Passport stamps are a familiar sight to Charles de Vaulx, who was born in Morocco and lived in several countries before moving to the United States in 1985. Now comfortably settled in the New York offices of International Value Advisers, the firm he launched in 2008 with longtime associate Charles de Lardemelle, de Vaulx continues globe-trotting for the IVA Worldwide Fund. In the two years since it opened, the fund has accumulated an astounding $5.5 billion in assets and has a solid fan base that includes many financial advisors.

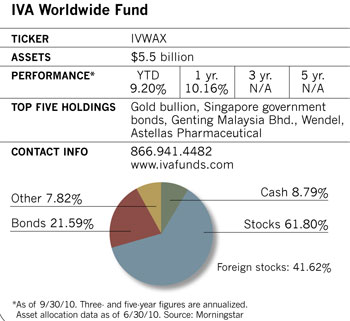

About two-thirds of that money is invested in a multi-cap portfolio of stocks from countries around the world that have strong balance sheets and trade below estimated intrinsic value, or what a knowledgeable private buyer would pay for a business. The fund's eclectic investment menu also features bonds, precious metals, cash and currency plays.

The undervalued investment stew is designed to offer a margin of safety and downside protection. "My partners and I have a lot of our own money invested in our funds, so we have an incentive to limit losses for ourselves and our shareholders," says the 49-year-old manager in a melodious French accent.

His flexible investment charter, his aversion to downside risk, and his personal stake in the fund are key components of his style and have been since 1999, the year he was named co-manager of two First Eagle mutual funds managed by the legendary Jean-Marie Eveillard.

De Vaulx first met the value maestro more than two decades ago as a young French analyst at Société Générale Asset Management, First Eagle's former parent company. "Most of the trainees were in New York to have a good time, and they would come to work in the morning looking bleary-eyed," recalled Eveillard in a 2003 interview with Financial Advisor magazine. "Charles was the exception. He took the job seriously."

The Eagle Funds invested in undervalued stocks, but the managers would also move hefty sums into cash when the opportunities seemed unappealing, and they also kept a stake in alternative investments such as gold bullion. Though these gambits kept the funds off the list of chart toppers during strong bull markets, they also helped keep the Eagle Funds resilient in down markets. And over the long term, the funds have delivered market-beating returns with less volatility and risk than most of their peers.

The investment strategy remained seamlessly intact when de Vaulx assumed control of the First Eagle funds after Eveillard's retirement in 2005. But then de Vaulx unexpectedly left the firm in early 2007, launching the IVA Worldwide and IVA International funds the following year.

De Vaulx, who once called Eveillard his "mentor and friend" won't comment on his surprising departure or whether he has had contact with his former colleague, who now sits on First Eagle's board of trustees. The First Eagle camp is equally mum about the subject.

But he responds quickly when asked why investors might consider his new funds over those he left behind, which are now run by a team of Eveillard-trained co-managers. For one thing, the core members of the team that helped make those Eagle funds a success are now at the new firm. They include fund co-manager and former First Eagle associate portfolio manager Charles de Lardemelle, as well as several analysts. To keep the fund at a manageable size, de Vaulx has pledged to close IVA Worldwide, which now has $5.5 billion in assets, once it reaches $15 billion.