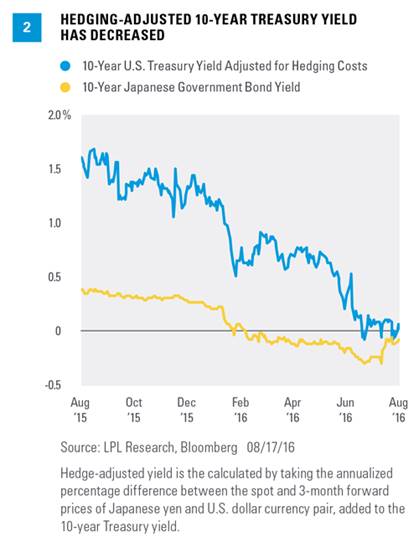

Figure 2 shows that after accounting for the cost of a currency hedge, the yield advantage of 10-year Treasuries has diminished greatly over the past year versus the 10-year Japanese government bond (JGB). Treasury strength, coupled with an increase in hedging costs, has brought the post-hedge yield of the Treasury more in-line with comparable JGBs in recent weeks, making the trade less attractive for overseas investors. A similar phenomenon is occurring with regard to German bunds. Treasury prices have been range bound to slightly weaker, after the 10-year Treasury yield reached a new all-time low in early July 2016, suggesting that foreign demand may be fading.

U.S. Treasuries may be considered “safe” investments but do carry some degree of risk including interest rate, credit and market risk.

The currency spot rate is the current quoted exchange rate that a currency pair could be bought or sold. If an investor or hedger conducts a trade at the currency spot rate, the exchange of the currency pair may take place at the point at which the trade took place or shortly after the trade.

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position.

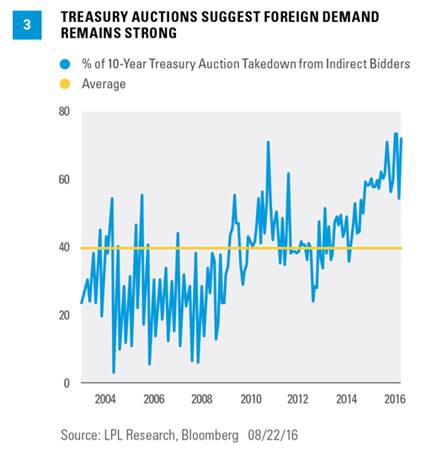

NO DECLINE IN AUCTION DEMAND

Rising currency hedging costs would seem to indicate foreign demand may decline, but auction data suggest foreign demand remains strong. The percentage of total purchases (known as takedown) from indirect bidders, a group of auction bidders that includes foreign investors, was near all-time highs on the most recent 10-year auction [Figure 3]. The indirect bidder takedown has been elevated for auctions across the maturity spectrum, including the 5-year and 30-year, according to Treasury data. In other words, if foreign demand is fading, it is certainly not showing in auction data thus far.

This week will provide another glimpse of overseas demand as the Treasury auctions 2-, 5-, and 7-year securities. The indirect bidder percentage will be scrutinized to see if foreign demand is fading. Although the cost to hedge the impact of currency movements has increased, it is too early to determine if these costs alone will erode overseas investor demand—a key support of domestic bond markets in 2016.

ANOTHER CHECK

More comprehensive data on overseas buying of Treasuries are captured by the Treasury International Capital (TIC) report. The most recent report revealed that though flows for the past 12 months remained negative (due to overseas central bank sales), foreign entities were net buyers of Treasuries during the month of June 2016, with demand from private investors (which include everything other than central banks), outpacing sales from foreign central banks by approximately $7.6 billion. So although foreign central banks may be reducing Treasury purchases, the amount was more than offset by institutional and individual investor demand.