When it comes to evaluating securities, most active fund managers look at traditional metrics such as earnings, cash flow, price-earnings multiples or management’s professional experience. Many stick fairly close to benchmark sector allocations and market-cap weightings to avoid deviating too broadly from their peers. In the case of asset allocation funds, a fairly consistent weighting of stocks to bonds that doesn’t change much over the years reigns supreme.

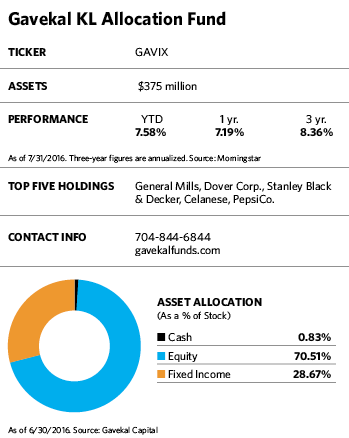

None of those conventions applies to the Gavekal KL Allocation fund. While manager Steven Vannelli uses traditional stock evaluation tools, he also applies a little-known screen for “knowledge leaders” to uncover companies that are innovators in their fields. Instead of maintaining a standard allocation to stocks, bonds and cash, he divvies up the $375 million fund based on his assessment of market factors such as where the best values are and which asset classes offer the most downside protection in distressed markets. Many of the fund’s sector and country allocations deviate broadly from those of its asset allocation fund peers and its benchmark, the MSCI All Country World Index (MSCI ACWI).

Vannelli believes strongly that investing with conviction is key to outperformance. “Studies show that funds with high active share tend to outperform others after fees,” he says. “The opposite is true for closet indexers.” While many asset allocation funds advertise themselves as all-in-one stand-alone holdings, he considers the Gavekal fund to be a satellite holding that can help improve portfolio performance, add diversification and provide downside protection.

It has done all those things over the long term. The fund was in the top 2% of its Morningstar peers for the year ending June 30, in the top 6% for the three-year period ending that day and in the top 3% for the five-year period. Its 9.92% annualized return over those five years also compares favorably with 5.38% for the MSCI ACWI and the 4.93% returned by a 60/40 blend of stocks and bonds. Its maximum drawdown over the past five years was 6.14% while the benchmark’s was more than 17%.

Among the things that make it stand out are its beta of 0.44 and a lower standard deviation than the MSCI ACWI has. Also, it has a much higher average market capitalization than the index. The fund is heavily overweight in developed Asia and has a sizable presence in the U.S., but is dramatically underweight in Europe.

Despite his disdain for benchmark huggers and support of active management, the 42-year-old Vannelli prefers looking at hard numbers to methods such as visiting companies, attending road shows or evaluating products. When asked about products in one portfolio company’s pipeline, for example, he responds, “We don’t spend time looking at that because there is not much of an association between a company’s products and underlying firm value.”