Although the Obama administration released its 2013 revenue proposals on Feb. 13, 2012, there has been no legislative action to make these proposals binding law. Without some action from Congress before year-end, the tax rates for estate, gift and generation-skipping taxes will increase on Jan. 1, 2013. Because Congressional action in the transfer tax area has been notoriously difficult to predict during the last 10 years, the law is unclear. Despite this legislative uncertainty, planning opportunities should be considered to minimize taxes and preserve wealth. In fact, where wealth transfer is appropriate, there is an immediate urgency to prepare to act as many wealth transfer strategies take several months to fully implement. Time may be running out.

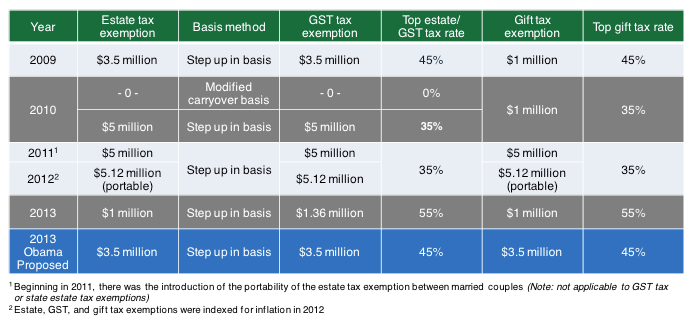

Specifically, without legislative action, we will see the following estate, gift and generation-skipping tax rate increases and tax exemption amount decreases:

A 57 percent increase in the highest estate, gift and generation-skipping tax rate (top rate once again 55 percent increased from the current 35% rate)

An 80 percent decrease in the estate and lifetime gift tax exemptions (total exemption $1 million, decreased from $5,120,000)

A 73 percent decrease in the generation-skipping tax exemption (total $1.36 million, which will be indexed for inflation, decreased from $5,120,000)

The chart below summarizes prior, current and future law, as well as the president's proposal:

A note on the portability election for a married individual who died in 2011 or dies in 2012 with an estate not exceeding these thresholds: Normally, an estate tax return is not required. However, if the deceased spouse's estate does not use the full exclusion amount, the executor can elect to pass the unused amount to the surviving spouse, which can only be done through filing a complete estate tax return. This is an additional administrative burden and expense for the estate, but it is the only way of ensuring the unused exemption is utilized. There are discussions from the Department of the Treasury and various professional associations regarding creating a short form that would ease some of this cost and administration.

The Obama administration proposal also includes the following provisions relating to estate, gift and generation-skipping tax, which will curb the application of some currently popular planning strategies:

A permanent portable estate tax exclusion

Basis reporting requirements for donated and inherited property

Limitations on availability of valuation discounts for transfers made between related parties

A 10-year minimum term for grantor retained annuity trusts (GRATs) and requirement for the remainder interest to have a value greater than zero at the time the interest is created

Elimination of tax benefits associated with the sale of an intentionally defective grantor trust (IDGTs)

Limited duration of generation-skipping transfer tax exemption

Estate Planning Opportunities Through Year-End

In addition to the current generous lifetime gift exemption of $5.12 million available only through the end of the year, interest rates and asset values are at historic lows. This environment provides unprecedented opportunities for lifetime giving. Furthermore, with the potential for legislation to limit some of the beneficial planning strategies available, as noted above, acting before year-end is not only beneficial, but may be the last chance to take advantage of currently available strategies.

First, high-net-worth clients should consider using the $5.12 million lifetime gift exemption before year end. This exemption amount can be further leveraged by giving assets subject to valuation discounts and/or giving assets to a generation-skipping trust. Implemented separately or together, these strategies can maximize currently available benefits. As an example, if one gives assets with a valuation discount of 20 percent for lack of marketability or lack of control to a generation-skipping trust, you would be able to give $6.25 million of assets, while only using $5 million of the lifetime gift exemption. This $6.25 million asset and the future appreciation would pass to beneficiaries free of gift, estate and generation skipping tax.

Additionally, consider using freeze strategies such as the aforementioned Grantor Retained Annuity Trust or Intentionally Defective Grantor Trust to take advantage of low interest rates, while these strategies are still available. Whatever the situation, we recommend discussing your personal financial planning goals and objectives with an advisor and attorney to help you prepare for the impending changing tax environment to best preserve your wealth.

Domingo P. Such is a partner in the Private Client Group at McDermott Will & Emery, and Tina Davis Milligan is a partner in the Private Client Group at Baker Tilly Virchow Krause, LLP.