There will be no increase next year in the maximum amount clients can add to their 401(k)s and individual retirement accounts, the Internal Revenue Service recently announced. A modest rise in the government’s inflation barometer, coupled with indexing’s minefield of thresholds and rounding rules, left several closely watched tax figures unchanged for 2014. Other IRS numbers will increase just a tad.

Not only do 401(k) and IRA contributions remain capped at $17,500 and $5,500, respectively, but catch-up contributions to 401(k)s for clients age 50 or older will similarly continue at 2013’s level, which is $5,500. And the additional $1,000 IRA catch-up that’s been allowed since 2006 won’t change, as the law doesn’t adjust it for inflation.

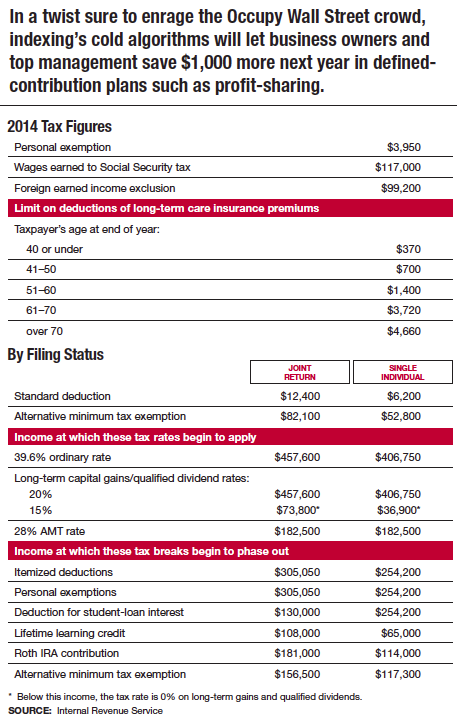

But in a twist sure to enrage the Occupy Wall Street crowd, indexing’s cold algorithms will let business owners and top management save $1,000 more next year in defined-contribution plans such as profit sharing. The limit on DC plans’ total contributions (i.e., employee plus employer contributions) inflates from $51,000 to $52,000.

Indexing will be particularly stingy regarding transfer taxes in 2014. The annual gift-tax-free amount is staying put at $14,000, while the $90,000 bump in the lifetime estate tax exclusion is its first smaller-than-six-figure increase since it began indexing in tax year 2012. The exclusion is $5.34 million per client in 2014.

Finally, in case you haven’t heard, inflation and this year’s new 3.8% Medicare surtax are in a complicated relationship. For individuals, the surtax’s income threshold is not indexed for inflation, but for trusts it is. In 2014, the 3.8% surtax applies to the smaller of the trust’s undistributed net investment income or its adjusted gross income in excess of $12,150. That’s up from $11,950 this year.

Other tax items set to adjust on New Year’s Day are shown in the accompanying chart. See more at http://www.irs.gov/pub/irs-drop/rp-13-35.pdf.

Inflation Brings Odd Twists, But Little Change To 2014 Taxes

December 2013

« Previous Article

| Next Article »

Login in order to post a comment