Game theory is a set of principles for scrutinizing the strategic interactions of multiple agents, such as the parties involved in the upcoming U.S. elections. Many investors agree that geopolitical events can have a large impact on markets and currencies, but few have a formal way of accounting for geopolitics—other than avoiding affected markets altogether.

Ross Hambrick is dynamic allocation strategies team analyst at William Blair.

Game theory provides a way for our team to organize available information to understand strategic negotiations and the associated investment implications, which can take the form of either reducing or increasing risk.

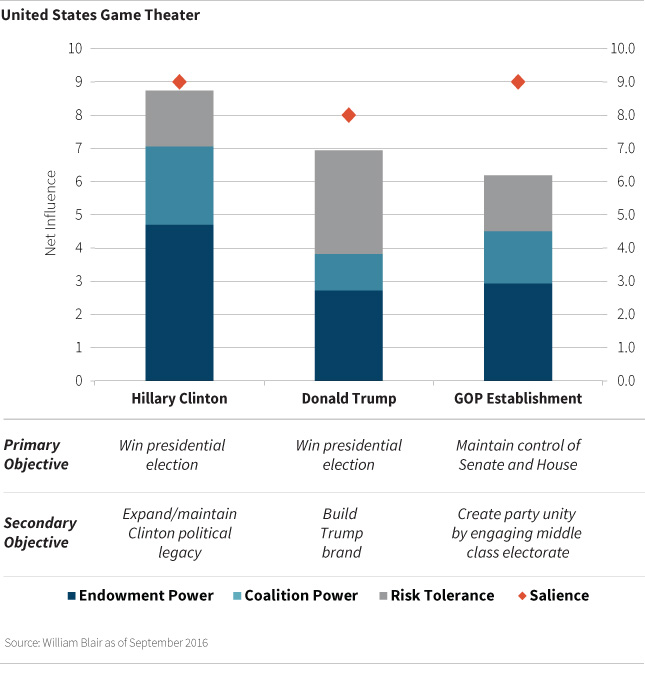

Within our current U.S. game theater we currently observe three players: Hillary Clinton, Donald Trump, and the GOP Establishment. The GOP has distanced itself from Donald Trump and has its own objective of maintaining control of Congress, therefore becoming a standalone player. Clinton and Trump are both trying to win the election with Clinton trying to maintain her family’s legacy and Trump trying to further his brand.

In a previous post we described the various powers each player can wield to achieve their objectives. In our U.S. game theater, Clinton currently has the most power at her disposal. This is largely driven by endowment and coalition power coming from her lead in polls, as well as her strong base and appeal to moderates. She also has a very high salience given that it is “White House or bust” for her.

Trump, on the other hand, is lagging in polls and lacks support from moderates. He also has a lower salience given that his contingency plan is to continue running the Trump empire. He does, however, have a higher degree of risk tolerance and is willing to take extreme views, which is contrary to Clinton. The GOP Establishment maintains a high degree of salience given the importance of having control of Congress for enacting policy.

Within this analysis, it’s important to consider the makeup of the Electoral College, because in the United States, the popular vote doesn’t determine the election; all but two states are “winner take all” in terms of electoral votes. Clinton benefits from an Electoral College structure that has favored Democrats for the past decade. But, in any election year, only a handful of states decide the election. As a consequence, we look at polling information, demographic trends, and other factors in those battleground states, which include Ohio, Pennsylvania, and Florida, to get a sense of the probabilities of each possible election outcome.

We also look at demographics. Both Trump and Clinton are very unpopular, which means they each have a niche of committed supporters. A segment of the population supports Trump, another segment supports Clinton, and the outcome of the election depends, to some extent, on whether the candidates can get their supporters to vote.

While it is easy to focus on the presidential race, investors must remember that the U.S. government is set up with a framework of checks and balances. The candidates can talk of sweeping policy changes on the campaign trail, but if they do not have support of Congress then it is difficult to implement them.

The Base-Case Scenario: Clinton Wins; House Stays Republican

Our base-case scenario is Clinton winning the presidential election, with the House staying Republican. The Senate is a coin toss.

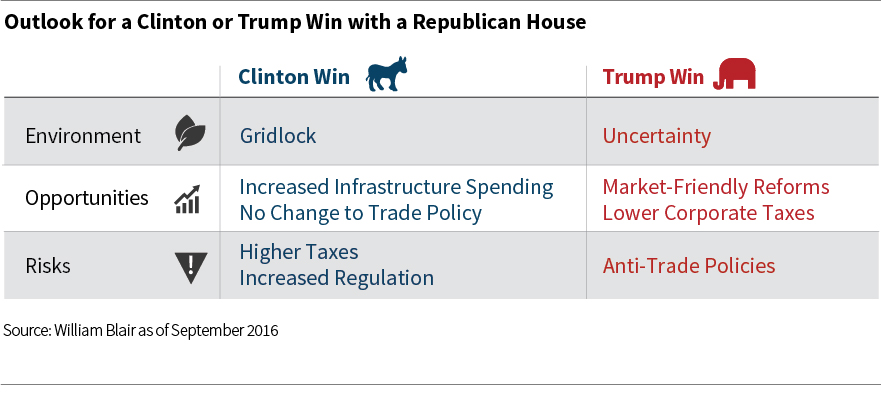

Either way the coin falls on the Senate, we would see a split government, which tends to result in policy gridlock and/or compromise. The legislative branch checks the president, the president checks the legislative branch, and the Supreme Court checks them both.

Many of Clinton’s policies are tax- and spending-related, and those policies must pass through Congress. So, if the House remains Republican, Clinton will have difficulty increasing taxes and spending. You might see some shifts, but game-changing policy moves would be very difficult.

For the markets, that’s a positive. Markets are more comfortable with the status quo, particularly as it relates to government policy and regulations. Uncertainty usually upsets the marketplace. We, therefore, see a likely positive market reaction in the event of a Clinton presidency with a Republican-controlled House and/or Senate.

Potential benefits of our base-case scenario include increased infrastructure spending, which Clinton supports, providing a potential benefit to U.S. materials and industrials sectors. Trade policy would likely remain status quo, which is also a positive for the markets.

We see two risks to our base-case scenario, however. The first is severe gridlock that limits the government’s ability to deal with any adverse events. Gridlock is good as long as players agree just enough to keep things moving; if a total lockup results, the market could be at risk. The second risk is increased regulation of the financial and energy sectors. Although new laws would have to be passed through Congress to implement broad changes, Clinton can still create difficulties for businesses in these sectors by asking regulators to focus on certain aspects of existing laws.

The Other Scenario: Trump Wins; Republican Sweep

While we believe Clinton has the edge given recent polling information and the methodology of the Electoral College, it is certainly possible for Trump to win the White House. If Trump does win, the most likely scenario is a Republican sweep. In that case, uncertainty would dominate the markets as Republicans may be able to put through significant policy changes. Additionally, when it comes to Trump, it is hard to distinguish between campaign talk and policy action.

The biggest risk revolves around trade. Trump has spoken out against the North American Free Trade Agreement (NAFTA) and called China a currency manipulator, playing on the anger of a middle class that feels it’s been marginalized by free trade. So with Trump, there’s certainly the potential for a trade war locking up the economy—but we just don’t know what Trump would actually do.

Initially, the market could react negatively to a Trump win because there’s so much uncertainty—but this may be short-lived, because on the positive side, a Trump win could bring market-friendly reforms (such as less regulation) and lower corporate taxes. Those would take time to work through the system, but would be positive for the markets.

Portfolio Implications

We have made a number of changes to our portfolio as a result of our analysis of the U.S. election. One implication is that we are less optimistic that the Trans-Pacific Partnership (TPP) passes. We had previously added a position to Vietnamese equities as we felt they stood to benefit the most from the trade agreement in addition to Vietnam being a fundamentally cheap market. We have been more recently reducing our exposure, however, given the anti-TPP sentiment of both Trump and Clinton.

We have also reduced our long exposure to the Mexican peso, which is likely to be volatile as we approach the election and could face downward pressure in the Trump win scenario. We have increased our short exposure to the fundamentally unattractive Mexican equity market.

And lastly, over the last few months, we sought to embed downside protection within both U.S. equity and fixed-income markets through the use of options. Implied volatility has been less than our forward-looking estimates of risk in both the equity and bond markets, and we therefore felt it was prudent to introduce this protection given the uncertainty we see from our game-theoretical analysis and the potential binary outcomes for markets that this election presents.

Of course, these aspects are always fluid and our analysis and positioning may change as we get closer to the election. Any number of unknown developments can change the direction of the election. Either candidate could say or do something that completely changes the game. It would take a lot more for Trump to do that than Clinton, given how far outside the political norm Trump has already gone, but these types of events are hard to predict, which is why we have built convexity into our portfolios through the U.S. election window.

Investment Implications Of The U.S. Elections

October 18, 2016

« Previous Article

| Next Article »

Login in order to post a comment