Through the middle of February, high-quality stocks performed well, driven upward by the prospect of Federal Reserve (Fed) rate hikes. But when the Fed took a more dovish turn, suggesting that rates would stay low, risk was back on. This was evident as those stocks in the bottom quintile of quality, as measured by return on invested capital (ROIC), within the Russell 3000 Index outperformed those in the top quintile of quality. The story is far from over however, because higher-quality stocks have tended to outperform over the long term—and I believe the eventual tightening of monetary policy could help drive us toward that more normalized market environment.

To illustrate that higher-quality stocks have tended to outperform over the long term, we looked for a common measure as a proxy for quality.

There are many available, including return on equity or assets, margins, leverage, and earnings variability, but in this analysis we use a company’s ROIC because it provides an assessment of how efficiently management allocates capital to profitable investments. We used the Russell 3000 Index as our universe, representing high-quality stocks as those in the index within the top quintile of ROIC, and low-quality stocks as those in the index within the bottom quintile of ROIC.

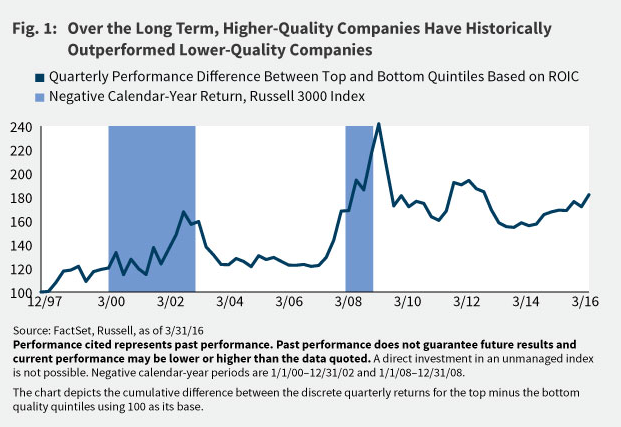

As you can see from figure 1, which shows the quarterly performance difference between the top and bottom quintiles as measured by ROIC, higher-quality companies have historically outperformed lower-quality companies. This has particularly been true when the market has been down, as the light blue shading—which represent negative calendar-year returns for the Russell 3000 Index—indicates.

Looking at the data on a more granular level, when the index has experienced a quarter of negative performance, higher-quality stocks have outperformed lower-quality stocks almost 80% of the time.

It’s notable that while lower-quality outperformance has occurred, the duration of such occurrences before 2009 was relatively short lived, often lasting only a quarter or two. Beginning in 2009 that changed, most likely due to highly accommodative monetary policy.