Higher recession risks will center on a further slowdown of economic momentum and continued tightening of financial and credit conditions.

Any weakness in job growth and consumption will signal the expansion is at extreme risk and hopefully prompt the Fed to delay hiking rates.

While there is little near-term risk of recession, that risk is likely to grow later this year and into 2017.

Fed Chair Janet Yellen was correct when she recently said that economic expansions don’t die of old age. However, the last expansion ended when the recession began in December 2007, and no one rang a bell. Even the National Bureau of Economic Research, the group that officially dates business cycles, did not alert the public until June 2008, after the recession had started and well after markets had begun to sink. This is the typical process. Post-war business cycles have averaged about six years, with the current one close to seven years old. So during these late-cycle periods, it is prudent to monitor data and various recession risk indicators that have proved useful in the past. Probit modeling (a statistical technique where the dependent variable can only take two values) points to a roughly 30% probability of recession in the next six months, which is still low but higher than at any time this cycle. This is because the economy has lost some momentum and financial conditions have tightened. Unfortunately, there is no set of consistently accurate indicators — experience and judgment play key roles. But using leading and real economy indicators coupled with financial indicators and historical insights can improve signaling.

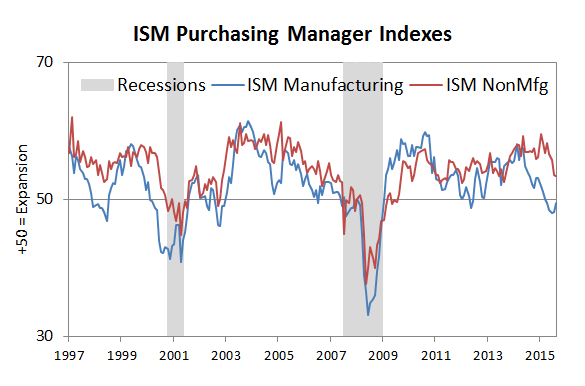

Many leading indicators of U.S. growth continue to flag warnings with the Conference Board Index and the Chicago Fed National Activity Index seeing downside momentum, but both still some distance from a contraction signal. The manufacturing and industrial sectors are bearing the weight of the adjustment to dollar strength, weak trade and softer global demand. While it may not account for a major share of the economy, manufacturing typically leads — and weakness here often leaks into the larger service sectors. The ISM Purchasing Manager Indexes show the manufacturing sector already in contraction and the service sector activity still in expansion but softer (Exhibit 1). We should note that whenever these and many other measures have shown this much weakness, the Fed is usually either easing monetary policy or beginning new rounds of quantitative easing (QE). But this time, the Fed favors tighter monetary policy.

Exhibit 1: Economic Indicators Are Flagging Caution

Source: Institute for Supply Management, February 2016