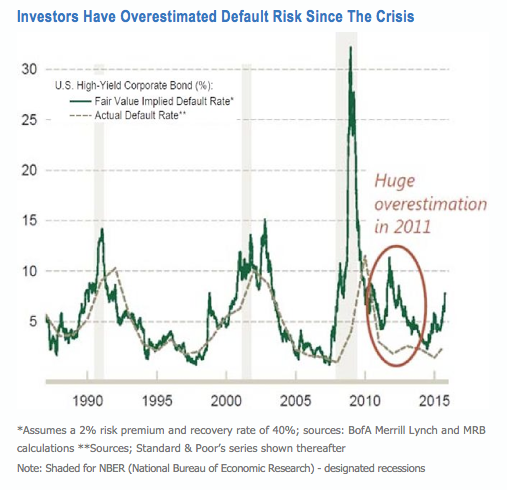

It’s been a familiar pattern over the past several years. A global growth scare leads investors to flee the high-yield bond asset class in droves, resulting in a spread widening, negative short-term returns and an overestimation of default risk. Looking back at 2011, during the third quarter high-yield bonds (BofA Merrill Lynch U.S. High Yield Master II index) posted a total return of -6.3 percent on fears of a double dip recession in Europe and the possibility of a technical default by the U.S. government facing a shutdown. Spreads widened to 800 basis points, implying default rates over 10 percent. When reality set in and worst-case scenarios faded, defaults averaged less than 3 percent, spreads compressed and high-yield bonds finished at +4.4 percent in 2011 (+6.2 percent in the fourth quarter) and +15.6 percent in 2012.

Investors Have Overestimated Default Risk Since The Crisis

Fast forward to 2015 and fears of a global growth scare are here again, led by China and a bear market in commodities. Again, outflows have followed as high-yield bond ETFs (exchange-traded fund) and mutual funds shed $3.9 billion over the last 13 weeks. This has resulted in the spread widening to 600 basis points, third-quarter returns of -4.9 percent and implied default rates in the 6 percent–7 percent range for ex-energy issues. Default rates of this magnitude would likely imply a recession, though in our view the U.S. economy is a long way from signaling one is on the horizon. Default rates have picked up recently, but rose to just 2.6 percent (annualized) in September.

This selloff leaves the broad high-yield market with a yield of 8 percent, which masks the bifurcation between commodity-linked sectors yielding 9 percent–14 percent and the broader asset class yielding 7 percent. This yield looks attractive when compared to Treasurys, particularly with a looming Federal Reserve rate hike. A hike would signal an economy strong enough to handle policy normalization, muted defaults and spread narrowing. Treasurys currently offer only a small income cushion given near-record-low starting yields. In contrast, high-yield bonds have averaged about 6 percent in annualized returns over the past five years, and that type of return is still possible looking out over the next couple years.

The spread between high-yield bonds and Treasurys has widened by more than 1% in the last quarter. Collecting income at a rate four times that of Treasurys should reward patient, value-focused investors over the next 12 to 18 months. Unless otherwise noted, all data is as of the date of publication.

Jon Adams, CFA, is portfolio manager at BMO Asset Management Corp.

John Boritzke, CFA , is managing director at BMO Asset Management Corp.

Sandy Lincoln is chief market strategist at BMO Asset Management Corp.

Alan Schwartz, CFA, is portfolio manager at BMO Asset Management Corp.

Lowell Yura, CFA, is head of multi-asset solutions at BMO Asset Management Corp.