What does a financial advisor have to know about the Portuguese economy? The first answer would perhaps be "zip." Now reframe the question. Replace Portugal with Greece. Back in January and February of 2010, a financial advisor would again likely have said "zip." And yet between April 19 and June 28, the Greek economic crisis sent the S&P 500 plummeting 16%. A drop like that one in just about two months caused many worries among investors, worries that no advisor can ignore. After hearing Portugal make squeaky sounds in April, should investors worry about another major quake, or should they expect a minor temblor like Ireland's that didn't get much attention?

The point worth pondering is that, of course, it is not possible for advisors to keep clients aware of so many global events on top of everything else they have to do. However, the "fiduciary" advisor should also recognize that sharp market corrections require proactive, not reactive, management. To that extent, advisors should find a way to offer global economic knowledge that cuts to the chase-offering their clients, say, a big picture overview of the ten largest economies. Surely, if Greece can knock the winds off our sails so easily, what could happen if a country like Germany or Japan failed? Such blows would indeed mean knockout punches for clients and advisors, too.

Understanding Our Own Economy Within A Global Perspective

In such global outlooks, we often forget to include our own countries. Yet all students of the global economy should know how the home country affects and is affected by global players. It is useful to review the domestic stage first, especially the evolution of the financial markets since the crisis of 2008. That year is fast becoming another legendary benchmark in the history of the financial advisory profession. Just as the events from 1929 to 1933 altered the financial services landscape for the next 80 years, it seems likely that the events of 2008 will too for a long time to come. Though the Great Recession seems to be over and the stock market is generally buoyant, there is still a consensus among buyers that now is not a very good time to enter speculative financial positions. The main impression one gets about the mood of clients from advisors and planners is that the level of risk tolerance is at nearly historic lows and most clients are preferring to hold a fairly significant portion of their portfolios in cash-like investments for now.

The 2008 crisis, which still has some of us in shell shock, has certainly opened our eyes to the fact that our domestic economy, now more than ever before, is far more globally dependent. Ravages to far-flung economies make waves on our shores. Instead of helplessly reacting to such events only when it is too late, it is worth our while to become more seasoned observers of the global economy and to use this knowledge to make more informed client money-management decisions. Furthermore, instead of stumbling around in the dark trying to figure out where to even begin collecting such information, it would be useful for us to understand the current ground realities of the world economy and how it will affect our clients' portfolios. This means ongoing scrutiny.

Again, let's start with the United States. Even though the stock markets of 2010 and early 2011 have been fairly optimistic, it may take us quite a long time before we can get back to the steady state we were used to before 2008. Since then, we have gone through a sea change for several reasons:

1.) 2009 marked the first deflation since 1954. Most of us have never witnessed deflation before because we only began understanding global economics after that time. 2.) We had all-time historic lows in Treasury security rates in the 2000s. 3.) We are seeing the highest unemployment rate since 1933-somewhere still around the "official" 10%. Most of us thought that a natural rate of unemployment around 5%, which has held over the last 25 years or so, would be a forever thing, just as we were told in 2005 and 2006 that housing prices wouldn't ever go down. 4.)

Meanwhile, all-time historic savings rates are low, although they have rebounded. They dipped into the negative for the first time in 2006. 5.) And finally, we have probably the highest stock market volatility levels we have ever seen over such a long period of time. The last factor is why many clients are deathly scared of investing their hard-earned wealth in any speculative investment.

You can imagine the impact of a significant change in even one variable such as interest rates or housing prices. Now imagine these five shifts. The effects are not 1,000-point drops in the stock market in ten minutes. They are much more subtle and seep into the underlying consciousness of clients' minds, gnawing on their thoughts, threatening future wealth losses, leaving people seeking straws to grasp at and finally beating them into a corner where only cash-based investments seem attractive.

After considering the U.S., we turn to China. This superpower in the making is already in close combat with the United States for global economic supremacy. Following China's economic condition is a key starting point because it'll help us determine the nature of some of the most significant economic shocks in our futures. Consider that China's economy has grown at a compound real GDP rate of 10% for each of the last 30 years or more while ours grows at 3% or so.

Furthermore, China can wreak havoc on our credit markets with their trillion-dollar holdings in the Treasury markets. Imagine what would happen if the credit rating of U.S. Treasury debt were cut (something Standard & Poor's threatened in April of this year) and China decided to time such a move by yanking its investments in ten-year Treasury notes, the yield at the heart of the financial products industry. If Greece were a 4 on our seismic scale, how big would such a China shock be? Though some proactive investors might find opportunities by planning ahead for such an event, others would experience disaster, as would the advisors who help them.

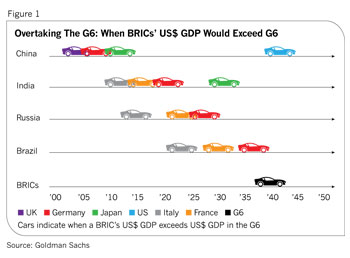

Beyond these two rivaling superpowers, other global economic power forces are the BRIC countries (Brazil, Russia and India, in addition to China). At their current rate of growth, this bloc is expected to be economically greater than the U.S., Japan, the U.K., France, Germany and Italy by 2040. Finally, there are many other geopolitical realities that we need to recognize early to effectively keep clients out of harm's way, coming from both on and off our shores. (See Figure 1.)

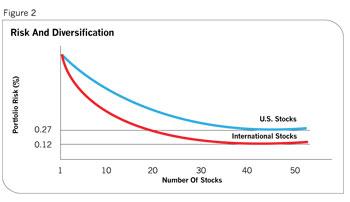

It is important for advisors to recognize that we are one of the ten countries in the chart and we are certainly not the only or clearly dominant leader. This different understanding of reality, without home country bias, is something each advisor needs to understand to serve his or her clients and beneficiaries better in the long term. According to the World Federation of Exchanges, the U.S. market accounted for about 41% of the global capitalization in 2010. That's down from an enormous 70% and higher in the 1960s and '70s. This trend itself is a good reason to observe international trends, since it will open doors to global portfolio construction. An advisor scared of unknown global investments who puts all eggs in the U.S. security markets is certain to expose clients to danger. (See Figure 2.)

Any astute manager will tell you that a simple mix of large-cap global stocks and global T-bonds is often the most important component of optimization on the portfolio covariance matrix. To this, add some global components that make sense domestically as well. For example, once you begin following China, you'll note that the Chinese do not like their dependence on the U.S. dollar as reserve currency, which means huge losses on their holdings due to the depreciation in the dollar's value. This has led them to look at other strategies such as buying foreign companies (Lenovo has bought the IBM PC brand, for example).

Even scarier is China's attempt to "buy" Africa by investing in huge infrastructure projects in resource-rich countries such as Sudan, Chad, Nigeria, Algeria, etc. These cash-strapped countries, typically ruled by corrupt despots, are only too willing to bend over backward for China's financial help and its support with the U.N. Security Council. China knows that its economic growth depends on access to commodities and building material-oil, energy, steel, cement, lumber, etc. It has therefore aggressively courted resource-rich countries to make them more dependent on it. If push comes to shove, the Chinese can acquire large resource ownership interests in these countries in return for its infrastructure loan payments. It's a win-win for China and China.

U.S. investors, of course, could take advantage of this by owning global commodity interests (such as energy or building material ETFs). The next global economic rebound is most likely to be led by China, and this may induce a bubble in the commodity markets. ETFs could not only benefit investors with rich returns but also offer an inflation hedge better than that of low-return TIPS. Finally, it is important to recognize that global markets are very nervous at this point, and there are lots of things that can trigger a massive sell-off.

The emergence of a deadly virus or a tsunami followed by a nuclear plant meltdown would play havoc in financial markets today. In such conditions, it would be wise to hold portfolios that have a large component of securities based on real assets-commodity ETFs or global REITs, for example. In today's environment, it seems easier to believe in tangible investments (ones you can touch) rather than paper investments like stocks and bonds.

Some Global Fun: Not For The Faint Of Heart

For those who help high-net-worth clients manage their money, there are some fun global investment outlets, especially in the alternative investments sector. To begin with, such clients should be accredited, and more important, have "at risk" money to invest-where the loss of the capital is not a problem but high growth is a requirement. In technical terms, these opportunities are for risk-neutral (not risk-averse) clients.

Consider that investments in emerging markets offer volatile rewards and that most people have either lost or not made money by investing in emerging country mutual funds and ETFs. To really reap the rewards being made in countries like China, India, etc., (or at least the returns we read about in magazines), one has to belong to certain inner coteries. For example, if you or your Chinese partners do not have the proper "guanxi" (connections to influential people such as political and bureaucratic dignitaries in China and India) you are not going to make money.

Consider the possibilities if you could pay off Uncle Sam to move your company's stock price up. While this is unthinkable here, guanxi makes it possible in many emerging countries. The proper guanxi opens up the riches of private equity and hedge fund returns, magnified by their existences in high-growth countries like China or India. To find such opportunities is not that difficult. It requires some of the assigned homework, though!

Somnath Basu is a professor of finance at California Lutheran University and the director of its California Institute of Finance. Dr. Basu also serves as a professor of the Helsinki School of Economics executive MBA program. He's involved with financial planning organizations including the National Endowment for Financial Education, the CFP Board of Standards, the International CFP Board and the Financial Planning Association.