Financial planners and portfolio managers are reevaluating their strategies in light of the global turmoil over the last several years. Much of their emphasis is to better understand and control portfolio risk.

Ironically, portfolio managers and financial planners should view portfolio management differently. Portfolio managers view risk as volatility -- a percent change in the value of the portfolio, typically measured as a standard deviation. Their mission is to optimize returns for a certain amount of risk. Having only a 30% loss when the market is down 40% is considered to be a success.

Financial planners, on the other hand, use investments to achieve the specific objectives of each client. For a client needing his funds to retire, a 10% loss may be a failure even if the market is off 40%. The difference is subtle but critical. This paper is targeted for financial planners and individuals planning for their own financial needs, those that view risk as a threat to achieving their objectives, not as portfolio volatility.

When understanding risk, the difference between risk tolerance and risk capacity is critical. The terms have been around for years, but most people when they discuss risk think of risk tolerance. Risk tolerance deals with the psychology of a loss. Can a person sleep at night if the portfolio drops 20 percent? Risk capacity deals with the question of whether a person who takes a loss is still able to achieve a key objective. If a portfolio loses ten percent, can they retire as planned? Typically only one, risk tolerance or risk capacity, whichever is most limiting, determines how much risk clients can take in their portfolios. I believe millions of people in 2008 didn't understand the difference, thought their portfolios were appropriately structured, and were forced to change their life plans when their portfolios got hammered. They and their advisors should have been worrying about risk capacity, not risk tolerance.

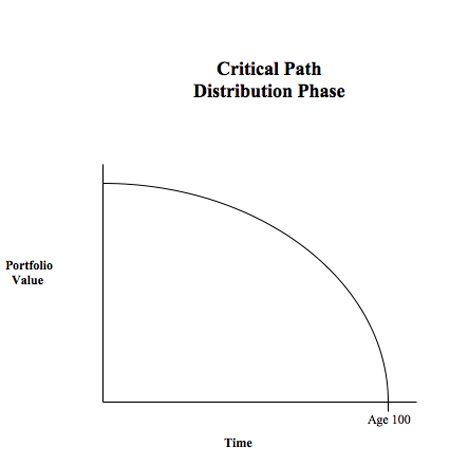

As we focused on risk capacity in my firm, we realized some people are in a position to take no risk with their money. This led us to the concept of the "Critical Path." I introduced this concept in an article published in FA Online September 21, 2011. The Critical Path applies to individuals with an objective that they absolutely must achieve. You can calculate and then graph the amount of capital they need to have over time to achieve this objective. This is the Critical Path, and is shown in the chart below using the goal, for example, of retiring with a minimum specified income. The discount rate used in the calculation is the riskless rate, which is close to zero today. Tradition argues individuals should have a portfolio with some risk so as to achieve a higher expected rate of return. But the higher "expected return" comes with some risk and if an individual can take no risk, he really has no choice but to invest in a risk-free manor.

An individual with a portfolio value above the Critical Path may invest in traditional ways which includes owning risky investments, those expected to achieve better than a riskless return. The constraints to the investor of a portfolio falling to or below the Critical Path, forcing someone to invest at the riskless rate, are so severe that they should do everything in their power to manage their portfolios in a manner to stay well above the Critical Path.

Financial planners have many tools available to move their clients above the Critical Path. One of the most effective ways to move upward versus the critical path is to encourage their clients to change their objectives. This may include be willing to save more, retire later or establish a lower amount for the minimum income needed in retirement. All of these drop the location of the Critical Path. As a paradox, this permits the individual to invest in more traditional ways and, hopefully, do better; thus possibly, increasing eventual retirement income.

An interesting outcome of the Critical Path is realizing Modern Portfolio Theory, upon which virtually all financial institutions base investment advice, probably should not be used as the foundation for providing investment advice to individuals on or below the Critical Path. This likely includes a large number of investors. Over the last several years, the underlying parameters for the models underestimated the frequency of "tail" and "Black Swan" events. (A tail event is a low probability event, but is forecast. A Black Swan event is not forecast to happen.) Additionally, advisors and their clients didn't take into account the level of the pain the losses would cause if these events occurred. These strategies did not provide comforting results for many investors.

With the changing view of the importance of risk, my firm began to rethink how to structure portfolios. We realized the future is not knowable and there are various scenarios that can play out; each with very different risks and different investment opportunities. This lead to the concept we call "Multi-Scenario Investing," which in portfolio construction emphasizes controlling losses instead of maximizing expected returns. Some assets are included in portfolios to hedge against certain risks; others are included to enhance returns. Gold in a portfolio has been a good example. We hold it as a hedge, hoping it will go up in value at a time when the loss of faith in governments might depress other asset prices. We diversified the traditional bond portion of the portfolio more than ever using foreign bonds, high-yield bonds and absolute return funds. We took these actions for risk reduction, not to enhance returns. Stocks remain the backbone to generate growth. In all asset classes, we seek out managers with proven records but who believe it is different this time. Admitting that the future could have a variety of scenarios puts us in the position of not needing to present a single forecast for the future, that which we stake our reputation upon. This is a huge shift in attitude. Our clients grasp it quickly and actually find it reassuring.

We believe the world is changing and investment strategies must change with it. Managing risk is back in vogue. As Mark Twain said, "I am more concerned about the return of my money than the return on my money." The last several years have exposed weaknesses in how we as advisors manage risk in portfolios. We need to continue to develop investment strategies to reflect both the changing world and address the current weaknesses in what we do.