Through the middle of February, high-quality stocks performed well, driven upward by the prospect of Federal Reserve (Fed) rate hikes. But when the Fed took a more dovish turn, suggesting that rates would stay low, risk was back on. This was evident as those stocks in the bottom quintile of quality, as measured by return on invested capital (ROIC), within the Russell 3000 Index outperformed those in the top quintile of quality. The story is far from over however, because higher-quality stocks have tended to outperform over the long term—and I believe the eventual tightening of monetary policy could help drive us toward that more normalized market environment.

To illustrate that higher-quality stocks have tended to outperform over the long term, we looked for a common measure as a proxy for quality.

There are many available, including return on equity or assets, margins, leverage, and earnings variability, but in this analysis we use a company’s ROIC because it provides an assessment of how efficiently management allocates capital to profitable investments. We used the Russell 3000 Index as our universe, representing high-quality stocks as those in the index within the top quintile of ROIC, and low-quality stocks as those in the index within the bottom quintile of ROIC.

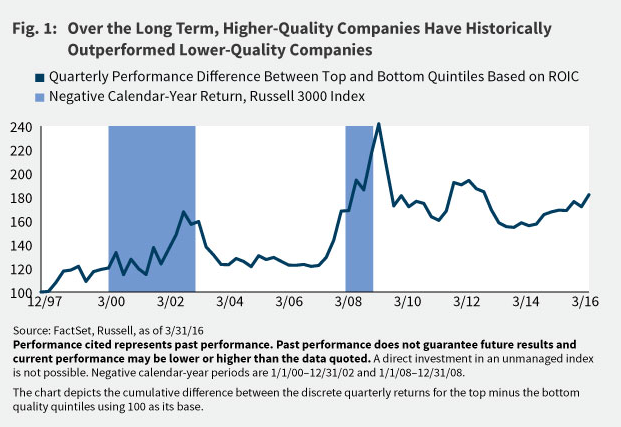

As you can see from figure 1, which shows the quarterly performance difference between the top and bottom quintiles as measured by ROIC, higher-quality companies have historically outperformed lower-quality companies. This has particularly been true when the market has been down, as the light blue shading—which represent negative calendar-year returns for the Russell 3000 Index—indicates.

Looking at the data on a more granular level, when the index has experienced a quarter of negative performance, higher-quality stocks have outperformed lower-quality stocks almost 80% of the time.

It’s notable that while lower-quality outperformance has occurred, the duration of such occurrences before 2009 was relatively short lived, often lasting only a quarter or two. Beginning in 2009 that changed, most likely due to highly accommodative monetary policy.

During the current bull market in U.S. equities, which is in its seventh year, an abundance of accommodative monetary policy and an extended period of historically low interest rates benefited lower-quality stocks in a number of ways. For example, the environment allowed lower-quality companies, which are generally more reliant on the capital markets, to refinance their higher levels of debt at historically low interest rates. Investors were further encouraged to take on the risk of lower-quality stocks given the extended period of extremely low volatility the highly accommodative monetary policy environment fostered.

We’ve been saying for a while that this environment is likely to change as the Fed’s accommodative monetary policy comes to an end and interest rates rise. These higher interest rates should put more pressure on the balance sheets and cash flows of lower-quality companies, potentially increasing the bankruptcy risk associated with lower-quality stocks.

As we noted, this appeared to be happening early in the first quarter, but lower-quality stocks began outperforming again when Fed commentary suggested that its plans to keep rates low for much of 2016.

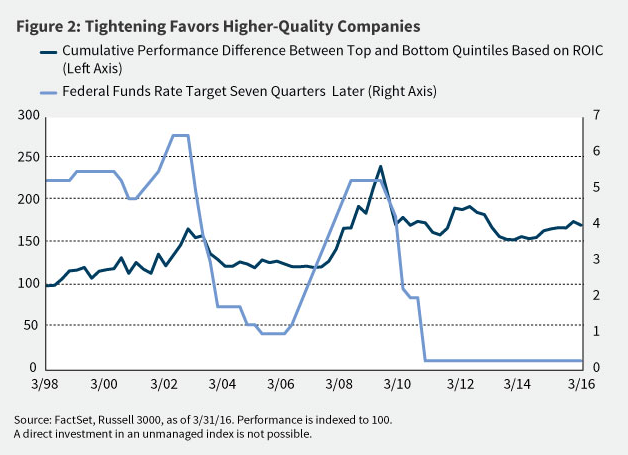

That said, the domestic economy appears to be making progress toward sustainable growth, with the end of the Fed’s quantitative easing program and interest rate hikes potentially coming closer into view. And we believe a moderately improving economy, or one that necessitates Fed tightening to help restrain inflation, favors companies with higher ROIC, as figure 2 shows. Unlike lower-quality companies, such companies are generally less reliant on the capital markets because they are able to generate enough cash and access enough capital to fund initiatives as interest rates rise.

In sum, higher quality stocks typically outperform lower quality stocks over time. While we’re not bearish on future market returns in general, we believe it’s prudent to consider the possibility that any tightening of monetary policy should lead higher-quality stocks to again outperform lower-quality stocks.

Matt Neska is the domestic equity specialist at William Blair for the firm’s U.S. value equity strategies.