KEY TAKEAWAYS

· Foreign demand has helped drive Treasury yields lower and support prices over the past year, though increasing hedging costs may prove problematic moving forward.

· Demand from indirect bidders continues to be strong at Treasury auctions, muddying the argument that higher hedging costs may cause foreign demand to weaken.

· For now, foreign demand remains supportive of domestic bond prices.

Overseas investors remain a key support of domestic bond prices and have helped to drive the 10-year Treasury yield to a recent level of 1.55%. Although weaker than expected economic growth over the first half of 2016 and sluggish growth in Europe and Asia have contributed to bond strength, foreign demand for Treasuries has played a large and increasing role in Treasury strength.

Record amounts of monetary stimulus from central banks around the world have led to low or even negative yields for government debt in many developed nations, with Fitch data indicating that $11 trillion in debt is now trading at negative yields worldwide. The yield differential between 10-year U.S., Japanese, and German bonds shown in Figure 1 makes it easy to see why foreign investors have shown more interest in U.S. debt this year.

HEDGING COSTS INCREASE

U.S. Treasuries would seem a logical choice for overseas investors seeking the safety of government bonds, given their yield advantage. However, foreign investors have one additional risk to factor in—currency movements. If the dollar depreciates relative to the investor’s home currency, the investor receives less of the local currency back for each dollar, reducing total return. Given that exchange rates can be volatile, it is possible that a depreciating dollar could wipe out a significant portion (or all) of any advantage the investor would see from investing in the U.S., especially with interest rates at low absolute levels.

For this reason, overseas investors may choose to hedge their U.S. dollar investments via currency futures by buying dollars at the spot rate, and simultaneously selling currency forward to lock in a given exchange rate over a selected period of time. In this way, currency hedging can help reduce the risk of unforeseen currency swings. However, a currency hedge involves a cost and this cost can fluctuate over time due to a variety of factors.

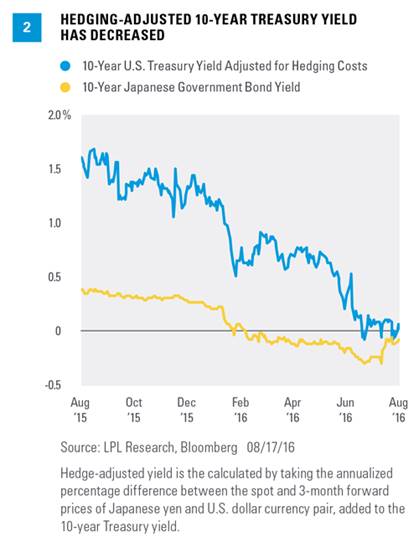

Figure 2 shows that after accounting for the cost of a currency hedge, the yield advantage of 10-year Treasuries has diminished greatly over the past year versus the 10-year Japanese government bond (JGB). Treasury strength, coupled with an increase in hedging costs, has brought the post-hedge yield of the Treasury more in-line with comparable JGBs in recent weeks, making the trade less attractive for overseas investors. A similar phenomenon is occurring with regard to German bunds. Treasury prices have been range bound to slightly weaker, after the 10-year Treasury yield reached a new all-time low in early July 2016, suggesting that foreign demand may be fading.

U.S. Treasuries may be considered “safe” investments but do carry some degree of risk including interest rate, credit and market risk.

The currency spot rate is the current quoted exchange rate that a currency pair could be bought or sold. If an investor or hedger conducts a trade at the currency spot rate, the exchange of the currency pair may take place at the point at which the trade took place or shortly after the trade.

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position.

NO DECLINE IN AUCTION DEMAND

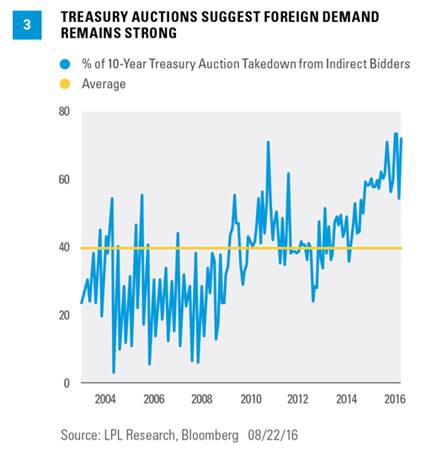

Rising currency hedging costs would seem to indicate foreign demand may decline, but auction data suggest foreign demand remains strong. The percentage of total purchases (known as takedown) from indirect bidders, a group of auction bidders that includes foreign investors, was near all-time highs on the most recent 10-year auction [Figure 3]. The indirect bidder takedown has been elevated for auctions across the maturity spectrum, including the 5-year and 30-year, according to Treasury data. In other words, if foreign demand is fading, it is certainly not showing in auction data thus far.

This week will provide another glimpse of overseas demand as the Treasury auctions 2-, 5-, and 7-year securities. The indirect bidder percentage will be scrutinized to see if foreign demand is fading. Although the cost to hedge the impact of currency movements has increased, it is too early to determine if these costs alone will erode overseas investor demand—a key support of domestic bond markets in 2016.

ANOTHER CHECK

More comprehensive data on overseas buying of Treasuries are captured by the Treasury International Capital (TIC) report. The most recent report revealed that though flows for the past 12 months remained negative (due to overseas central bank sales), foreign entities were net buyers of Treasuries during the month of June 2016, with demand from private investors (which include everything other than central banks), outpacing sales from foreign central banks by approximately $7.6 billion. So although foreign central banks may be reducing Treasury purchases, the amount was more than offset by institutional and individual investor demand.

The number of foreign buyers of Treasuries that hedge their bond currency exposure is unknown, which makes it difficult to assess how much hedging costs may impact demand. While hedging costs certainly play a role, especially for larger institutional investors, other investors may simply choose not to hedge currency movement either due to cost, size of transaction, or perhaps because they believe that currency fluctuations can help with diversification.

CONCLUSION

Historic monetary stimulus from central banks has left government bond yields for many developed nations in negative territory, and corporate bond purchase programs from the European Central Bank and Bank of England have led to declining yields on other high-quality bond options, leaving foreign investors with few options for attractive yields on low-risk assets. Extraordinary policy moves by overseas central banks appear unlikely to reverse soon and may continue to provide ongoing support to bond prices.

Increasing hedging costs and lower Treasury yields may be a headwind for foreign demand going forward, though a lack of data showing the proportion of buyers who hedge makes it difficult to determine the impact. Other indicators, including demand from indirect bidders at Treasury auctions and the (less timely) TIC report continue to show that foreign demand remains supportive of Treasury strength, at least for now.

Anthony Valeri is fixed-income and investment strategist for LPL Financial.