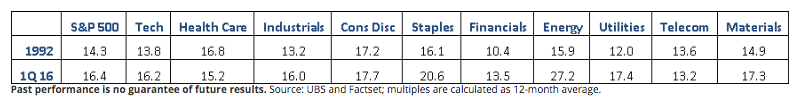

Figure 3 below compares S&P 500 sector valuations in 1992 versus today. Why 1992? Because it is hard to believe that U.S. equities were “overvalued” in the early 1990s, the preamble to the equity gains of the subsequent 8 years. In 1992, the S&P 500 traded on an average P/E multiple of 14.3x. In the first quarter of 2016, the S&P 500 traded on an average P/E of 16.4x, which assumes earnings of about $120/share.

Figure 3. P/E Multiples by Sector (x)

Quarterly Data, 3/31/1947 to 12/31/2015, Log Scale

The bulk (80%) of this valuation difference is accounted for by the “safety” sectors (32%) plus energy (37%) and financials (11%). For example, consumer staples and utilities traded on multiples of 16.1x and 12.0x respectively in 1992 versus 20.6x and 17.4x today. While financials and energy also trade on higher P/E multiples today, this reflects their compressed earnings base. On a price/book basis, for example, financials are trading cheaper today: 1.3x book value versus 1.6x book value in 1992.

What does all of this imply for what we should be thinking about?

If investors are “overpaying” for stability in sectors like consumer staples and utilities, how quickly could that sentiment reverse?

One insight may be the energy MLP stocks. These had been regarded as safe “bond proxies” when investors were reaching for yield. After peaking in 2014, these stocks lost more than half their value as their underlying business models proved far less defensive than investors had supposed.

Is overvaluation a headwind for the S&P 500, or is it more the pace of future earnings growth?

We think the resumption of the earnings cycle is the critical variable and will overcome investor concerns about valuation. This is why the debate over secular stagnation versus normalization of global growth is worth monitoring.

Treasury bonds are regarded as the ultimate safe asset. How vulnerable are fixed income markets to a modest return of confidence in the economic outlook?

If U.S. inflation drifts mildly higher, we see the potential for nominal GDP growth of 4%. As Treasury yields tend to equal growth in nominal GDP over the long term, the upside from current yields (1.78%) is significant.

Getting markets right is as much about formulating the right questions as knowing the right answers.

Michael Grant is senior vice president, senior co-portfolio manager at Calamos Investments.

Michael Grant is senior vice president, senior co-portfolio manager at Calamos Investments.