The recent improvement in European economic data has confronted investors with a question that seems to have plagued them over the last two years: “Has Europe finally turned the corner?” Since the global financial crisis, European growth has been negative or anemic due to political standoffs between core and peripheral nations. Recently though, Europe has made substantial progress in the integration of several components of the economy, including banking regulation and fiscal oversight. These reforms have helped to rebalance risk sharing and reduce the likelihood of severely negative outcomes.

This article will 1) review post-crisis efforts by the European Commission and the European Central Bank to provide liquidity to the periphery, 2) outline near-term challenges for the European banking sector, and 3) assess the outlook for the European economy.

Response To The Sovereign Debt Crisis

In early 2010, financial markets reflected concerns with the prospect of European sovereign debt default and the implications both for the public and private sectors within Europe. While the European Central Bank (the ECB) played a crucial role in providing liquidity to the financial system following the Lehman failure and the subsequent crisis, Europe also faced insolvency crises at the country level. The concern was reflected in credit spreads (see Figure 1) of the countries deemed to be at highest risk due to weak economic growth, forced austerity, and high debt levels relative to GDP. The focus of concern was ini- tially Greece, but worries soon spread to Italy, Spain, Portugal, and Ireland.

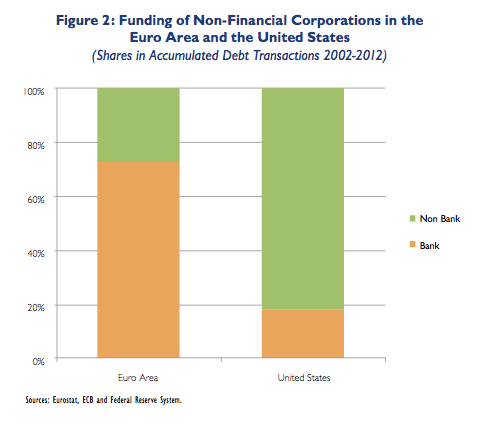

The impact of sovereign default would have been especially pronounced due to the concentration of sovereign bonds held on European bank balance sheets and the importance of bank financing for the corporate sector. Unlike in the U.S., the European economy is largely bank funded, with nearly 80 percent of debt funding for non-financial corporations coming from bank sources (see Figure 2). Sovereign bonds fill several important roles within the European banking sector, including setting benchmark borrowing costs and providing liquid tools for facilitating interbank loans. A pronounced deficit in equity capital created by sovereign bond devaluation would therefore have had a tremendously negative impact on the overall economy. The markets in government bonds for less financially strong countries ceased to function properly, negating the ability of the ECB to transmit monetary policy to the periphery.

In an effort to reestablish the normal channels for monetary policy transmission, the ECB created several mechanisms to support faltering markets, the most important components of which are described below.

-

Securities Market Program (SMP) introduced in May 2010: The SMP was established to provide depth and liquidity to dysfunctional markets through direct purchases of public and private debt securities. Over the course of the ensuing three years, the ECB purchased €218 billion in securities through the program. The initial intent was to provide more time for governments to manage their fiscal deficits while borrowing costs remained low.

-

European Financial Stability Facility (EFSF) introduced in May 2010: The EFSF mandate was to provide financial assistance directly to troubled Eurozone states using €440 billion in loan capacity backed by guarantees from member states. The temporary facility was set up to issue bonds with the support of the German Finance Agency to satisfy member requests for support. The facility was enlarged to €780 billion in October 2011, following unani- mous approval by Eurozone coun- tries. As of this writing €188 billion has been disbursed, with approximately 75 percent of the aid having gone to Greece.

-

European Financial Stability Mechanism (EFSM) introduced in May 2010: The EFSM has a simi- lar mandate to that of the EFSF, but was guaranteed and supervised by the European Commission. The total capacity at inception was €60 billion, with approximately €49 billion disbursed as of this writing.

-

Outright Monetary Transactions (OMT) introduced in September 2012: The OMT program was created to allow the ECB to make direct purchases of sovereign bonds in the secondary markets. The OMT was a replacement and enhancement to the SMP program in that the ECB could then issue unlimited securities to fund purchases of sovereign bonds, which greatly enhanced confidence in the effectiveness of the program to normalize sovereign spreads. The ECB has made clear that this pro- gram should not be considered quantitative easing, because all purchases will be fully sterilized via the reab- sorption of any additional money supply created in the process.

- European Stability Mechanism (ESM) introduced in July 2013: Although the EFSM and EFSF will continue to manage outstanding loans, they will not issue new loans and will eventually be wound down. The ESM was created as a permanent facility, designed to handle future requests from member states for financial assistance. The ESM increased confidence in the future stability of the Eurozone because it was identified as permanent, and was designed to employ leverage. EU members initially contributed €80 billion in capital, but the facility was granted €700 billion in authorized loan capacity. To access the facility, the borrower state must have 1) agreed to a fiscal adjustment program intended to rectify the situation and 2) signed the European Fiscal Compact. The Compact requires all members to maintain a general budget deficit of less than 3 percent and a structural deficit of less than 1 percent of GDP, assuming the member’s debt-to-GDP ratio is less than 60 percent. If it is greater than 60 percent, the structural deficit must bebelow 0.5 percent, with a plan in place to reduce total debt to GDP to the 60 percent target over time. To date, the ESM has disbursed about €50 billion in funds to Spain and Cyprus.

Rebuilding The European Banking Sector

The strains that the European credit markets suffered affected banking operations via a combination of asset impairment and constraints on capital. In addition to these market-related headwinds, European banking regulators began to implement a series of risk-reduction measures, which included higher capital requirements and changes to the recommended risk weights of certain assets. The effect was a reduction in loan growth as banks retained capital to comply with the new regulations. In many ways, this led to an exacerbated pro-cyclical response because of the centrality of the banking sector in business funding.

During the application of these new regulations, it became clear that a pan-European regulatory body would be required to ensure consistent regulation of banks across Europe. The European Banking Authority (EBA) was established in January 2011, to satisfy this need. Specifically, the EBA was given the power to overrule national regulators who were not properly enforcing existing regulation.

The first major action by the EBA was to conduct a stress test on the health of the banking sector. The results of the test, applied to 90 banks across Europe, were released July 2011. They showed that eight banks were unlikely to reach 5 percent core tier-1 capital ratios within two years, and that 16 banks would fall between 5 percent and 6 percent. The expected capital shortfall was about €2.5 billion after incorporation of the €50 billion in capital raised in the first half of 2011.

Unfortunately, like the results of the 2010 stress test performed by the Committee of European Banking Supervisors, the credibility of this report was seen as limited, given the broad failure of U.S. banks (which generally operate with lower leverage) under similar stress-test scenarios. Although the test was more transparent than previous iterations, the main points of contention about the report were decisions not to include estimates of sovereign asset impairments and overly optimistic “stressed” scenarios. To bolster the credibility of the exercise, the EBA undertook a recapitalization study, which included certain aspects of a stress test. The results were released in December 2011, indicating that 37 banks were, in aggregate, €115 billion short of reaching the recommended 9 percent core tier-1 capital ratio. Removing the most deeply troubled banks reduced the deficit to a still credible €76 billion.

The ECB is expected to assume the role of primary European banking regulator later this year. It will be responsible for enforcement of rules and guidelines created by the EBA. This task will require the creation of significant infrastructure for regulatory oversight, which should be in place early in 2014. At that time, the new regulatory body is expected to launch a brand new asset quality review (AQR) for all banks under its purview. This will ultimately be used as an input for a more stringent stress test to be performed in the early fall of 2014. The stress test will also test cred- ibility of the ECB as the new regulator. It is imperative that the ECB exercise good judgment when formulating and reporting the results of this stress test in order to restore confidence in the European banking sector.

The positive outcome of the delay in a final stress test is that many banks have been able to “earn their way out.” That is to say, they have generated earnings and raised capital to supple- ment buffers over the last few years. The higher buffers are expected to be adequate in most stress-test scenarios. The most bullish European bank ana- lysts are forecasting potential stress- test capital shortfalls of €10-60 bil- lion. Compared to earlier estimates of €250-300 billion, that range would be quite manageable, and would bolster credibility. If the ECB were able to produce a credible result with a small price tag, we could see a truly cleans- ing moment for the European banking sector, and a catalyst to jump start the economy.

Has Europe Turned The Corner?

The direct economic impact of the global financial crisis and subsequent European sovereign debt crisis was initially focused on the European periphery, but eventually spread across Europe, as bank lending slowed and demand weakened. Unemployment rates skyrocketed across Southern Europe, as the weak euro supported Northern exporters, Germany in particular. The newly signed fiscal compact required many countries around Europe to slash government budgets, just as demand weakened and unemployment rose. Many com- mentators and analysts have viewed the European process as unnecessarily drawn out and complicated. But the time and pain may have been neces- sary, given the lack of integration at fiscal and regulatory levels. The crisis precipitated a move to the middle, but the prolonged pain was required to create a sense of urgency among the worst violators of the original Maastricht treaty, which created the euro. The steps taken by the ECB kept the system stable long enough to slowly move through the process.

While austerity measures have severely limited growth, they have been surprisingly effective at correcting primary and structural fiscal deficits across Europe. Recall that the targets require a structural deficit of less than 0.5 percent of GDP, if debt-to-GDP stands around 60 percent, and a path to reduce debt-to-GDP to 60 percent within 20 years. Of the least financially sound European countries, Greece has made the most progress toward achieving the targets, followed by Italy. Greece has nearly achieved its structural deficit target and is a little more than halfway to achieving the primary deficit needed to reduce over- all debt in the allotted time. Italy is about three-quarters of the way there on each metric. Spain and Portugal lag much farther behind at about 40 percent and 50 percent complete on each, respectively. Ireland is about one-quarter complete in reducing its structural deficit and halfway to reducing its primary deficit. Importantly, both the appetite and need for increased austerity have abated, which leaves room for loosening of austerity measures. Lighter austerity will naturally lift economic growth in the most depressed economies.

Another hurdle to restoring European growth was the need to reset economic competitiveness across Europe without the benefit of nominal exchange-rate adjustments. Members were forced to regain competitiveness by resetting real exchange rates through unit labor cost reductions, driven mostly by very high unemployment. High unemployment and lower wages also depressed domestic consumption, which improved trade balances across Europe. A recent report from JP Morgan suggests that Portugal, Ireland, Spain, and Greece have all reset their real internal exchange rates nearly to the level seen when they entered the monetary union. Italy and France have been less successful, most likely due to less flexible labor market structures and lower unemploy- ment levels over the last couple of years.

With the combination of lower austerity, improved banking sector function, and restored competitiveness, growth in Europe is improving, especially in the periphery. Deposits started to flow back to the periphery in the middle of last year. Spanish and Italian 10-year spreads to German bonds have been well behaved during this time (see Figure 1). Exports from peripheral countries have been increasing consistently over the last few years, and except for Greece and Portugal, all carry a positive current account balance.

Consumer confidence measures have recently turned up sharply in Italy and Spain and are at a multiyear high. The June Eurozone manufacturing purchasing managers index showed the fourth straight month of improvement and crossed 50 (a level that indicates expansion) for the first time since July 2011. The greatest country-level improvements came in Italy (highest since July 2011), Spain, and France. It now looks possible that Spanish and Italian GDP may return to growth in the back half of 2013, with Eurozonewide growth turning positive in the fourth quarter of 2013.

European growth appears to be on a more solid footing than at any time in the last two years, as financial conditions improve and the focus shifts from austerity to growth. But the near future for Europe is not without risks. Economic data in previously strong Northern Europe has started to soften and unemployment remains elevated across Southern Europe. It is imperative that European regulators cleanse the banking system with a credible stress test that forces a “once and for all” capital raise. This could be politically difficult if the test highlights capital shortfalls in believed-to-be-strong banks in core European economies such as Germany.

Ongoing stability also depends on the ECB, and President Mario Draghi must be allowed to aggressively pursue his “anything it takes” approach to saving the euro and normalizing credit conditions for government borrowers. The political calendar is filled with pivotal elections over the next two years, which could mark major turning points for European political will. We will monitor these elections closely as we continue to watch Europe turn the corner.

Charles Wilson is an associate portfolio manager for the Thornburg equity teams, which manage a total of $72 billion (6/30/2013). He earned a BS in geology from the University of Arizona in Tucson, and a Ph.D. in geophysics from the University of Colorado in Boulder.