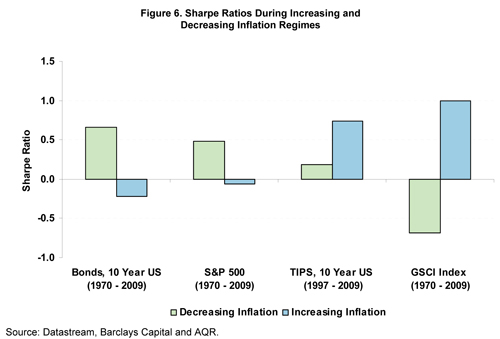

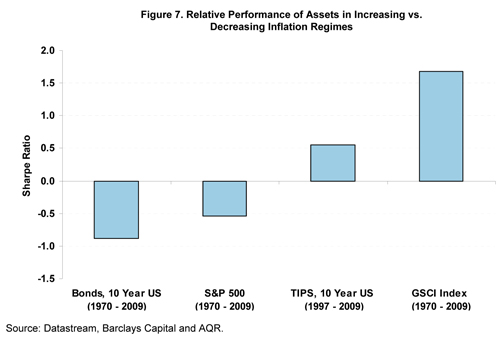

Figure 6 depicts the Sharpe Ratios of each asset in periods of increasing and decreasing inflation (as opposed to inflation surprises) since 1970 or since 1997 for TIPS. As expected from our theoretical analysis in Section I, stocks and bonds are meager performers in periods of increasing inflation. TIPS and commodities, on the other hand, perform better in these periods. Focusing on relative performance, which is observable as the difference in Sharpe Ratios for each asset between the

environments (Figure 7), we see similar results to our inflation surprise analysis, with commodities having the highest positive sensitivity (or beta) to changing inflation, while nominal bonds have the largest negative sensitivity.

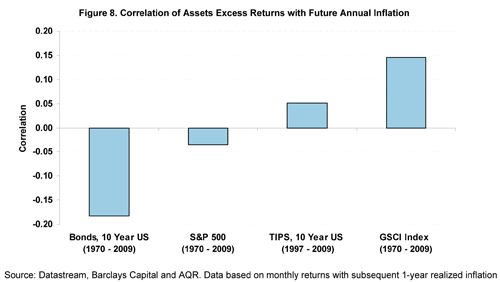

Figure 8 presents the correlation of assets' returns with subsequent realized inflation, based on monthly returns with subsequent 1-year realized inflation. The results are consistent with the relative performance in inflation regimes where commodity returns are positively correlated with future inflation and bonds are negatively correlated with future inflation. This suggests that commodities and bonds are both sensitive (in opposite directions) to changes in inflation expectations.

Inflation and Growth

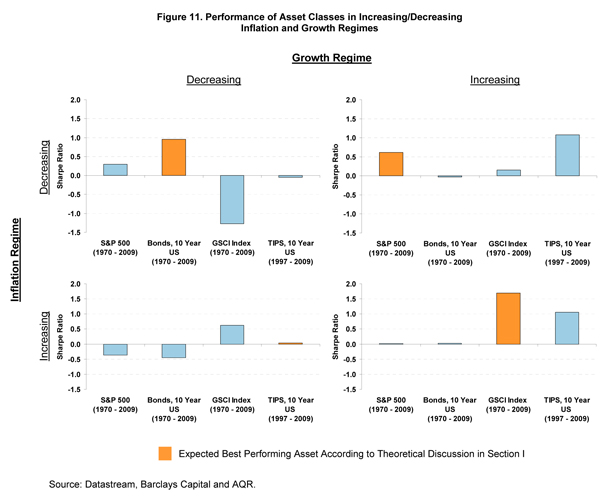

We believe it is important to further segment inflationary and disinflationary periods into environments of positive or negative growth because, as our theoretical discussion suggested, assets will respond to inflation changes differently based on the business cycle. Figure 10 shows the performance of each asset class across the four distinct inflation and growth surprises. Figure 11 shows the same data according to inflation and growth regimes. In Figures 10 and 11, we highlight the asset that we expect to perform especially well in each environment, as summarized in Figure 9.

Theoretical Performance of Assets in Inflation and Growth Environments

Stocks, Government Bonds, Commodities and TIPS sorted by each environment's expected highest Sharpe Ratio asset

A few interesting results are evident. As can be seen in figure 10, assets' response to inflation and growth surprises generally performed in line with our theoretical framework. Stocks have not performed well in response to inflation surprises, especially when accompanied by a positive growth surprise. This may be due to market expectations that the Fed would raise real interest rates to fight an overheating economy. Bonds performed well in response to disinflationary surprises when accompanied by a negative growth surprise since interest rates generally decrease during recessionary periods. They also performed well in positive inflation surprise periods accompanied by a negative growth surprise, since interest rates generally fall in that environment. Commodities show strong performance during inflation surprises, even in periods of negative growth surprises which may be attributable to the 1970s commodity-led stagflation.