, CFA

Senior Vice President, Co-Portfolio Manager at Calamos Investments

Dennis Cogan is responsible for portfolio management and investment research for the firm’s global, international, and emerging market equity strategies. Based in our London office, he joined Calamos in 2005 and has 15 years of industry experience. Previously, Dennis worked for Accenture in Strategic Planning and Analysis. He received a B.S. in Finance from Northern Illinois University.

Dave Gallagher, CFA

Vice President, International Financials Sector Head at Calamos Investments

Dave Gallagher is responsible for leading the research effort for the international financials sector. In this capacity, he conducts top-down and fundamental analysis on the international financials sector and makes portfolio recommendations to the co-portfolio managers. Based in our London office, Dave joined the firm in 2005 and has 13 years of industry experience, including tenure at J.P. Morgan Chase. He received a B.S. in Finance from Indiana University.