Riding the Turtle

Even if it takes years for his expectations for inflation-driven stocks and others to pan out, Bobrinskoy has proved he’s a patient investor who is willing to wait for a stock’s price to catch up with his assessment of what it’s worth. To provide a margin of safety, he likes to buy a stock when it is selling at a 40% discount to his estimate of private or intrinsic value. Often, he’ll step in after it has taken a beating because of disappointing earnings that occurred for reasons he considers temporary. He typically hangs on for four to five years, although his turnover was higher than usual last year because many stocks in the portfolio shot up to their intrinsic value pricing targets in the bull market. He’ll also sell if an investment thesis proves wrong or if a better alternative comes along.

At the same time, he’ll hang on to a stock even after it sees a large drop if he believes the reason is temporary and the original investment thesis remains in place. Earlier this year one of his holdings, gaming manufacturer International Game Technology, fell 22% after a subpar earnings report. The stock rebounded sharply in July when an Italian gaming company entered into a merger agreement to buy the company for $4.7 billion in cash and stock.

Patient investing is the cornerstone of Ariel’s marketing theme, which features a turtle with the caption “slow and steady wins the race.” Known best for its founder John W. Rogers Jr., a former Princeton basketball star known to pepper shareholder reports with sports analogies, Ariel Capital Management has over $9 billion of assets under management. Since its founding in 1983, the firm has focused mainly on investing in small and mid-cap out-of-favor stocks whose virtues, such as a strong franchise or good cash flow, eventually come to the forefront. There’s also a hint of socially responsible investing here, since the managers won’t invest in companies involved in tobacco or the manufacture of handguns.

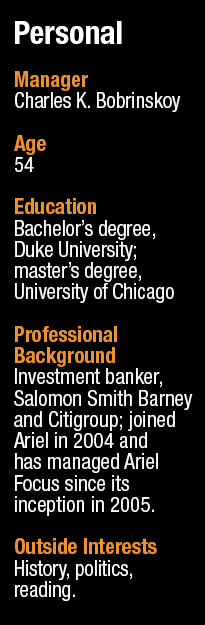

In 2005, the firm launched Ariel Focus to bring its value management style to the large-cap space. Bobrinskoy was no stranger to Ariel or its founder when he left a longtime career as an investment banker to manage the fund and become the firm’s director of research. He had known Rogers since high school, when the two of them sold hot dogs at Chicago’s White Sox Park. He had also served as an usher at Rogers’ wedding and was a founding investor in his firm.

His 20 years as an investment banker helped prepare Bobrinskoy for his new role by teaching him about the importance of strong balance sheets. “Many companies borrowed money which they could have repaid had the economy continued to be strong. But recessions come and debt becomes a heavy weight.”

Ariel Focus became an all-cap offering in 2013, allowing Bobrinskoy to invest in a broader universe and to share some of the ideas generated by its bigger and better-known sibling, the Ariel Fund. With a weighted average market capitalization of $36 billion, the concentrated portfolio of 25 to 30 stocks remains squarely in large-cap territory because Bobrinskoy believes large caps are generally cheaper than small caps right now.

Buying opportunities are popping up in stocks such as Bed Bath & Beyond. The stock was added to the portfolio in July of this year after it plunged 30% in the course of several months following two consecutive quarters of disappointing earnings. Bobrinskoy says the company’s earnings shortfall was due to temporary setbacks. Bed Bath & Beyond sales suffered because of bad weather and the company had to make an investment in its online platform. But he points out that the company has almost no debt and its balance sheet is strong. “This is a leader in the home furnishings business that will benefit from a pickup in the housing market. Investors don’t like negative price momentum. We see it as a buying opportunity.”

Inflation Preparation

September 2, 2014

« Previous Article

| Next Article »

Login in order to post a comment