During the current bull market in U.S. equities, which is in its seventh year, an abundance of accommodative monetary policy and an extended period of historically low interest rates benefited lower-quality stocks in a number of ways. For example, the environment allowed lower-quality companies, which are generally more reliant on the capital markets, to refinance their higher levels of debt at historically low interest rates. Investors were further encouraged to take on the risk of lower-quality stocks given the extended period of extremely low volatility the highly accommodative monetary policy environment fostered.

We’ve been saying for a while that this environment is likely to change as the Fed’s accommodative monetary policy comes to an end and interest rates rise. These higher interest rates should put more pressure on the balance sheets and cash flows of lower-quality companies, potentially increasing the bankruptcy risk associated with lower-quality stocks.

As we noted, this appeared to be happening early in the first quarter, but lower-quality stocks began outperforming again when Fed commentary suggested that its plans to keep rates low for much of 2016.

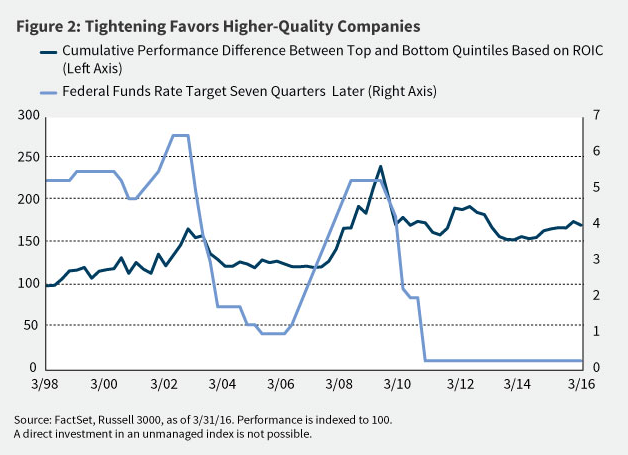

That said, the domestic economy appears to be making progress toward sustainable growth, with the end of the Fed’s quantitative easing program and interest rate hikes potentially coming closer into view. And we believe a moderately improving economy, or one that necessitates Fed tightening to help restrain inflation, favors companies with higher ROIC, as figure 2 shows. Unlike lower-quality companies, such companies are generally less reliant on the capital markets because they are able to generate enough cash and access enough capital to fund initiatives as interest rates rise.

In sum, higher quality stocks typically outperform lower quality stocks over time. While we’re not bearish on future market returns in general, we believe it’s prudent to consider the possibility that any tightening of monetary policy should lead higher-quality stocks to again outperform lower-quality stocks.

Matt Neska is the domestic equity specialist at William Blair for the firm’s U.S. value equity strategies.