Quick! Name the head groundskeeper at your favorite team’s stadium. Can’t recall? Not surprising, since those playing the game will be your focus rather than those who mow the grass. The groundskeeper is rarely if ever mentioned during the game nor interviewed by the media afterwards. The attention is on players and coaches and the critical decisions and plays they made during the game.

For the Federal Reserve, the groundskeeper for the U.S. economy, it is a different story. Since the economy plays an outsized role in our lives, we would feel better if someone were in charge. But the truth is no one is in charge. The economy’s impact on us is the result of the unfathomably complex interaction of billions of independent consumer and business decisions.

We find this unsettling, so we look to the Fed much as the residents of Oz did with their wizard, imbuing it with powers they do not have.

An aura of extraordinary importance surrounds the Fed as a result, with the press doing everything it can to perpetuate this myth. Thus, a huge number of economic and market stories mention the actions of the Fed, from the Fed raising interest rates to providing excess liquidity. These mentions happen so frequently that they turn into an availability cascade. We thus falsely conclude what the Fed is doing must be important, especially when making investment decisions.

Maintaining The Economic Playing Field

The Fed has two primary responsibilities. The first is to grow the money supply at a rate consistent with low inflation and strong economic growth. The second is to act as the lender of last resort, ensuring the integrity of the banking system. The latter can be thought as maintaining the “financial railroad” upon which the economy runs. If it breaks down, the economy collapses.

The late Milton Friedman famously suggested the first function could be best accomplished by replacing the Fed board with a computer that grew the money supply at a consistent 5 percent to 6 percent annually. In other words, put monetary policy on cruise control in order to avoid making big mistakes.

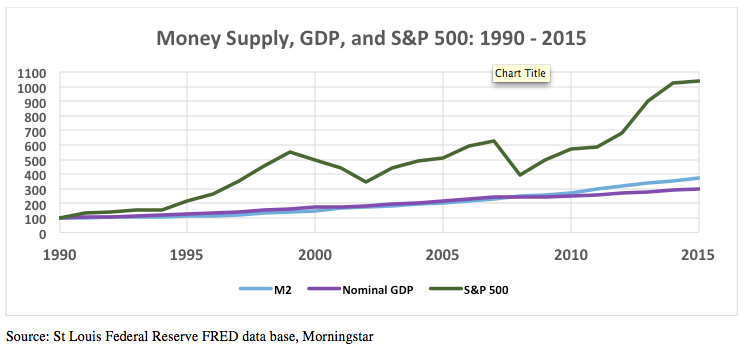

The chart below reports what has occurred over the last 25 years (1990 = 100). The money supply (M2) grew 5.5 percent annually and the economy (nominal GDP) by 4.5 percent, while the stock market’s annual return averaged 10.2 percent over this period.

Money supply and GDP grew consistently together during this period. Seminal 1960’s research by Milton Friedman and Anna Swartz concluded that money supply leads GDP, so it’s important to consistently grow money supply by 5 percent to 6 percent annually. The Fed has been largely successful in doing this since 1990, thus meeting its primary responsibility.